What Is Market Structure & How To Trade With It?

This trader is one of the few who consistently nails the important levels in the Emini futures and does so hours or days in advance.

He is able to do this due to his deep understanding of Market Structure and Order Flow. This knowledge largely comes from his years working as a market maker where he was the one responsible for moving prices.

He doesn’t use his real name in public due to issues relating to his former role as a Market Maker in the Small cap space where he pushed deals for shady characters and players who operated in the gray areas. Instead, he goes by the name of JJ and tweets under the @vwaptrader1 handle on Twitter.

This is a summary of an interview with JJ where he rolls back the curtain and shows us how the market really works, who moves prices and how you can take advantage of it.

How Did You Get Started In The Market?

I started in the business in 1993. I started in Vancouver, BC which was the offshore capital for unregistered stock and Reg S stock coming from offshore tax havens into the United States.

Little did I know then that I would be at the epicenter of some of the most interesting stock stories of the 90s. I actually started out selling advertising to Hedge Funds and Stock Promoters and public companies so they could get leads.This was back in the day before the internet when you had to get leads the hard way. They mailed them in.

Later I became a trader on a trade desk at one of the sort of nefarious brokerage firms in Vancouver and my job was to liquidate large insider stock positions for the people who promoted and financed the deals. My actual education was four years of Microbiology and Immunology so, in this trading business, I started at the bottom as a geek on the trade desk.

I worked hard and eventually had a lot of clients who did nothing but liquidate positions at five percent commission. So very quickly I became one of the number three producers in the firm so that was my life for 20 years.

What Did Your Actual Job Entail? What Did You Do On A Daily Basis?

I was basically the executing trader for large early stage investors. My job was liquidating/selling their investment into the retail flow when the buying came in. This is how I developed relationships with all the wholesale market makers in New Jersey.

What Was Your Relationship With These New Jersey Marker Makers? How Did You Work Together?

There were tons of them back then and what they do is they’d show me bids (buy orders from their retail clients) all day and I would control the supply (how many shares were actually sold). Therefore we could control the price of the security and just distribute.

How Did Your Career Evolve?

I started out in the Pink Sheets/ OTC Market which is basically the sewers of the stock market and I worked my way up to a better class of clients. By the end of my trading tenure I was working on Nasdaq small caps and then full-blown Nasdaq stuff.

My specialty was doing the Short Squeeze and I was an expert in cross-border clearing between Europe and the United States. I liked to consider myself sort of like the concierge of the small cap markets. If you needed something when you came to me I’d find the person to do it for you if I couldn’t do it myself.

You Described The OTC As The Sewer Of The Stock Market, Why Is That?

I traded for lots of crazy people. Arms dealers, large Hedge Funds, Small Hedge funds all sorts of just crazy, crazy people. I’ve been around maybe 200 Reverse Mergers (and IPOS and I’ve been the executing trader on those mergers.

How Did You Leave That World And Transition Into What You Do Now?

I had a heart attack in 2012 at the age of 44. I had a quintuple bypass and I had to do something a little bit less stressful so I chose retail trading because I know Order Flow and Mechanics of markets and how they work.

I had to figure out how to trade when you can’t cheat and trading has been sort of a passion of mine and we’re teaching people now so that’s what I’m up to now.

What Do You Mean By That? How Were You Cheating Back In The Day?

We get our stock at ridiculously cheap prices compared to what the retail traders were paying. We were always in the stock at a discount so that’s changed a lot.

Also, the analyst back then was a paid analyst so you would have a Nasdaq small cap stock at like 5 bucks or 10 bucks and you would pay somebody 10 grand who was a CFA or something like that to write a favorable analyst report so you could use it in marketing materials to get retail investors to come and buy the stock because it made it look credible. The whole of that stuff is gone.

Now Let’s Talk About Market Structure. What Is It How Is It Used To Make Money ?

Market structure is the structure of the transactions that have occurred. This structure can help you to deduce where the inventory is and if people are trapped long or short and if there’s supply or not.

