The Ultimate Hedge

What happens if I told you I could give you a free Put where you just participate in the market crashing and you don’t lose any money? You would tell me that’s the most perfect thing in the world right?

Of course there is no such thing as a free put but you can come pretty close if you do your job well as a Volatility trader and structure the perfect hedge. You should be able to have a situation where you can take advantage of extreme volatility in the market, a market crash for example, and have very minimal or zero risk.

Kris Sidial is the Chief Investment Officer at the Ambrus Group. Ambrus is a Long Volatility fund. He has over 15 years of experience in volatility trading on an institutional level.

This article is a summary of Kris’s recent presentation on trading volatility from an institutional perspective. This is tremendously valuable information that you won’t come across everyday. It is the most recent trading strategy featured.

What Is Volatility Trading?

The typical retail trader thinks that trading volatility involves just going long the VIX or buying a bunch of VXX Calls when the market tanks and volatility spikes. Unfortunately, this assessment is only half right.

Actual volatility trading is done with the objective to make outsized returns in the event of a market crash. It is like a two edged sword because you are simultaneously seeking outsized returns in an adverse market event, as well as trying to protect or hedge a portfolio with heavily weighted long exposure.

The Long Volatility Trade

This is the most basic form of volatility trading and this is how it works:

It can be looked at like a sophisticated form of insurance. Just like you would pay your insurance premium every month for your home or your car to ensure that if some crazy event occurs you are covered, it’s the same thing that you would do for your portfolio.

Let’s say you had a portfolio of stocks and maybe some other investments worth about a 100 million dollars, you would take like five percent and allocate to a long volatility strategy so that in the event of a crash, you would make outsized returns that would cover the losses in the overall portfolio.

Let’s make this clear though. It is not as simple as just buying a ton of puts on the S&P or loading up on VIX Calls because if you’re doing things like that you are unlikely to get that type of asymmetric payout. You would bleed a tremendous amount because the time decay would crush the premiums in the VIX Calls & S&P Puts when there is no volatility.

How To Structure The Volatility Trade

With this long vol trade, you must be able to trade uncorrelated strategies that will offset the inevitable losses that you will have from carrying S&P Puts and VIX Calls all the time.

So you really have to look at the long vol strategy in two two different baskets:

(i) you have basket number one where you are long Volatility via the VIX Calls and/or S&P Puts and

(ii) you have a bunch of uncorrelated strategies that you run that will offset the bleed. This is the active side of the book.

You have to do this in a way to ensure that you are not shorting concave structures to fund convex structures.

In other words, you need to structure the trade so that you are NOT taking bets that are 10 to1 against you in order to try to make bets that are 1 to 10 in your favor.

Unfortunately, this is the way a lot of traders do it and this puts them in a very bad situation in terms of the overall risk exposure.

In such a trade, if an event happens it will compromise the goal and purpose of the strategy which is to make outsized returns in a volatility event.

The Active Side Of The Volatility Book

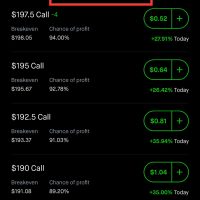

While you are long S&P Puts and VXX Calls in the first basket, you want to be trading a lot of intraday order flow strategies that generate daily returns in the second basket. These would mainly consist of various scalping strategies and selling premium on out the money contracts that expire on the same day.

You won’t be carrying any of these positions overnight so you want to be flat on the other side of the book by the end of the day.

The whole idea is to have a side of the portfolio that is constantly turning over and generating returns to offset the losses/bleed that you will have from carrying all the long S&P out of the money Puts and the VXX calls aka “the tail”.

The Payout Structure

If you have like 10 “tails” ( active Out Of The money Options positions) allocated and let’s say those options go up 50x in a volatility event, then that’s like a 5x return on the entire portfolio.

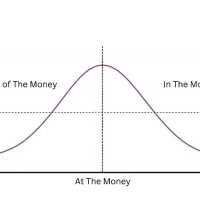

Remember that these are very far out of the money options (i.e like sub 5 delta options) and that’s why the payout is so convex because the nature of these things is that like 99% of the time they’re gonna lose but when you have that event it pays out really really big.

The purpose of the long volatility strategy is to hedge against any enormous tail risk, it’s not just a normal hedge.

For instance, if the market dropped like 5% in a month it’s very unlikely that these tails are going to pick up and make a ton of money but if the market drops say 30% in a month then these things are going to pay off really really big. It can be dormant for long periods of time but when the volatility erupts it comes alive with huge gains.

Who Uses The Long Volatility Trade

If you’re a large institution or a family office and you have a mix of investments in all these different areas and asset classes, you can’t trade in and out the market every single day so you need to have something in your portfolio that could protect you against some sort of exogenous event and that’s really why institutions or family offices or Funds of Funds use these strategies or just allocate a part of their portfolio to a fund that specializes in in this strategy.

Insurance With A Twist

The best way to grasp the concept is to think of it as insurance that pays for itself. So let’s Imagine if you had to pay insurance on your car every month and that insurance cost you $300/month.

And let’s say you invested $50000 in an interest bearing instrument at a bank that pays you $300/month and you use that money to pay for your car insurance. You could keep this investment in the bank and it will pretty much yield $300 and you could just take that $300 and pay for your car insurance.

So, effectively, to you this becomes like free car insurance right? That’s the same way you should look at the long volatility book in order to understand it better.

