The goal of just about every trader is to get profitable and then quit the day job to live the dream life. But as it turns out, there is a small subset of profitable traders who still work 9 to 5 and have no desire to quit.

Asymtrading, as he calls himself on social media, is one such trader and here he tells us why he has chosen to keep clocking into his day job:

The Struggle For Trading Consistency

Some of you wonder why I’m still working if I’ve been doing trading for 20+ years and finally “put things together”. To be frank, out of the 22 years I’ve been trading, I was a completely wretched trader for 15 of them. And this isn’t uncommon. Zanger and Qullamaggie blew up several times in the beginning. Minervini said he lost money for six years straight. No one starts in this game winning consistently.

I joke that I’m probably the worst trader that has ever lived. In 15 years of failure, I blew up many times – Currency, Options, Futures, Stocks – you name it, I’ve probably blown up with it at least once. And it wasn’t for lack of trying or lack of dedication or lack of study.

I was him for 15 years. Wide-eyed and hopeful, going to “kill it” in the market. I thought if I studied long enough and hard enough, traded like my mentors, I’d be raking in 100% a year. That’s like watching hundreds of hours of Tiger Woods playing golf on TV, spending thousands of hours on the driving range practicing his patented “Stinger” shot, and thinking I’m going to be on the PGA tour in no time.

It doesn’t work like that. The market humbled me again and again and showed me I have a lot more to learn and demonstrate. The market doesn’t care how long it takes you to learn the lessons, but they will be learned.

I Had To Become The Casino

And it’s not the market’s fault. The market is like an uncaring, unforgiving river. It doesn’t know you as a person, doesn’t care about your dreams, and merely acts based on the forces applied to it. The river can be your greatest asset if you harness it, understand it, and work with it. Or it can be your worst enemy, if you fight it, don’t understand it, and blame it when things go awry.

I struggled for so long because of many reasons. The main ones were emotional disregulation, indiscipline, and ego. This led to overconfidence, lack of risk control and lack of market awareness. The market, being what it is, will push you to the edge of your emotional boundaries.

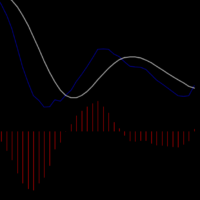

Greed, fear, and uncertainty abound. I thought I could “get rid of uncertainty” by engineering the market into a black box or an indicator. It worked for a time, but the market is frequently changing character – from uptrend to sideways chop and slop to downtrend.

I had to learn that the only “certainty” in the market is uncertainty and I had to embrace and thrive in the face of that uncertainty if I was going to survive. I started taking more of a poker mentality, like Minervini suggests.

Trading became an “odds-based pattern recognition game” as Mark Douglas described. Rather than the gambler wasting his money in the casino, I became the casino. This isn’t an easy mental transition, but it’s a necessary one.

It Takes Time To Grow The Account

Another reason I still have a “day job” is because it takes time. Blowing up and resetting is mentally tough. You get a little gunshy after losing a lot of money. I went from gunslinging to being relatively conservative with my risk.

Even after I “got it”, the last 6 or so years haven’t been a straight line up. 2018 and 2020 had some treacherous slides. 2022 was brutal for a long-only player with an almost year long bear a little in the way of prolonged rallies.

So even 50% gain here, doubling or tripling an account there during the good periods, it takes time to build something substantial. If I double $50k, I have $100k. If I triple that, now it’s $300k. If I add 50% more, now it’s $450k. And don’t ask me about taxes.

I’m already in one of the highest brackets with my job, so that feels like getting r@p3d ever year. You have to be realistic about the timecourse that it takes. If you have $2k in your account, you won’t be a millionaire in 3 years. Sorry to burst your bubble.

I’m not where I want to be because I spent so long waffling. It doesn’t have to take 15 years, but usually the smarter you think you are, the harder trading will be for you. But once you put all the pieces together, things start to feel “easy”.

I put that word in lightly because trading is never “easy”. You just learn to tame your emotions, execute your plan, and stay in control in the face of never-ending uncertainty.

I actually Like My Job

And the last point I want to make is, even when I can stop working, I probably won’t stop working. Many people hate their jobs and their situation, so they see trading as an escape route after they “get rich”. That’s fine, I guess, but I actually like my job.

I feel like I’m making an impact. Besides, it only takes me like 30 mins or less a day to “trade” – and I’m including scanning time and analysis. I might actually spend 5 mins of total time in the actual act of trading – putting in orders and moving stops. That’s it.

WTF imma do with the other 86,395 minutes of the day? Watch paint dry? Stare at every tick of something I have no control over once I’m in? Fucking waste of time. I have better things to do.

You came here to “get rich”, but what you need to do is come here to “get consistent”. Embrace uncertainty, maintain discipline, control your emotions, and trade your plan. The sooner you do that, the sooner you can start compounding your money and make the progress that will get you rich over time.

If you liked this feature, you can check out other featured traders like Tim Grittani, Modern Rock, Andrea Canto, Dr David Paul, Michael Huddleston, Mark Ritchie, Patrick Walker and many more

This feature is based on a post by Asymtrading and shared with the readers of Stocks & Futures Trading Magazine.