It can give a hell of an edge because you know where the shorts are trapped which is a great way to know where buying is going to be if i’m short. So I know where to cover and I know where to initiate longs based on shorts being trapped and supply running out.

We teach very simply in our room that it’s all about supply. If there’s supply you can go short but if there’s no supply you’ve got no business going short of the market because you need supply to push prices.

When people are trapped over a level you know they will become supply. For instance, you know that if you’ve got six hours of trading above a level with no upside, those people are gonna start getting tired and they’re gonna start breaking and they will create the supply to push prices down and that’s when you can short, it works really quite nicely.

How Do You Get This Info? How Do You See Market Structure In Real Time?

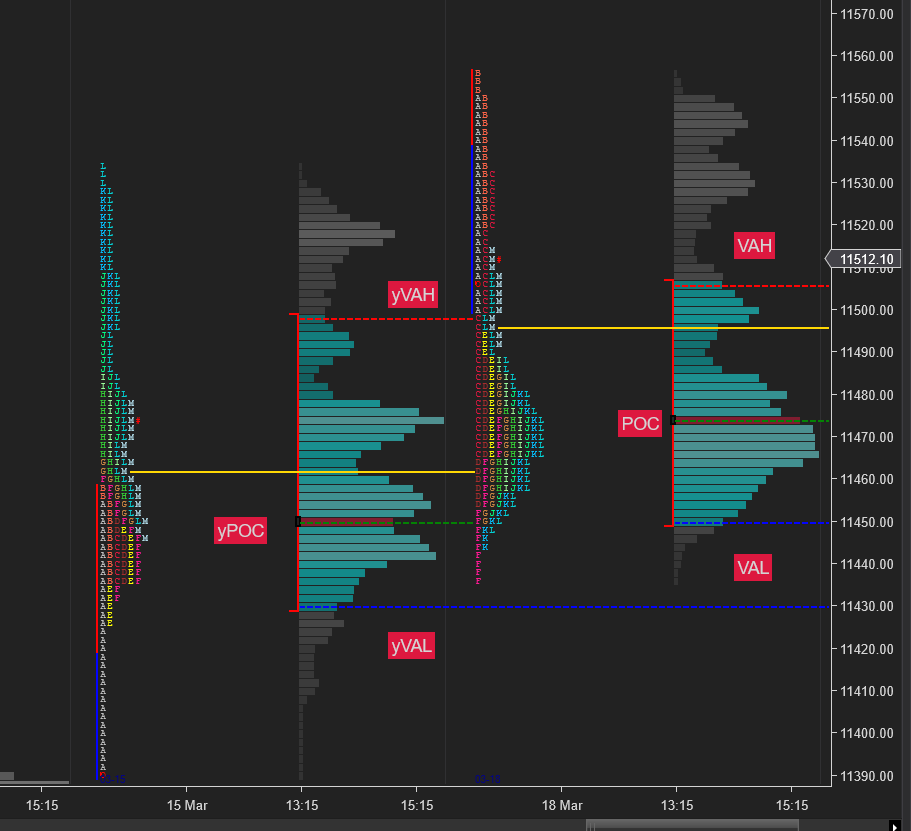

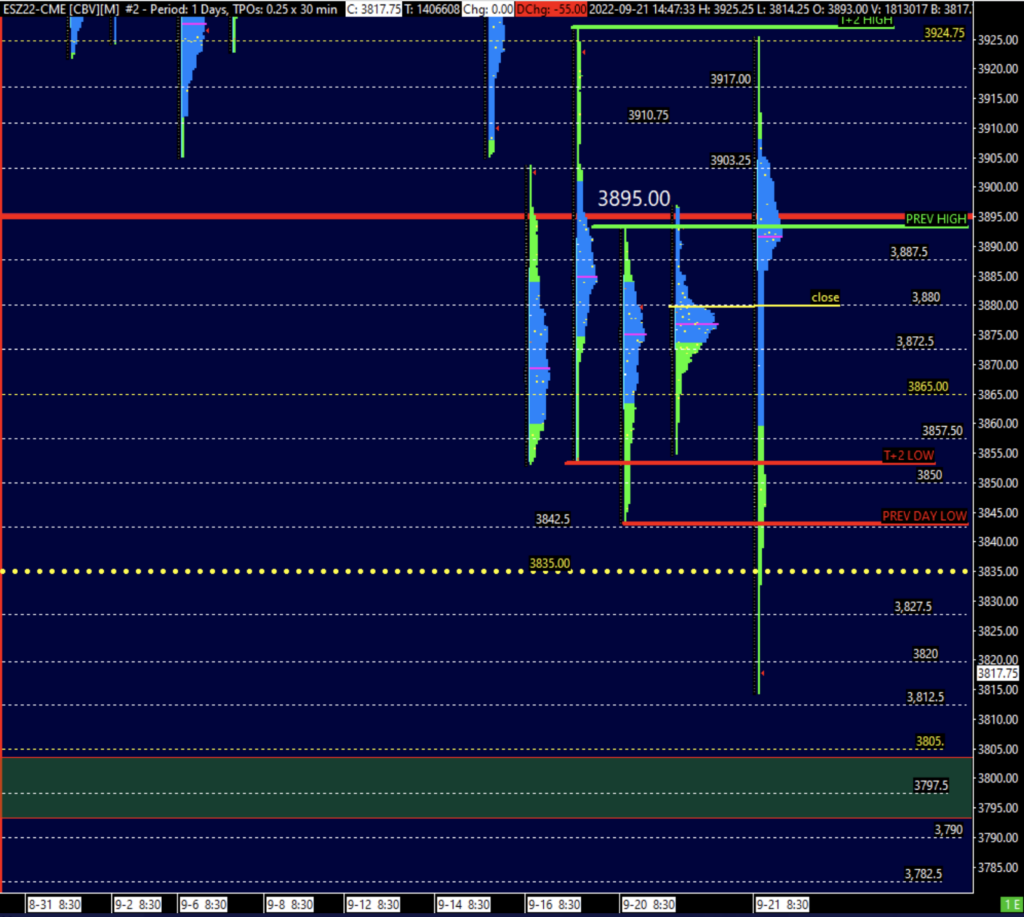

I use profile charts. A lot of people call them alphabet charts because they have abcd lettering. These charts clearly show you when supplies run out and it’s quite fascinating.

I only discovered them in 2012 or 2013 and I’d never seen them before but after spending years with them I got pretty familiar just sitting and watching price action for about 18 hours a day.

So You Are Basically Self Taught?

