Pradeeb Bonde aka Stockbee has a nightly practice of reviewing stocks that have made a 20%+ move in the last five days. One of the main benefits of this practice is that when it is applied consistently, it can help you uncover whats really going on in the market and unearth some incredible Swing trading setups.

Here is a more comprehensive breakdown of the key benefits of running this nightly scan:

1) You can understand what “technical theme” is working.

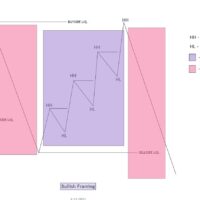

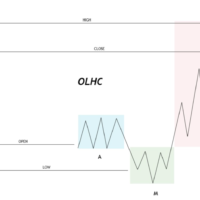

Not all moves are created equal. For instance in a bear market, many stocks will make 20%+ moves from deeply oversold, 52-week low conditions. This runs entirely counter to what you might see during a healthy bull market, where stocks will make 20%+ moves from breakout areas.

Understanding the technical picture of fast moving stocks allows you to adapt your tactics and stay out of markets that don’t align with your setup.

2) You can see how “deep” a market is.

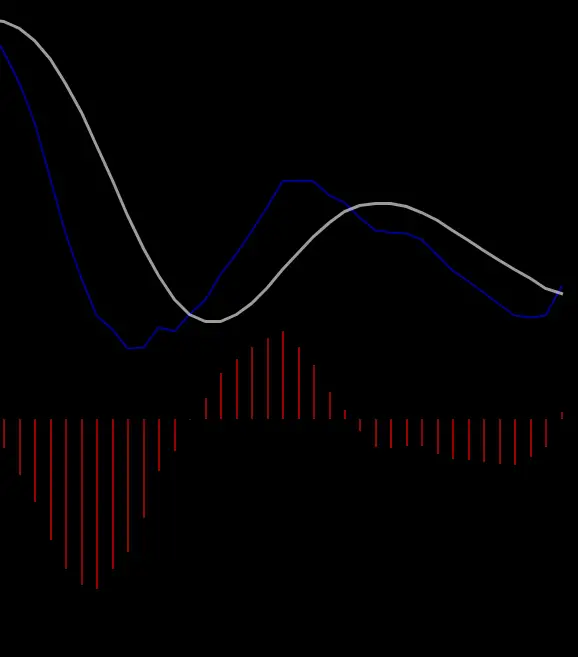

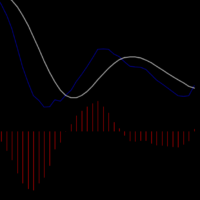

The advance/decline line is misleading, as many stocks can make marginal up-moves while a smaller handful can be breaking down on sizeable volume. By studying 20%+ movers (both to the upside and downside), you understand how “deep” a market is for momentum trading.

Directionless markets will see a dry-up in 20% movers. These periods can frustrate and chop-up a trader without a plan. This study helps confirm the environment.

3) You can self-reinforce what a quality breakout looks like.

By studying the move after the fact, you can zoom into exactly from where the move emerged. You can burn this picture into your mind to study your setup.

You can also discover whether you missed any trades that you should have caught, then reverse engineer your process to see why it was missed and how those moves could be caught in the future.

A big thanks to Junior for breaking down the 20% Method.

He also reminds us that we can think of this practice the way a fisherman might think of “draining the lake”. For instance, a drained lake will reveal all the fish that were there for the catching.

If you liked this feature you can check out others like Blackrock’s Aladdin, A Tutorial On Market Structure, How To Trade With the BPSPX, The ICT Candle Counting Method, How To Pass A Trader Evaluation & Get Funded, The Top Step Trader Review, ICT Liquidity Runs, How To Trade The Options Chart & The Falang Futures Algo and How To Use Volume To Trade Like Banks & Institutions