The Steven Dux Trading Strategy

At just 27 years old, Steven Dux has already achieved more than most traders do in a lifetime. He even holds the record for the highest profit and loss (P&L) in a single trading day in 2022, making over $6 million trading DWAC (Digital World Acquisition Corp)– which later became Trump Media & Technology Group (DJT)– in just one day.

However, he is not content to rest on his laurels. His next goal is to make $200 million a year as a retail trader, a target he believes is achievable once the market conditions line up right.

Background and Early Struggles

Steven Dux’s journey into trading began during his freshman year of college. Born into a family facing financial difficulties due to his parents’ divorce, Dux felt the weight of financial pressure early on. He used his $25,000 tuition money to start trading. But this was a decision that led to significant losses because he ended up losing more than half of his capital.

However, instead of giving up, he borrowed money from his friends and started again. This persistence paid off as he ended up turning $27,000 into $900,000 in his first year of trading. By his second year he had made $2.7 million and his trading profits continued to grow from there.

Dux studied chemical engineering in college, a field he initially pursued due to his interest in nanotechnology. This provided him with a strong foundation in statistics and analytical thinking. However, his passion for trading soon took precedence, and he shifted his focus entirely to the financial markets.

Steven Dux’s Trading Strategy

Steven Dux’s trading strategy is rooted in a combination of psychology, statistics, and extreme discipline. He primarily focuses on short-selling penny stocks, a strategy that has a high winning percentage due to the inherent volatility and inefficiencies in these stocks. Dux’s approach involves:

Learning from Others’ Mistakes: Dux believes that the fastest way to become a successful trader is to study the mistakes of others. He meticulously analyzes the losses of other traders to avoid making the same errors. This contrarian mindset has been crucial to his success.

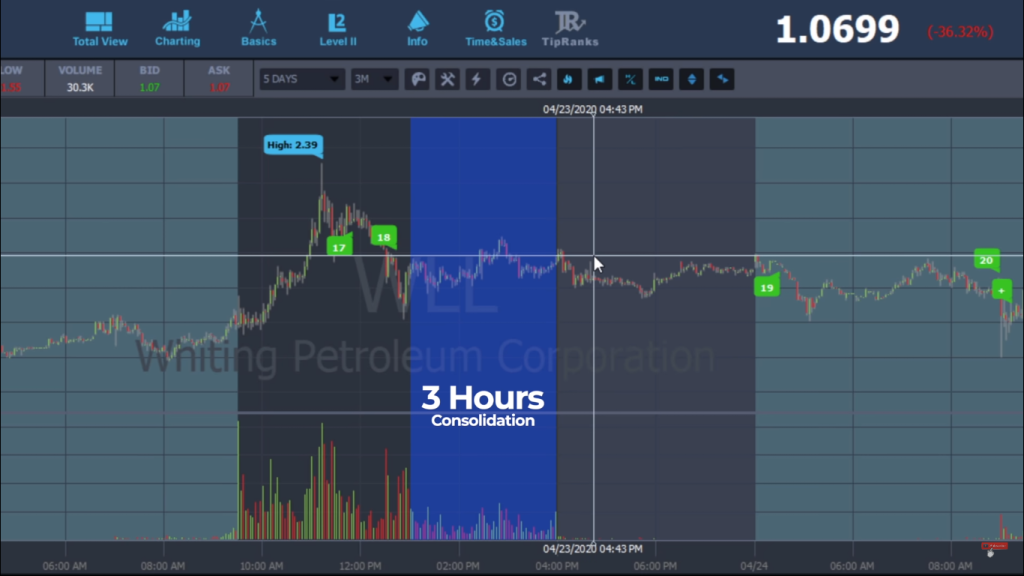

Tracking Statistics: Dux is a data-driven trader. He categorizes stocks based on market cap, float, and volume, and tracks patterns to identify high-probability trades. He uses historical data to predict how much retail investors can push a stock’s price before it reverses, allowing him to time his entries and exits with precision.

Psychology and Market Behavior: Dux places a strong emphasis on understanding market psychology. He recognizes that trading is a zero-sum game, and to win, he must capitalize on the emotional mistakes of other traders. By understanding the psychology behind price movements, he can anticipate market behavior and make informed decisions.

Risk Management: Dux is highly disciplined when it comes to risk management. He sizes his positions based on the winning percentage of each pattern, allocating more capital to high-probability setups. He also avoids overtrading, a common pitfall for many traders, by sticking to his A+ setups and maintaining a long-term perspective. Here is his typical set up:

His Trading Philosophy

Steven Dux’s trading philosophy is centered around continuous improvement and discipline. He views trading as a game, where the goal is not just to make money but to perfect the system.

He tracks his performance meticulously, aiming to reach 85% of the maximum potential performance of his trading patterns. Despite his success, Dux remains critical of his own performance, often referring to himself as a “garbage trader” when he falls short of his goals.

Dux’s philosophy also extends to his approach to life. He wakes up at 5:30 AM every day to scan for trading opportunities, but if there are no setups that meet his criteria, he doesn’t force trades. Instead, he spends his time playing video games, a hobby that has also helped him develop the quick decision-making skills and focus needed for trading.

Steven Dux’s story is one of resilience, discipline, and an unrelenting pursuit of perfection. From losing half of his initial capital to becoming one of the most successful retail traders in the world, Dux’s journey is a testament to the power of learning from mistakes, staying disciplined, and continuously refining one’s strategy.

As he continues to push the boundaries of what is possible in trading, Steven Dux remains a shining example of what can be achieved through hard work, focus, and a deep understanding of the markets.

If you liked this feature you should check out these other trading strategies from traders like: Andrew NFX, Lewis Borsellino, Alex Temiz, Lance Breitstein, Sam Parikh, Qullamaggie, Stockbee, Tim Grittani, Maury Kravitz and many more.

Comments are closed.