How To Pass Your Trader Evaluation & Get Funded

Jinkles is only a few hundred bucks away from passing his fifth separate evaluation account so he is obviously doing something right.

A few days ago he took the time to lay out, step by step, how he has managed to achieve this. These are the steps presented mostly in his words .

Read carefully and take notes if you want to. What you are about to see might just be the type of information that will get you a funded account:

Step 1: Define Your Risk

Let’s get the boring (and most important) stuff out of the way first. I use a 50k account. There’s zero reason to use a bigger one imo. The trailing drawdown is almost exactly the same, and the profit goal is half the size on 50k. More leverage = failure.

I am risking $300-400 on every trade in an evaluation. If I ever risk more I usually make mistakes. To succeed in trading you need discipline. Choose the risk you’re comfortable with and do not alter it. If you go into drawdown, your risk should be immediately halved. Not doubled.

Step 2: Establish The Bias For The Day

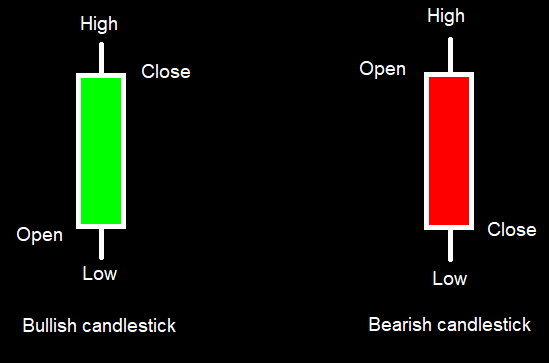

To establish bias for the day, and often the entire week, we can look at how each candle is formed in the most basic way by using the “power of 3” (OHLC/OLHC). The opening and closing price for each day forms the bodies while the highs and lows form the wicks. Simple enough.

However, when we look at this on an actual chart it paints a more clear picture. We mark out midnight open and it shows us how we can anticipate the direction on the day using power of 3. Accumulation -> Manipulation -> Distribution.

Step 3: Identify The Liquidity Levels

First thing I am doing after I mark out my midnight times and NY open price is looking for the major liquidity levels on the chart. Slide back on the daily chart and mark out prior day highs and lows.

These are going to be your most obvious liquidity targets that the algo will seek. Next, we’ll mark out the highs/lows from the Asian (20:00-24:00) and London (02:00-06:00) sessions. Let’s see what that looks like on the same chart we used to illustrate our Power of 3.

If we assume we have a bullish bias going into the day (e.g. moving towards HTF premium arrays), we’ll target our PDH liquidity once the manipulation sweeps sellside liquidity (lows) from Asian and London Sessions.

Step 4: Wait For The Entry

Ok so we have context for our trade. Now we just need to wait for our entry by focusing on the FVG/Order Block Entries . I personally like to use the ICT 2022 Mentorship entry model for my trading. I only take entries on this setup between 09:50-11:30 & 13:30-15:00.

Here’s what it looks like zoomed in.

Notice the precision on the order block entry. This is also a great example of why I wait until 9:50 to enter when I’m trading the NY session. Everyone who went long at the first dip into the FVG is getting cleaned out on that 10:10 wick.

Make Sure The Risk Model Works

Finally, let’s tie all of this together into an actionable and successful strategy to pass evaluation accounts.

We’ve planned this trade out and analyzed the different sessions leading up to this. We enter at 4375.5 middle of the FVG. Stop would be at 4372, which is 3.5 handles.

2 mini $ES contracts ($50/handle risk) x 3.5 handles = $350 risk (fits our $300-400 risk model) We’ve just discussed why there is logic to hold for prior day highs, but even if we didn’t have the patience to hold for that we can still target a new high from where we are as seen here:

See how quickly that happens? We didn’t have to risk more than a few hundred to get there.

The tricky part about all of this is holding for targets. Getting into a logical trade is the easy part. Even if you sold your position at a new high, you’re still halfway to your goal.

Why This Strategy Can Help You To Pass Evaluation Accounts

These patterns repeat every single week. As long as you are disciplined enough to wait for them and don’t try to trade with a huge amount of leverage, you can obtain funding very quickly.

The best part about this is that I only had to risk $18 of my own money on each eval.

Jinkles also took the time out to recognize Inner Circle Trader- Michael Huddleston and credit him for all the excellent Trading knowledge that he has been sharing for free.