I first came across the ICT Trading concepts via Twitter and initially brushed it off as another round of BS ( I have seen many in my time) but after a conversation with someone who has been following this system for some time, I decided to take a closer look and soon found myself going down a rabbit hole. It wasn’t long before I ran into the “father” of ICT Michael Huddleston and his deep catalog of trading education videos.

In this profile, we are going to take a look at how Michael Huddleston got his start in trading and how the now popular ICT Trading came into being. If you are more interested in learning the actual ICT trading strategy then you can check it out here. This profile basically highlights some of the key events and milestones in the life of ICT and Michael Huddleston.

The Beginning: “The Richest People In The World Trade Futures & Options”

These were the words that set Michael off on his trading journey. He had an uncle who had found some success trading commodities and ,as a teenager, that uncle told him that he needed to go to school and then get a job trading Futures & Options because “the richest people in the world trade Futures & options”.

Although Michael was not initially interested in the idea, he was constantly reminded of it by his uncle, and eventually, it stuck with him.

Real People, Real Money

Michael’s first job was working for a Jewish family in Owings Mills, Maryland where he was responsible for servicing vending machines. He was fascinated by the cash aspect of the business and dreamed of becoming an entrepreneur.

One day, he stumbled upon an advertisement for a Trading Course in an issue of Entrepreneur magazine that promised to teach people how to make money in the market. Part of the pitch was a showcase of students who had taken the course under the caption “real money, real people.”

What really caught his attention was that he was seeing where people were supposedly turning small sums of money into huge wins like $800 to $32000 and $1500 into $9000 all in relatively short periods of time. He was intrigued by it and so he called the 1-800 number in the ad.

Losing 50% Overnight

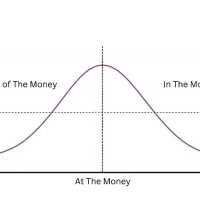

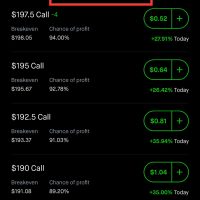

The course he bought turned out to be a poorly written Ken Roberts’ course that covered the basics and came with broker recommendations. His first trade was in Orange juice Options and he immediately lost 50% of his money. That was his introduction to trading.

Someone Took My Money

Having lost half his account on his first trade, he quickly realized two things:

(i) He did something wrong that led to that loss and

(ii) The fact that he lost meant that someone else won, or as he puts it ‘ someone took my money”

This made him very depressed at first but that depression slowly transformed into a motivation to become that other person on the side of the trade who “took his money”.

The 9 Month Winning Streak

Michael stepped up his game after the early losses primarily by taking some Larry Williams courses. William’s trading style was one that emphasized buying strength so Huddleston had a simple system where he was using the Stochastic divergence to go long on the hourly time frame.

This was all being done in the midst of a raging bull market back in the mid 1990s so his results were awesome and, naturally, he fell into the age old trap of believing that he was just smart and very good at trading.

I Just Need To Make A Million Bucks Then I Can Quit My Job

The thought that kept guiding his trading decisions was that all he needed was a million bucks so he could quit his job and his 9 month winning streak had brought him pretty close to it.

Eventually the market conditions started to change but his lack of experience blinded him to this fact and pretty soon every trade he was taking were turning out to be losers. But instead of stepping back and changing tactics, he went heavier on the leverage and this led to the inevitable blow up of his account.

He hadn’t taken out any of the money that he made over the 9 month run, so he ended up losing all of it. This was another turning point for him.

