ICT Trading Range

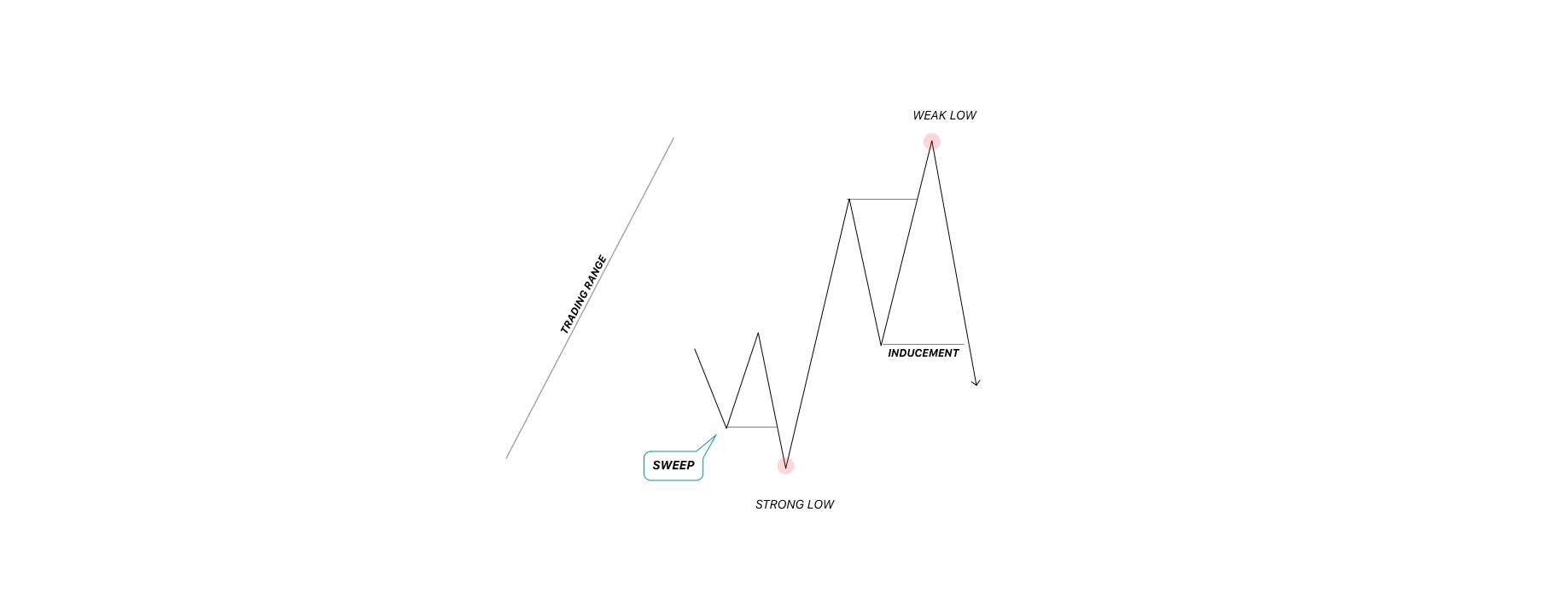

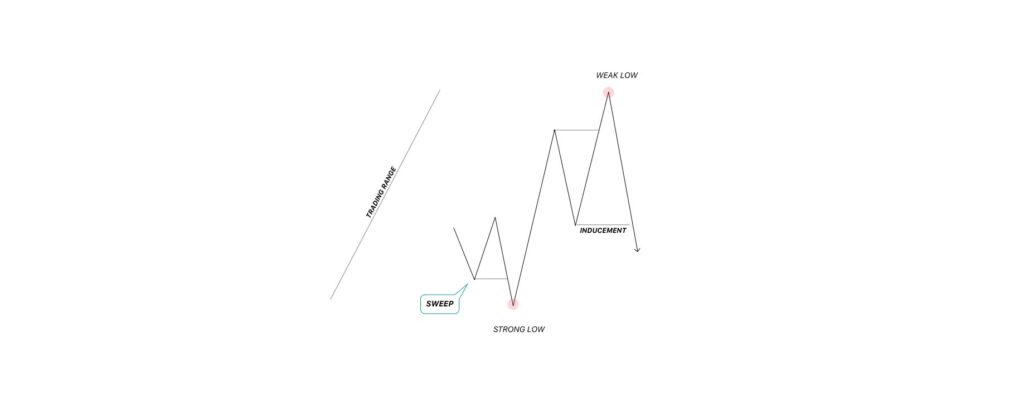

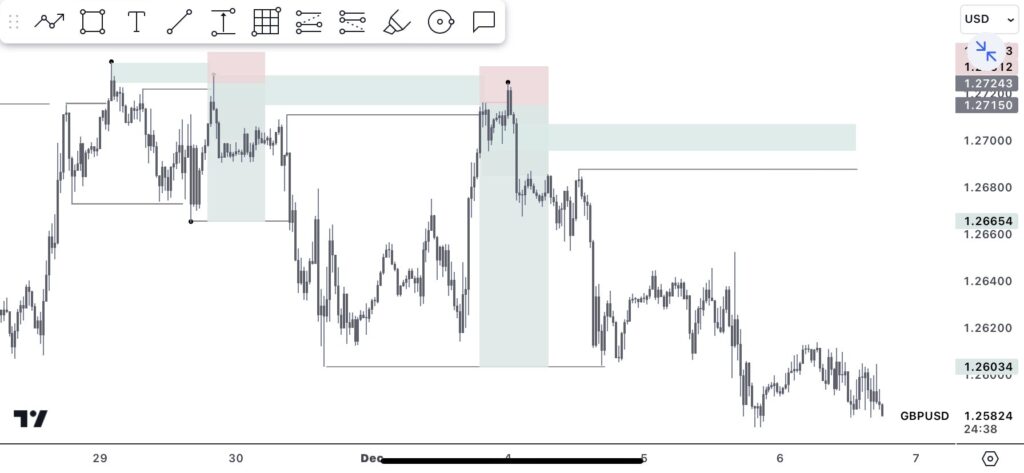

Understanding the Trading Range will help you to know where the liquidity/ inducement is, where price is going to and also where to pick your POI from.

What Is a Trading Range & How Is It Formed?

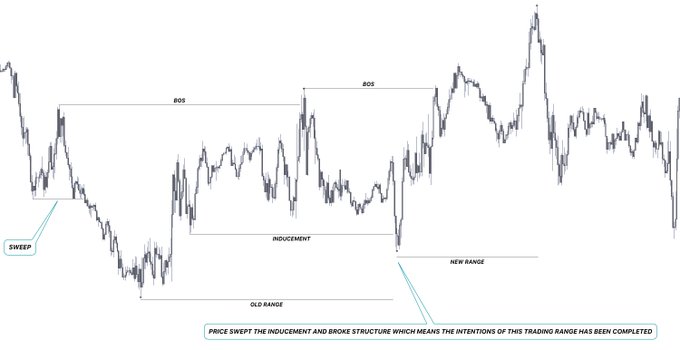

A trading range helps us understand where we are in the market and where the liquidity is. Trading range helps us get a better view of the market direction, internal and external range liquidity and POI to pick our trades from.

For a range to be formed, we will need a QM (Quasimodo) on both sides. But because the market is fractal and so is the QM, we need to focus on the logic A QM is equivalent to SH (strong High), SL(Strong Low), WH (weak High), and WL (Weak low).

If you don’t know what a QM (Quasimodo) is

A Quasimodo (QM) is simply a lopsided Head & shoulder pattern with more detail of course. It is from this pattern that the concept of Strong Low/High and Weak High/Low was made from.

In order to make it easy for you, you can just call them Strong and Weak Highs/Lows instead of Quasimodo.