Yes for the most part but I picked up all the fundamentals from reading Peter Steidlmayer‘s book, Trading With Market Profile and Jim Dalton‘s book Mind Over Markets and took those theories and applied them to shorter time frame trading.

It’s so simple and it’ll blow you away how accurate it is if you know what to look for. I use the market profile and then I mix it in with a five and a one minute candle to show where short term inventory is so we can see when supply is running out, this way we know when to cover our short or when to initiate a long.

What Advice Would You Give To A Trader Who Wants To Start Trading Market Structure?

If you’re going to trade short term you should be clear about a few things. You need to know is it really for you? Do you have the time and energy to put into this?

If not, you’re better off thinking longer term and you should probably be sitting down with your financial advisor to put together a long term investment plan.

Market Structure Trading Resources

You can check out JJ’s live trading room at his website at Microefutures.

This article was not meant to be a comprehensive tutorial on Market Structure so if you are interested in in diving deeper into this topic, here are some books, research papers and videos about Market Structure that will ensure you get a sound understanding of the concept and a solid start:

Fundamental Surprises, Market Structure, and Price Formation

Stock Market Structure, Volatility, and Volume

Trading Market Structure Primer

Market Structure Strategy: In 3 Simple Steps

What is “Good” Market Structure?

Written By Kareen Jeffs