We have to buy all these tails for insurance so how do we pay for this? That comes with the other side of the book which is a lot of the active trading for income generation.

Thinking Through The Volatility Trade

It is important to keep in mind that even though we know we need to have the tail side and the active trading side of the book to make things work, it is still not just a matter of buying long dated out of the money Puts on one end and then trading other instruments around them. It is never that simple.

When you buy these tail options you want to make sure that if the market gets to those extremes, that you have a good idea of what the payout on those options is going to be. It’s a very very different game here that you’re playing.

You have to make sure that when you’re structuring your portfolio that you are buying value that would make the return asymmetric and , at the same time, eliminate the

basis risk if we are faced with that sort of a Volatility shock where correlations go to 1 and and Volatility is starting to move.

You should also put the trades together so that if, for example, the S&P goes down but the volatility doesn’t spike up you’re at least making a little bit of money on one of the plays/trades in the book.

Simply put, the hidden details are super important when you’re trying to

put on these positions, execute and figure out what you want to buy because if you’re just going and buying willy-nilly at any price point, when the event happens you’re not really getting the value and payout.

Q& A With Kris Sidial, Volatility Trader

In this next section, Kris answered some specific questions about what he does and how he does it. The questions and answers are summarized, edited and posted below.

Volatility spikes usually happen when the Market is crashing but there are instances where the volatility spikes when the market is going up as well, are you indifferent whether the volatility occurs to the upside or downside?

Answer: September of 2020 was one of those times where you had the S&P and Tech stocks going crazy and front month VIX futures were also moving up in a big way. We are positioned to profit from things like that. VIX is just a weighting of SPX options and if it starts to move up, that’s going to be profitable for us. So whether the S&P is going up or down as long as VIX is going up, it’s good for us.

Do You Trade Volatility Shocks In Other Markets Like Crude Oil?

Answer: We are operating just in the equity space right now but there are lots of interesting opportunities in other areas like Chinese equities, FX etc. where you could get this sort of mis-pricing. Hopefully one day we can branch out and take advantage of cheap volatility elsewhere.

How Do You Identify When Volatility Is Mis-priced/Cheap?

Answer: This is one of those questions you could bring to 10 volatility traders and they will give you 100 different answers because there’s so many different ways to assess the value.

The way I was trained was to always think about the underlying first. More specifically, think about the supply and demand that could drive the underlying and then how volatility and the term structure react to that.

That would give you an idea as to what the pricing of the options should be and then you look at that relative to where they are now.

It’s almost the same thing as a value investor who, based on some valuation model, has a price projection for a stock and then looks at where the stock is trading now to see if it is a bargain or not. And if it turns out to be a bargain, what are the factors that could cause the price to go up.

Do You Hold The Options That You Use For Your Long Volatility Trades To Expiration? Or Do You Keep Rolling Them Month To Month?

Answer: There is a bit of a balancing act. We’re not always holding to expiration and we’re not always rolling either.

We like to think about the exposure that we have in certain trades at certain times, so there may be times where we want more exposure in our one month trades than we do in our three month trades.

There may also be instances when there are key economic numbers coming up and we might want a little more exposure in the one month trades than the other trades so that’s really the way we think about it.

It’s not really like a hard rule of always rolling or leaving till expiration, it’s thinking about the exposure in terms of current trades and how much exposure we want.

Does The Absolute Return Strategy Have To Be Used Along With The Long Volatility Strategy ? Or can It Be Used Separately?

Answer: the only form of revenue that our business earned in our first year of operating came directly from trading and it was from trading these types of

absolute return strategies. We did not charge a management fee.

The thinking is that if you can make money to fund the tails that means without funding the tails you probably have a pretty good return as well so it can be run on a standalone basis.

But the strategy complements the tails. A lot of the trades in the absolute return side of the book are only there because there is a specific tail that needs to be hedged. It’s a basket of these uncorrelated strategies. They are not something as generic as saying oh we’re going to short Vol here or we’re going to only be long stocks.

Is There Any Part of Your Absolute Return Strategy That Is Quantitatively Driven?

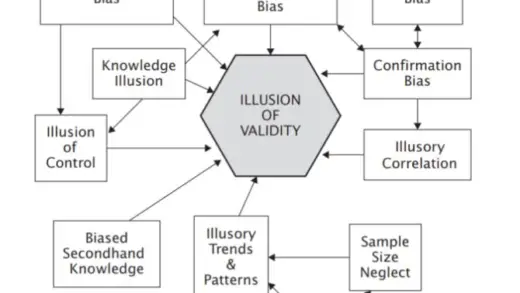

Answer: everything that we do has to have statistical affirmation behind it and

We have numerous ways that we test these strategies and make sense of the core data.

For example, trading against the reactive nature of market participants is one of the strategies that we know have statistical validity due to testing and data collection. So it’s more on the quantitative side with a little bit of the discretionary overlay to it.

What Is One Piece Of Advice You Would Give To Retail Traders?

Answer: you should always be thinking about risk first. That’s the number one thing. You should always be thinking about what is the most that i can lose in this position and how can I guarantee that it will not get over that.

The game of investing is really and truly about survival. If you play this game long enough you’re bound to run into a big drawdown so it’s all about how you can survive these bad runs so that you can be around for the sort of good periods where you really compound your wealth.

Kris Sidial is the Chief Investment Officer at the Ambrus Group . Ambrus is a Long Volatility fund. You can catch up with Kris on LinkedIn or Twitter. You can also check out the original version of the presentation on which this article is based here.