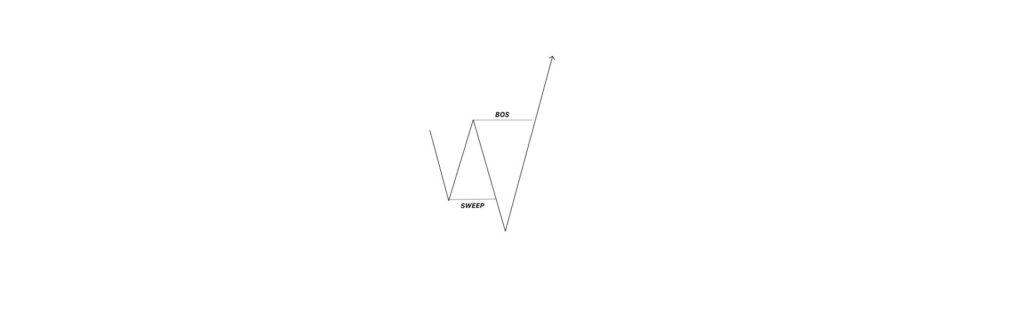

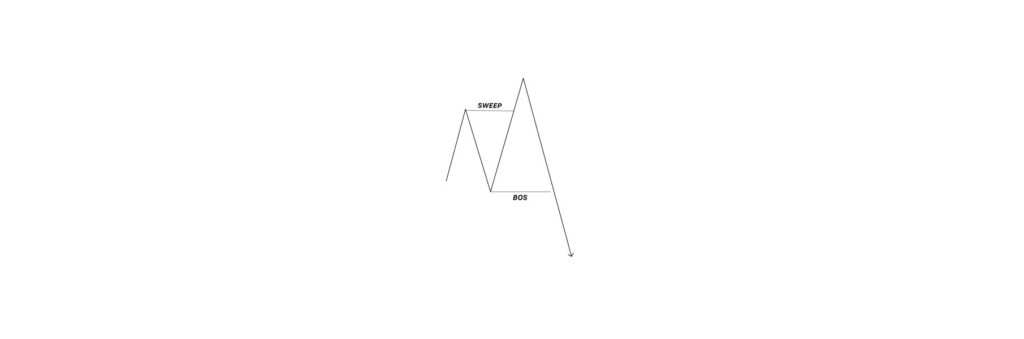

Bearish and Bullish example of a Quasimodo

•Sweep of Liquidity

•Break of structure

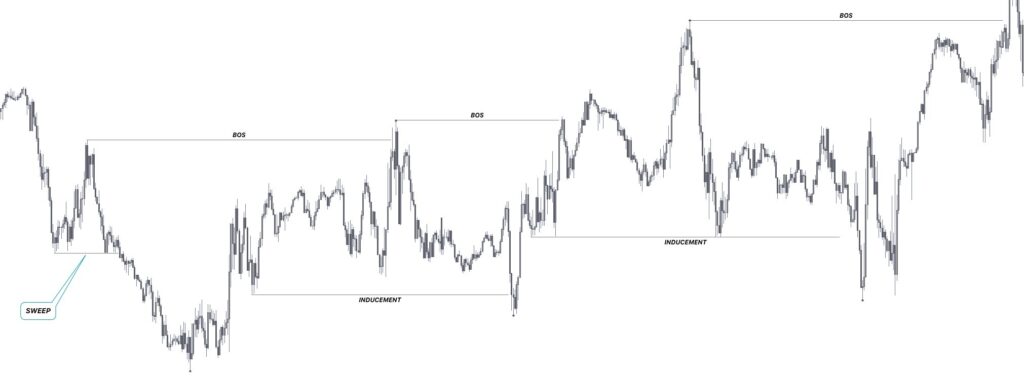

Let’s continue… In every trading range there needs to be a trap/ inducement but it’s also important to know how ALGO STRUCTURE works to trade this effectively.

Having the ability to understand these traps and identify them will allow you to anticipate where the market is likely to draw to and it will teach you how to approach certain situations.

Bullish & Bearish Trading Range

Bullish Trading Range

In a Bullish scenario you are to buy below the Inducement which is the trap and in a Bearish scenario you’re to sell above the inducement and target either the weak high or low

Here is another bullish scenario showing a proper bullish trading range

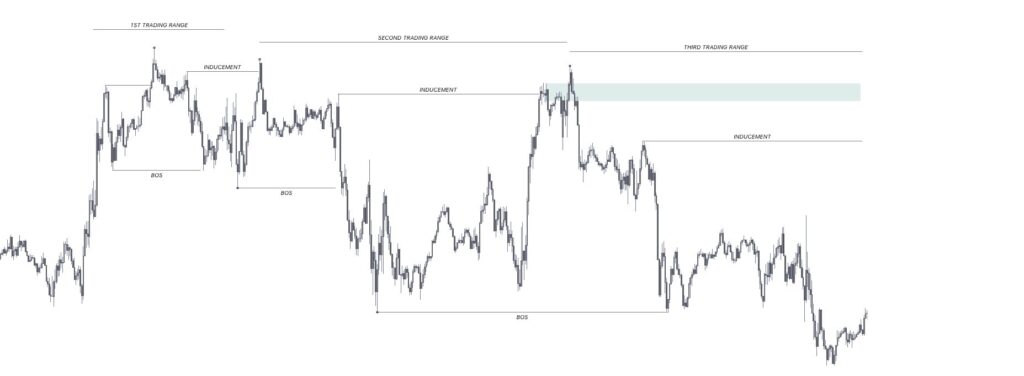

Bearish Trading Range

Now take a look at the Bearish Scenario:

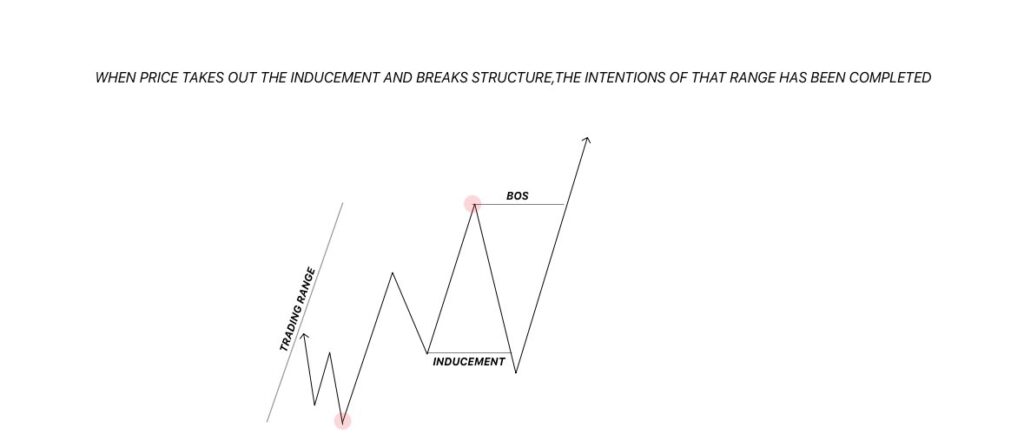

It’s also important to note that when price sweeps the inducement and breaks a structure the intentions of that trading range has been completed.

This quick tutorial was presented thanks to the great work by trader @Dexter. As mentioned before, you can check out more ICT Concepts, definitions and tutorial on the ICT Fair Value Gap, AMD, Asia Range , Market Maker Models , Volume by Price Trading, ICT Judas Swing etc at the ICT Terminology section of this site.

Comments are closed.