The Algorithm Idea

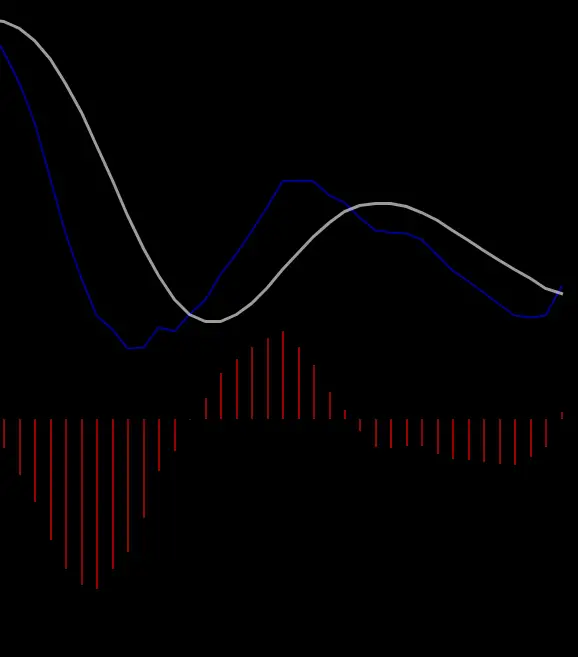

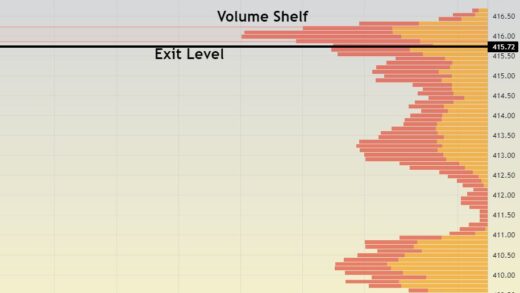

After years of careful study ( he claims to have read over 2000 books) and observation and trading, Michael turned things around and kept getting better and better as a trader. His breakthrough came when he realized that there seemed to be an algorithm that served as the primary driver of price movement in the market.

He points to the fact that the algorithm basically “attacks liquidity” by looking for where the orders are and then going there. This is something that he has been challenged on by other traders but his response is always to invite them to look for themselves. So far, his theory has stood up to scrutiny and has pretty much worked out for those dedicated enough to try it.

The Birth Of Inner Circle Traders (ICT)

Michael has always had a passion for teaching and just generally dispelling the many market myths that so many traders get caught up in. In fact it was this same passion for teaching that led to that, now infamous, run in with the government in the form of the Commodity Futures Trading Commission (CFTC) back in the late 90s.

The government basically approached him because he was supposedly giving “financial advice” by calling market moves in trading chat rooms back then. By his own admission, he was at fault because he gave no disclaimers or warnings and this exposed him to legal ramifications.

After this incident he disappeared from the chat rooms for a very long time in order to avoid any further issues with either the government or the people that he was sharing trading information with.

But that passion for teaching was always there and he couldn’t shake it. Eventually he started presenting material again but this time the disclaimers and warnings were plentiful and persistent.

It was through these teachings that his concepts and ideas began to spread among traders. He eventually took the phrase “Inner Circle” from a course that Larry Williams had at the time because it sounded cool. This is when he starred to present his work under the title of “Inner Circle trader”.

The Growth Of Inner Circle Trader (ICT)

The soundness of his approach and the fact that he basically gives it all away in a bunch of very detailed free mentorship videos plus frequent gems dropped on Twitter has endeared him to many struggling traders.

This is an industry in which people with less experience and no public track record charge thousands of dollars for re-hashed strategies and indicator packs. So the fact that Michael has chosen to teach and give freely sets him apart. And the fact that his system actually works well and works consistently, has made him a near hero in the retail trading space.

His video catalog on Youtube has racked up millions of views and his subscriber count now stands at just over half a million. Over on Twitter where he makes frequent live calls and shares trading wisdom , he has amassed a following of over 250 thousand followers and his tweets get seen, and interacted with, many many times that number on a monthly basis.

However, the real testament to the growth of the brand and the trading concepts are the thousands of students who have now become teachers themselves. And of course, we can’t discount the many who have simply copied the concepts, whole or in part, and have slapped their own brand on it.

In fact there are now dozens of trading courses and products that are being pushed under the ICT brand but have absolutely nothing to do with the real ICT. This is a clear and inevitable downside of growth and success.

The Future Of Inner Circle Trader (ICT)

Michael has made no secret of the fact that he plans to be done with the teaching and mentorship at the end of 2023. He has taken a conscious decision to avoid partnerships and bigger teaching opportunities thereby restricting the growth of his personal brand and footprint.

But the actual concepts and strategy will persist through the students and traders who continue to credit their success to the teachings. These days you can’t seek out information on Forex or Futures trading strategies without coming across someone touting ICT or selling some related product or service.

The ICT Trading Strategy – Final Thoughts

Every 25 years or so, we tend to see the emergence of a trader or investor who brings some new insight, or a new look at an existing concept, to the trading and investing world. These traders usually end up leading a movement (whether intentionally or unintentionally) that lifts large numbers of traders out of their “struggle state” to the point where they start to taste some success.

This success spawns many disciples and followers who go on to teach and perpetuate the concepts and strategies and these persist to the point that the movement tends to outlast the founder.

Of course I am thinking of people like Gann, Baruch, Darvas, Wyckoff, O’neal, Zanger etc. And it now seems inevitable that Huddleston and his ICT strategy will end up being the most recent version of this.

Ryan Thibault is a trader and contributor to several online trading and investing publications including StocksandFuturesTrading.com