Alex Temiz Trading Strategy

Over the past decade, Temiz has carved out a niche as a short seller, specializing in identifying and betting against the “worst companies in the world.” His story is not just one of financial success but also of personal growth, driven by a desire to prove himself after a painful breakup and a determination to master the art of trading.

Background: From Coffee to Charts

Ten years ago, Alex was working at Starbucks, making just enough money to cover basic expenses. A pivotal moment came when his girlfriend left him for a wealthier man. This heartbreak became the catalyst for his ambition to get rich. He researched the fastest ways to make money in America and settled on the stock market, drawn by its low barrier to entry compared to real estate.

Temiz’s early days in trading were far from glamorous. In his first year, he lost money consistently, a common experience for many novice traders. However, he discovered his edge in his second year when he stumbled upon short selling.

Realizing that every time he bought a stock, it went down, he decided to flip his strategy and bet against companies instead. His first successful short trade netted him $1,000 in just five minutes, and he was hooked.

Overcoming Failure: The Path to Success

His journey hasn’t been without setbacks. He recalls losing money early on and feeling the sting of failure. However, he views losses as valuable lessons and believes that every trader must experience failure to grow. He credits his ability to persevere through tough times to his passion for the markets and his desire to constantly improve.

One of his most significant lessons came from a losing streak that forced him to sell the rims off his car to fund his trading account. He gave himself one last chance to succeed, and that moment of desperation became a turning point in his career. Since then, he’s adopted a more disciplined approach, focusing on consistency and risk management.

Trading Successes: From $1k to $700k In A Day

Alex’s trading career has been marked by significant milestones. He recalls one of his largest single trades being a $700k profit on AMC in single day. More recently, he made $400k in a week in a week by shorting DJT (Digital World Acquisition Corp.), a stock tied to former President Donald Trump’s media company. His ability to capitalize on market volatility, particularly during high-profile events like elections, has been a key factor in his success.

His trading philosophy revolves around identifying “A++” setups—high-probability trades where the odds are heavily in his favor. He likens these setups to betting on a sure thing, such as a friend getting drunk at a club rather than at Disney World. When the conditions are right, he sizes up aggressively, but he’s also disciplined enough to cut losses when the market moves against him.

His Trading Strategy: Short Selling & Market Cycles

Temiz’s niche is short selling, a strategy that involves betting against companies he believes are overvalued or fundamentally weak.

He describes his approach as the opposite of Warren Buffett’s: while Buffett invests in the best companies and bets they’ll go up, he finds the worst companies and bets they’ll go down. His strategy is rooted in understanding market cycles and adapting to changing conditions.

One of his key insights is that the market is always evolving. What worked in 2020 may not work in 2025, and traders who fail to adapt risk losing everything. He emphasizes the importance of staying in tune with the market and being willing to adjust strategies as conditions change.

He also stresses the importance of grading setups—identifying which trades are high-probability “A++” opportunities and which are lower-probability “B” setups. This grading system helps him determine how much capital to allocate to each trade.

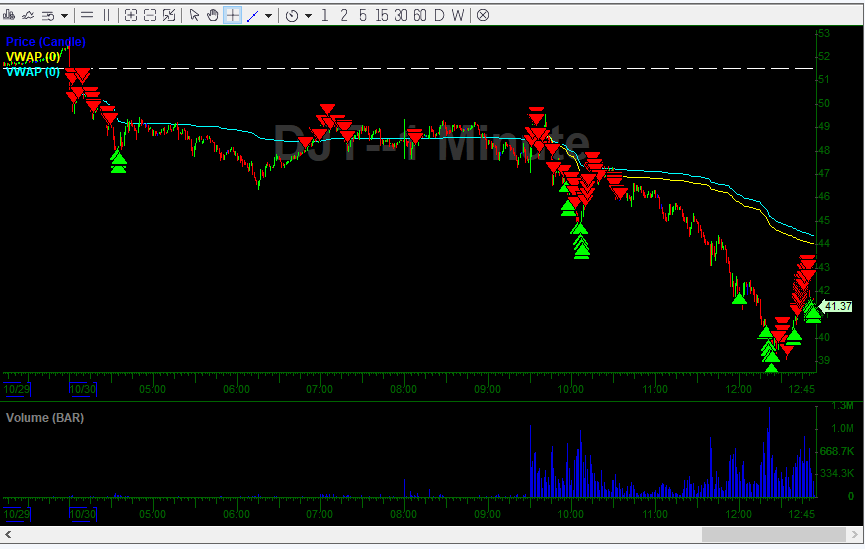

The chart below shows his typical style of entering his positions against the VWAP and covering, or exiting the trade, when there is an extension away from the VWAP. The stock in this example is the DJT referred above.

Alex Temiz’s Trading Philosophy

His trading philosophy is basically “treat trading as a business“, not a gamble, and approach it with a methodical mindset.

For instance, he wakes up at 5:00 a.m. to prepare for the market, reviewing pre-market movers, analyzing charts, and identifying potential short opportunities. By 10:30 a.m., he’s often done for the day, having executed his trades and locked in profits.

One of the most striking aspects of his approach is his focus on risk management. He sets strict loss limits and ensures that he never risks more than he can afford to lose. He also emphasizes the importance of taking money out of his trading account regularly, both to reward himself and to avoid the temptation of overtrading.

He is a firm believer in the power of mentorship and learning from others. Early in his career, he attended a trading conference in Las Vegas, where he met a mentor who taught him the importance of technical analysis and risk management. This relationship was instrumental in shaping his trading style and helping him achieve consistent profitability.

Temiz’s ultimate goal is to achieve a $1 million trading day, a milestone he’s been working toward for over a decade. He acknowledges that trading is a long game, requiring years of dedication and learning. But for Tamise, the journey is just as important as the destination.

He remains passionate about the markets, constantly seeking to improve his skills and adapt to new challenges.

If you liked this feature, be sure to check out other great traders like Lewis Borsellino, Alex’s buddy Bao “Modern Rock” Nguyen, Michael Huddleston of ICT fame , Maury Kravitz and many more

Written by Kareen Jeffs for Stocks & Futures Trading Magazine

Comments are closed.