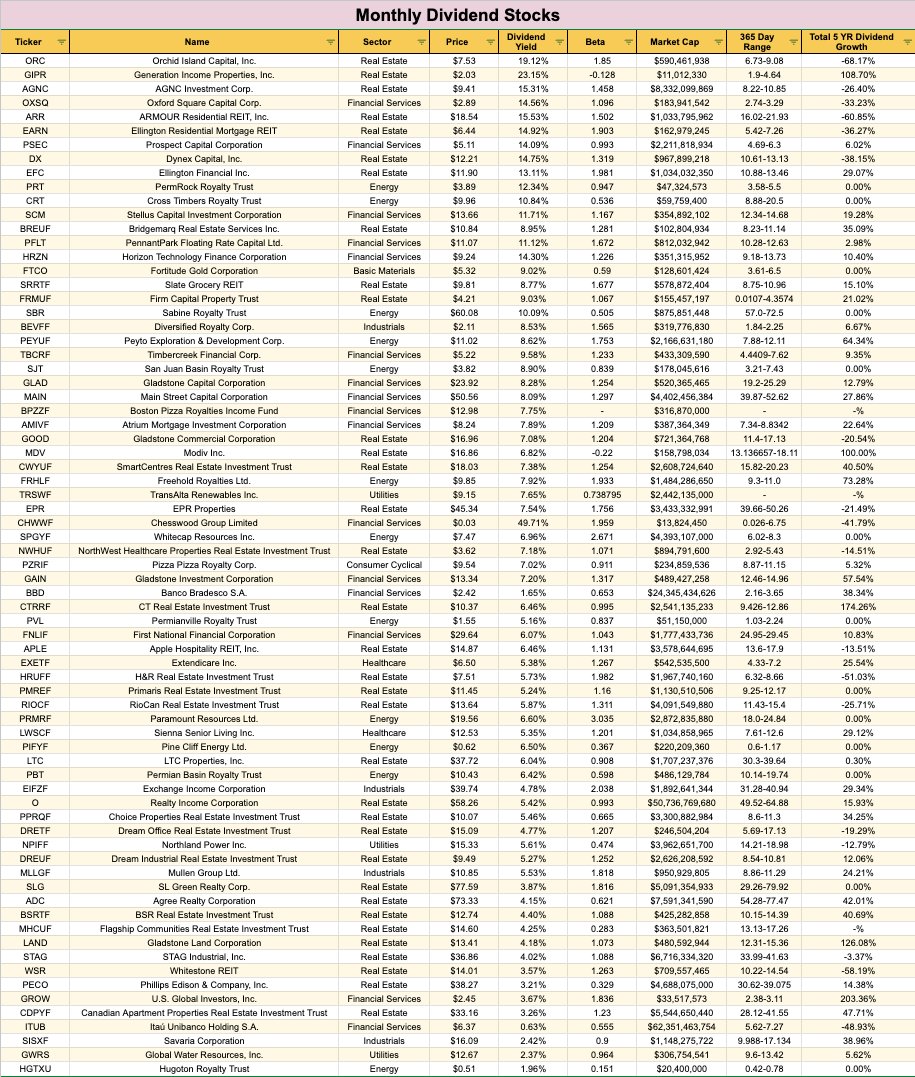

The Complete List Of Stocks, REITS & ETFs That Pay Monthly Dividends

Stocks, REITs, and ETFs That Pay Monthly Dividends

Investing can be a great way to grow your money over time, and one popular way to earn income from your investments is through dividends. Some companies and funds pay dividends every month instead of just once a quarter. In this essay, we’ll explore Stocks, Real Estate Investment Trusts (REITs), and Exchange-Traded Funds (ETFs) that offer monthly dividends. We’ll also discuss the pros and cons of these investments.

What Are Monthly Dividends?

Dividends are payments made by companies to their shareholders, often as a way to share profits. When a company earns money, it can choose to reinvest that money into the business or pay a portion of it to investors. Most companies pay dividends every three months, but some choose to pay them monthly. This can provide a steady stream of income for investors.

Stocks That Pay Monthly Dividends

Some companies, especially those in industries like real estate, pay monthly dividends. For example, Realty Income Corporation is known as “The Monthly Dividend Company” because it pays its investors every month.

REITs (Real Estate Investment Trusts)

REITs are companies that own, operate, or finance real estate properties. They are required by law to pay out most of their income as dividends. Many REITs, like STAG Industrial, pay monthly dividends. This makes them a popular choice for investors looking for regular income.

ETFs (Exchange-Traded Funds)

ETFs are investment funds that hold a collection of stocks or other assets. They can be bought and sold on stock exchanges, similar to individual stocks. Some ETFs focus on high-dividend-paying stocks and distribute monthly income to their investors. For example, the Invesco S&P 500 High Dividend Low Volatility ETF pays dividends monthly.

Pros and Cons of Monthly Dividend Stocks, REITs, and ETFs

Pros

Regular Income: Monthly dividends provide a consistent cash flow, which can be helpful for budgeting or reinvesting.

Reinvestment Opportunities: Investors can reinvest their dividends to buy more shares, potentially leading to more income in the future.

Less Volatility: Many dividend-paying stocks, especially REITs, tend to be less volatile. This means they may not fluctuate in price as much as other stocks, providing some stability.

Tax Benefits: Qualified dividends may be taxed at a lower rate than ordinary income, which can be beneficial for investors.

Cons

Risk of Dividend Cuts: Companies can reduce or eliminate dividends if they face financial difficulties. This could result in less income for investors.

Lower Growth Potential: Companies that pay high dividends may not reinvest as much back into their business, which can limit growth compared to companies that reinvest their profits.

Market Risk: While monthly dividends can provide stability, the stock market can still be unpredictable. Prices of stocks and funds can go down, affecting overall investment value.

Management Fees: Some ETFs charge management fees, which can eat into returns. It’s important to consider these costs when investing.

Investing in stocks, REITs, and ETFs that pay monthly dividends can be an attractive option for those looking for regular income. Understanding the pros and cons of these investments is essential for making informed decisions. As with any investment, it’s crucial to do your research and consider your financial goals. Whether you are saving for a big purchase, planning for retirement, or just looking to grow your money, monthly dividends can be a valuable part of your investment strategy.