How Gamma Exposure (GEX) Moves The Market

Gamma Exposure (GEX) is a critical concept in understanding how market makers and dealers hedge their positions in the options market and how these hedging activities influence market volatility and price movements.

What Does Gamma Exposure (GEX) Do?

Gamma Exposure (GEX) Measures the exposure of market makers to changes in the gamma of options contracts. Gamma (Γ) itself is the rate of change of delta (Δ),which measures how much an option’s price will change with a $1 move in the underlying asset.

It indicates whether market makers need to buy or sell the underlying asset to hedge their positions, which in turn impacts market volatility and direction.

Basics of Options and Market Makers

Options Contracts

Options are financial derivatives that give the holder the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a specified price within a certain period.

Market Makers

These are entities that provide liquidity in the options market by acting as intermediaries between buyers and sellers. Their goal is to minimize directional risk rather than speculate on price movements.

Delta & Gamma

Delta (Δ) is the sensitivity of an option’s price to a $1 change in the price of the underlying asset. Calls have positive delta; puts have negative delta.

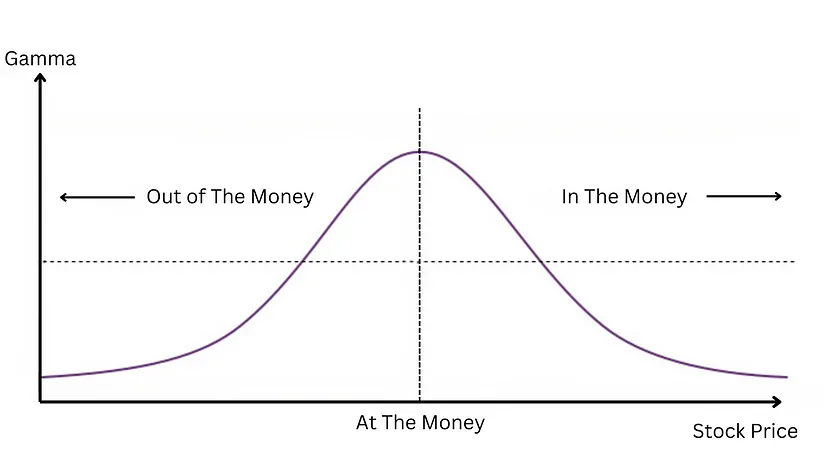

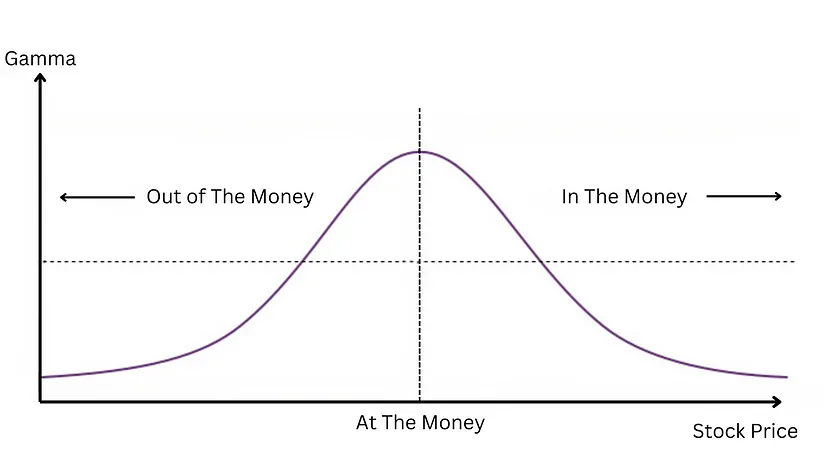

Gamma (Γ) is the sensitivity of delta to changes in the price of the underlying asset. It indicates how much delta will change as the price of the underlying asset moves.

Gamma is highest as price approaches the “At The Money” strike, increasing exponentially as it is approached from either direction. So, gamma is essentially measuring the rate of change or the acceleration of an option’s delta and hence, an option’s price.

Hedging & Its Impact

Delta Hedging

Market makers hedge their delta exposure by buying or selling the underlying asset. For example, if a market maker is short a call option (which has positive delta), they will buy the underlying asset to hedge the delta risk.

Gamma and Dynamic Hedging

Gamma indicates how delta changes with the price of the underlying asset. As the price moves, market makers must adjust their delta hedges continuously, a process known as dynamic hedging.

Gamma Exposure (GEX) Explained

Positive and Negative Gamma

Positive Gamma

When market makers are long gamma, they need to buy the underlying asset as its price falls and sell it as the price rises. This suppresses volatility.

Negative Gamma

When market makers are short gamma, they need to sell the underlying asset as its price falls and buy it as the price rises. This increases volatility.

