Andrea Canto’s Tesla Trading System

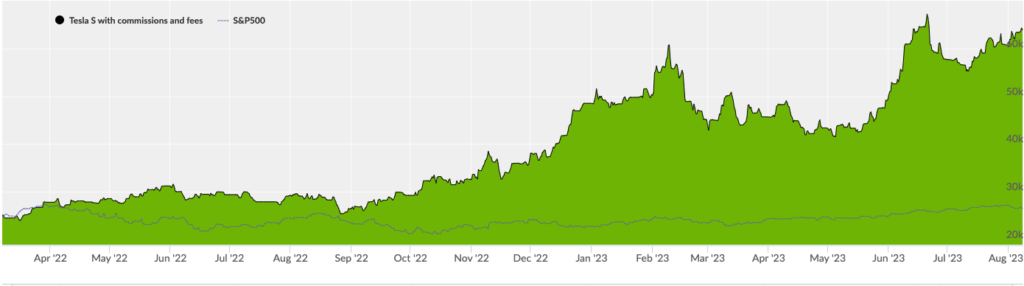

I recently came across a trading system that pretty much only trades Tesla (TSLA). The system has only been around for about 1.5 years but it has been putting up really good numbers as it registered a 94% return last year and is +31% so far this year.

After a few weeks of tracking the trades, I decided to reach out the lead trader to find out more about the system and the person behind it.

I want you to meet Andrea Canto, and Italian trader who has been active in the US markets since 1986.

I sent him a few questions and he graciously agreed to answer them. English is not Andy’s first language so I slightly edited his responses to make sure his ideas were properly conveyed. But what you will see below below are substantially his own words as he lays out his background, trading strategy and overall philosophy.

Trader

Andrea Canto

Markets/Instruments Traded

US stocks, with focus on Tech market

Trading System Name

Background

My first approach in trading stocks happened in 1986 when I was just 15 years old. After watching the movie Wall Street, I was literally seduced by the stock market. I asked my father to lend me some money and he did.

I was lucky enough to watch, in real time, the Wall Street crash on October 19, 1987 when the Dow Jones index lost 22.6% in just one trading session.

Then, came the “dot com” mania in the late 90’s that eventually crashed the Nasdaq market in 2001. I still remember when QQQ was trading at 10$ per share and Amazon fell to 1.5$ (before splits).

I saw many other booms and crashes along the way, that is the nature of stock markets.

I have a degree in Economics, an MBA and a further specialization in Corporate Finance.

I actually work in a Private Equity fund.

Trading Style

Although I like investments with a long term approach, mainly in disruptive companies that break the rules (like Shopify, Tesla, Virgin Galactic and so forth), my main focus is a swing trading approach.

This gives me the opportunity to to trade both on long and short sides and/or stay in cash if I notice that the stocks I usually trade (AMD, TSLA, ROKU and other volatile stocks) show no pattern.

Also, I prefer the cash position if a trade does not give me at least a 2:1 profit ratio or more.

How He Trades Tesla (TSLA)

In particular, I am pretty active in trading TSLA since 2018. This stock has recurring patterns that are not so hard to identify: it generally moves sideways for days or even weeks, then makes a large move on long or short side.

In 2022, I decided to share my trading experience on Collective2.com that allows me to post my trades with a verified track record. I called this strategy Tesla S.

Tesla S is a mechanical trading system that trades only Tesla stock, both on long and short side using a simple algo.

Each trade has a stop loss. This one is not hard but it depends on the TSLA price action and volume traded. So, it is a “mental” stop loss that I monitor during the trade and it is provided by my algo.

Once the stop is triggered, the system reverses direction (i.e. from Long to Short).

The holding period of each trade can range from some days to some weeks.

The system stays in cash during earning release days, due to extreme volatility linked to earnings.

Trading Philosophy

My trading philosophy is focused on risk management. Being a good trader means being a risk manager. If a trader fails to control the risk, sooner or later this trader will burn out his trading account.

I have been there too. Several years ago, early in my 20’s, I did not place much emphasis on managing the risk in any of my trades and even long term investments. Back then I had very little control over the two emotions that dominate a trader: fear and greed.

I read, over the years, several dozens of trading and investments books and I eventually realized the main question that makes the difference between a successful trader and an amateur.

These days I do not tell myself “I want to make money” when I am getting into a position.

Instead, I ask myself: “How much can I afford to lose in this trade?”

This very simple question made all the difference for me.

Risk cannot be eliminated from a trade.

Life, in itself, places risks that are partially out our direct control. The real difference is recognizing and accepting the risk.

If the risk is too high, I simply step back from the trade.

Comments are closed.