The Best Stocks For Day Trading & Options Trading

Updated August 1, 2023

I am not about to give you a list of stocks that you can just go through and pick the ones you want to trade. I have had many readers repeatedly ask for that but I think that if I did that, it wouldn’t be helping you much.

The fact is that, a stock that is good for Day Trading or Options Trading today, may not be good next month or next year. So just throwing out a list of “best stocks to trade” would be silly and I would just end up getting the same questions over and over again from readers.

What I want to do instead is to lay out the criteria/profile for a stock that is good for Day Trading and Options Trading, in this way, you will become familiar with the criteria and be able to identify suitable trading candidates on your own regardless of the market conditions. So here goes. Grab a pen and paper and take notes.

There are basically three things that you need to look for when trying to find the best possible stocks to Day Trade or Trade Options. They are:

- A Wide Daily Range

- High/Deep Liquidity

- Relatively High Volume ( And you will see later why high volume and liquidity are not always the same)

Now let’s dig a little deeper into each criterion.

1. A Wide Daily Range

A wide daily range is very important because if stocks do not move sufficiently, you will have a hard time getting into a trade, getting out, covering your commissions and realizing a decent profit on the trade.

There is no sense in day trading a stock with a 1point/$1 average daily swing as it would mean that you would need to buy at the absolute bottom of the range and sell at the top just to make a buck and that is before we even subtract commission.

It’s the same thing if you are trading options, you will need to focus on stocks with a higher average daily range than just $1. If you recall from a previous post I made about Options Trading, I said the Option Delta is basically the rate at which an Option will change based on the change in the stock price.

So if you have a stock that only moves $1 then that means the Option Price will not move enough for you to make a profit and cover commissions. The situation is even worse if the Option is out of the money and being eaten by time decay.

Now the question is how do you identify a stock with a wide daily range? The answer is that there are two simple ways to find them.

The first way is to simply look at the high-low range of the market leaders. There are many free services which can provide this information. One of the better ones is Barchart.com which gives you daily lists of range advances and range declines.

It is not sufficient to just grab the list and start picking stocks though. You should realize that some of these range movements are one time occurrences driven by some kind of news or sudden spike in trading activity.

You want to ensure is that the wide range happens frequently if you intend to keep trading the stock and this brings us to the second way to find stocks with wide ranges….. which is, the Average True Range (ATR).

The ATR is a volatility indicator and basically works such that a stock with a high volatility has a high ATR/daily range and a stock with low volatility has a low ATR/daily range. It makes sense to trade high volatility stocks if you are going to day trade and we also know that options trading is essentially about trading volatility, so you naturally want more of it.

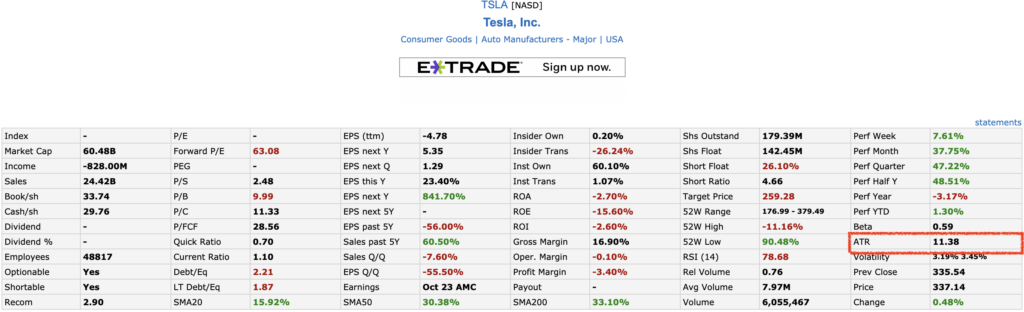

There are several free services that provide ATR information and most brokerages/platforms offer it these days. If you are using your platform ATR indicator, be sure to set it to the 20 Day Moving Average as it gives you a decent average and puts the ATR in perspective. Below is a screen shot of TSLA with the ATR circled. This information can be had for free at Finviz.com.

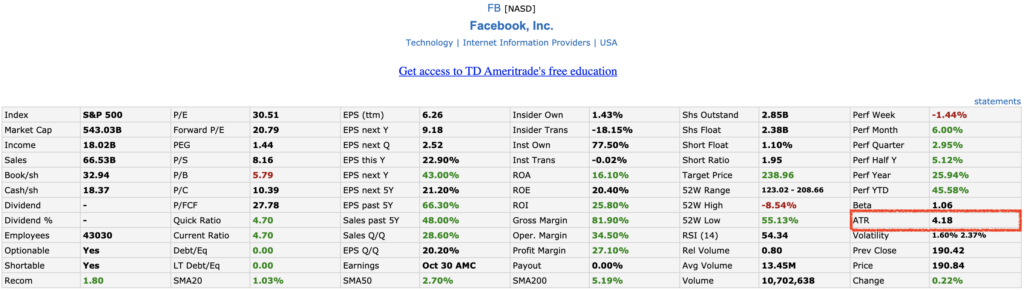

Now we want to compare the ATR on Tesla Inc (TSLA) to that of Facebook Inc.(FB) on this screenshot right below. FB, in its own right, is not that bad of a stock to Day Trade or play with options. In fact, I have traded it many times before.

2. High Liquidity

Liquidity simply means that the market in a particular stock is large and has many buyers and sellers at any given time and at many different price levels.

Liquidity is very important when looking for stocks and options to trade as it helps you to get in and out of the trade with ease and allows you to get good fills. An illiquid stock will tend to have large bid-ask spreads on both the Options and the underlying stock.

The bid-ask spread is the difference between the asking price and the bid price. In fact, the real market price of the stock is always somewhere between the bid and the ask and not the last price quoted. As Richard D. Wyckoff once said, “The last sale is not the market, that is market history”.

Whenever the spread is too wide, you risk paying too much to get into a trade and leaving too much on the table when you are getting out. Furthermore, when there are narrow spreads and a wide range, a stock will naturally attract more players which will, in turn, deepen the liquidity and possibly further widen the range. So it becomes a self feeding mechanism until it changes.

Yes, the character of a stock or the way it trades often can, does and will change. And this is why you are reading this article. So yo can know how to recognize when it changes and use the criteria I am listing here to find new stuff to trade. This now brings us to the final criterion.

3. High Average Volume

It is not uncommon to hear traders talk about liquidity and volume in the same breath. In many respects, they are very close to being one and the same but there are certain instances in which they are different and it can literally pay to be able to recognize the differences when they do occur.

In my attempt to highlight the subtle difference, I look at volume as being the amount of shares being bought and sold, and liquidity as the ease with which those shares are bought and sold.

The most liquid stocks are usually those with high volumes so you need to focus on trading stocks with high volume to ensure liquidity. It is important that when you go looking for high volume stocks, that you pay attention to the average volume as opposed to just raw volume.

A high average volume will indicate that the volume profile of the stock is ongoing and that you can count on it to turn over a certain amount of shares each and every day. I usually set my volume screen to look for stocks with a 20 Day average volume of greater than 1 million shares.

I know this was a long read but if you are still around at this point, it means you have a genuine hunger for market knowledge ( even the little nuances) and that is the hallmark of a good trader/investor. I have been in this business for 18 years now and I have never come across a successful trader/investor who didn’t spend time soaking in as much as they can, whenever they can. This is not a lazy man’s job. Stay hungry.

Comments are closed.