Jordan F recently posted a short tutorial on Volume Trading in an effort to help out the traders that he feels were “taught the wrong way” to use volume.

How To Identify Real Volume

We all know the classic volume tips that we were told in the penny stock era like Wait for a run up, then look for a pullback on LOW volume to get an entry. This isn’t how you should be looking at volume.

First, let’s start with what do I mean by volume:

Volume Profile? No.

# of shares? No.

I look at the actual volume BARS

How To Use Relative Volume

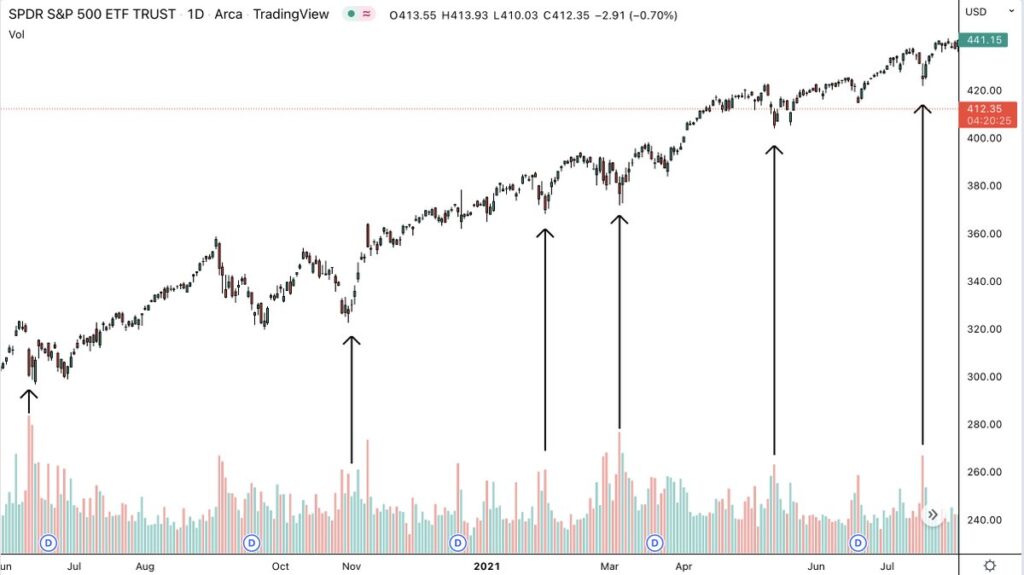

The key is to look at relative volume compared to the previous candle bars Low volume bars don’t matter The secret is in the high volume bars.

Why? Because high volume bars indicate REVERSALS (in most cases).

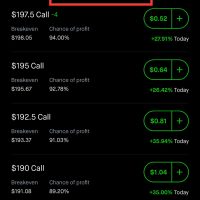

Not every bottom or top will have high relative volume. However it’s another element that can be used in your strategy for confirmation. Take a look at $SPY Notice the volume on each bottom?

Here’s an example of Tesla (TSLA). Aside from the open (which will always have high volume)the highest volume bar on the 5min timeframe for the last hour was an intraday high!

Here’s another example on Meta Platforms (META) Notice the high volume? That was was the low of the week.

How To Confirm A Reversal After A Big Volume Bar

High volume doesn’t always mean a reversal is coming 100% of the time. You will need some confirmation before you make your move.

The key to confirmation is simply waiting. Wait and see what the following next few candles do. Ask yourself the following questions:

Does price immediately reverse?

Does it consolidate?

Does it continue pushing?

If you see a huge volume candle and price keeps squeezing right through with no signs of a reversal, it usually means price will continue squeezing. Why? Shorts immediately got ran over and now have to cover, pushing price even higher.

His Final Bit Of Advice

It’s important however that you only use volume in terms with your strategy. Don’t use volume as a sole indicator to get in or out of a trade Have a strategy and test to see if adding volume will help it or hurt it.

If this info was useful to you, you can check out Jordan’s work on on X where he goes by @FT__Trading

You can also check out other powerful trading strategies like the RSI2 Mean Reversion & ORB Day Trading on this website.