Kris Sidial is the CIO of Ambrus Group and perhaps one of the best minds today when it comes to the subject of Volatility and how to trade it.

He has been featured here on this site before where we looked at how he manages volatility in the event of a market crash. Please do take a read as the information he shared was extremely helpful.

More recently, Sidial shot off a Twitter/X thread that basically laid out his framework for handling a scenario where the Volatility (VIX) Index crosses the critical level. In the last volatility piece, that I mentioned earlier, he spoke somewhat conceptually but in this one he laid out specific approaches that can make a huge difference in the outcome of of your trades when volatility spikes.

According to him there are six key things that you will need to consider:

Time

The first thing you should pay attention to is time. or more specifically, how you perceive time during these moments when volatility spikes and you have important trading decisions to make.

In this regard, Kris states that ” It may sound cliche, but things truly start slowing down during those moments. Hyperbole would be saying that it feels like the matrix, except your emotions will be extremely heightened. Every market tick feels massive in both directions.

Days feel like weeks, weeks feel like months. Every headline and piece of news has a stronger smell to it, markets will digest and react immediately. This will drain you, mentally and physically, be prepared for that.”

Environment

The second point of focus should be the market environment. He writes that “Dislocations are affirmations to your view. Things from a cross-asset standpoint will not make sense and this will be the sign to stay strong in your position, vol is here to stay. Ex: during cov-19 there were moments where single stock surfaces didn’t hold true to put-call parity.

Things were breaking and price insensitive end users were creating dislocations across the surface. You also had smaller nasdaq names that had offers through the bid (the matching engine was breaking).”

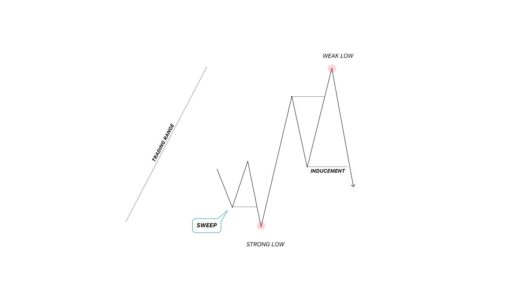

Price action

Thirdly, you need to pay attention to what the actual price is doing. he states that “Vol does not just go straight up. It’s going to feel like vol is going to collapse every single second of the day, mentally you have to be prepared to see your P&L swing rapidly.

There will be times where you see vol collapse 5 vol points overnight. Understand that this is healthy for vol. This back and forth price action is what traps aggressive shorts and ultimately leads to bigger upside moves.”

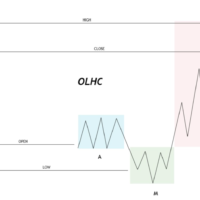

Monetization

Taking full and correct advantage of the volatility spike is the end game right? These are opportunities to make money and this is how Kris suggests you approach this “As patient as you have to be, you also do not want to be the guy that watched the option he bought for $0.10 go to $10.00 and then to $0.

When thinking about monetizing, you are going to want to scale out of your exposure in the heat of vol raging higher. Vol of vol is your best friend during these moments, you have to let it work in your favor.

The only way to do this is by scaling out into those fast vol moves higher. This will suck, because you will always feel like you are selling too early when you begin scaling. Just accept that you will never time this process perfectly. You do not want to be selling your exposure when vol is moving lower and prices are deflating across the surface.

Suckers chase exits, good traders will hand the market the position it desperately wants at a premium. Vol of vol and the “repricing of risk” will create that premium for you, use it.”

News consumption

Under just normal circumstances, the information you consume shapes your perception and influences your decisions even even without you knowing. This is probably 10 times worst in period of stress and high volatility.

Kris says “you are going to want to limit what your mind digests. Perma-bear research and click bait news headlines are just going to creep it’s way into your decision making process.

Avoid playing into that, if you are in front of screens, you have the fastest news outlet in the world, the price action from the market will tell you what you need to know.

Build up a team of reliable brokers who’s word is valid. Floor brokers have been my best friend during these moments and they have earned my loyalty/ business just from a few instances when the bullets were flying.

For retail traders this isn’t as easy, try building out more infrastructure that you think can be more helpful to your news digestion.“

Mindset

Finally, you should focus on your mindest. Trading, generally speaking, about 90% psychology. Kris says it is ” corny and cliche but it’s true. These moments rarely present themselves, so when they do, put everything else aside. Friends and family are going to have to understand that you take risk for a living and there are certain moments that are crucial.

You may end up missing events/ moments in order to regroup yourself mentally and physically. Just know that this is your sacrifice and it’s even a bigger reason as to why you need to be sharp and execute.

If you botch this one, it may take you 5 years for the market to present you another opportunity.”

I really hope you found this is a helpful as I did. Sometimes a tip or some guidance from a seasoned volatility trader cab really put things in perspective and help you sharpen your approach.

Written by Ryan Thibault

If you liked this feature, you can check out other featured traders like Tim Grittani, Modern Rock, Andrea Canto, Dr David Paul, Michael Huddleston, Mark Ritchie, Patrick Walker and many more. There is also a great article covering a Crypto Fraud that has largely gone unreported and innovative FX Trading systems.