Gamma Exposure (GEX) Metrics

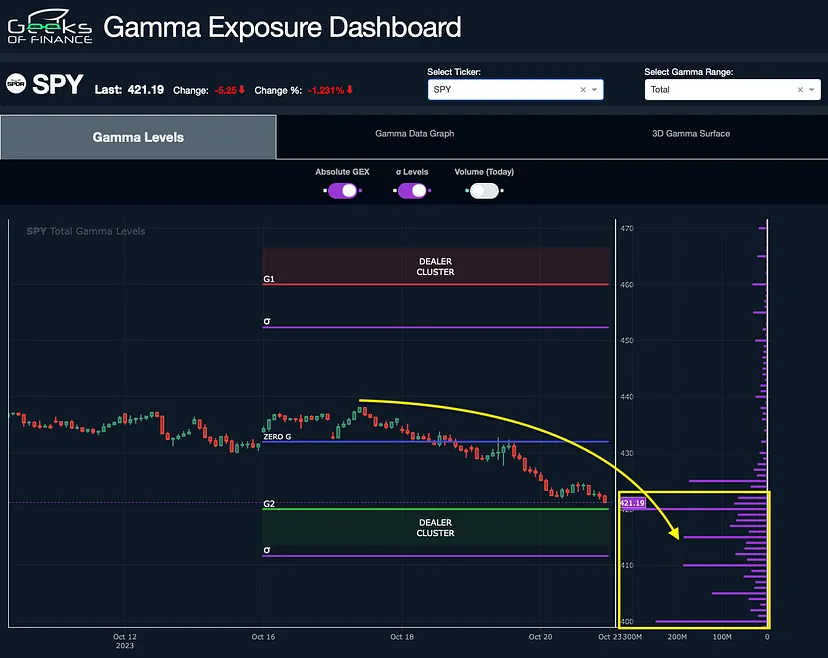

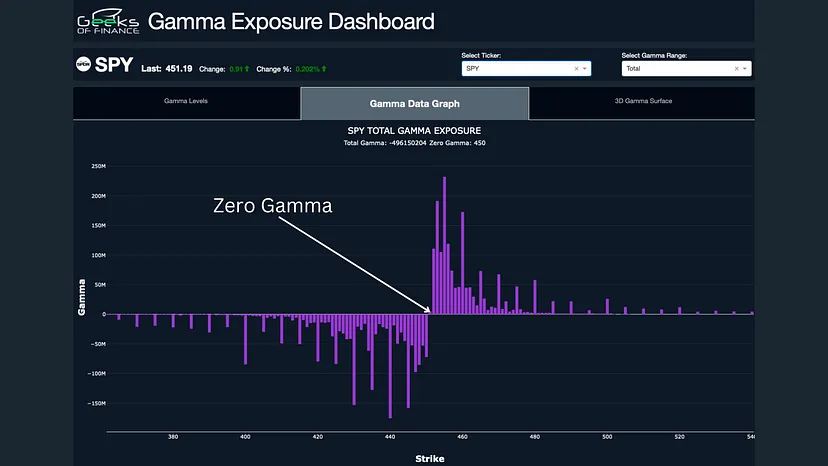

GEX Visualization

GEX is often presented in graphical form, showing the net gamma exposure across various strike prices. Positive GEX values indicate a net long gamma position, while negative GEX values indicate a net short gamma position.

How Gamma Exposure (GEX) Impacts The Market

Volatility Suppression (Positive GEX)

In a positive GEX environment, market makers’ hedging activities involve buying dips and selling rallies, leading to reduced market volatility and a more stable trading range.

Volatility Amplification (Negative GEX)

In a negative GEX environment, market makers’ hedging activities involve selling into dips and buying into rallies, leading to increased market volatility and potentially more severe market movements.

How The Market Behaves Around Options Expiration

Options expiration dates (OpEx) often lead to significant changes in GEX. As options contracts expire, the need for hedging decreases, which can lead to increased volatility and market movements.

One real life example played out during the COVID-19 Sell off in February & March 2020 when there was a significant drop in GEX was observed, exacerbating the selling pressure. Market saw large build-up in negative gamma, leading to increased volatility and a severe downturn until the end of the March options expiration.

Three Key Things To Remember In Your Trading

- When there is Positive Gamma Exposure you should expect reduced volatility and a stable market.

- When there is Negative Gamma Exposure you should anticipate increased volatility and possible market sell offs.

- Around Options Expiration you should watch out for significant changes in Gamma Exposure which can lead to notable shifts in market dynamics.

This primer on Gamma Exposure was produced by Quant Insider. If you liked this feature, you can check out How To Trade The VIX When Volatility Spikes, How To Use Volume To Trade Like Banks & Institutions , How To Trade The Options Chart Instead Of The Stock Chart, <strong>How To Trade Using The $BPSPX</strong>, How To Trade The Options Chart Instead Of The Stock Chart, This Is How You Can Make $250k Selling Options

Comments are closed.