This Is How You Can Make $250k Selling Options

I have made $255,630 selling options over the last 2 years. This is the simple yet effective strategy I use:

Covered Calls & Cash Secured Puts

The two strategies I use are Covered Calls & Cash Secured Puts. This thread focuses on Covered calls: Selling calls gives you the right to sell your shares at a certain price. While doing so, you collect a premium. This is how I am making $1000s of income every month.

This is a basic overview of how the covered calls process works:

1. Own 100 shares

2. Sell a Call

3. Collect Premium

4. Wait for Expiration

5. Close contract

Let’s break it down even more…

Own The Shares

To deploy this strategy, you must own 100+ shares of the stock/ETF. This is where the barrier to entry is. For instance, 100 shares of $MARA will cost you ~$1,631. 100 shares of $AMZN will cost you ~$18,600. & 100 shares of $QQQ will cost you ~$48,700.

Sell A Call

Now you own the 100 shares, you can write calls against those shares.

Ideally when you sell a call, you want the share price to stay BELOW the strike price at expiration. If the share price is ABOVE strike price, you are required to sell shares at strike.

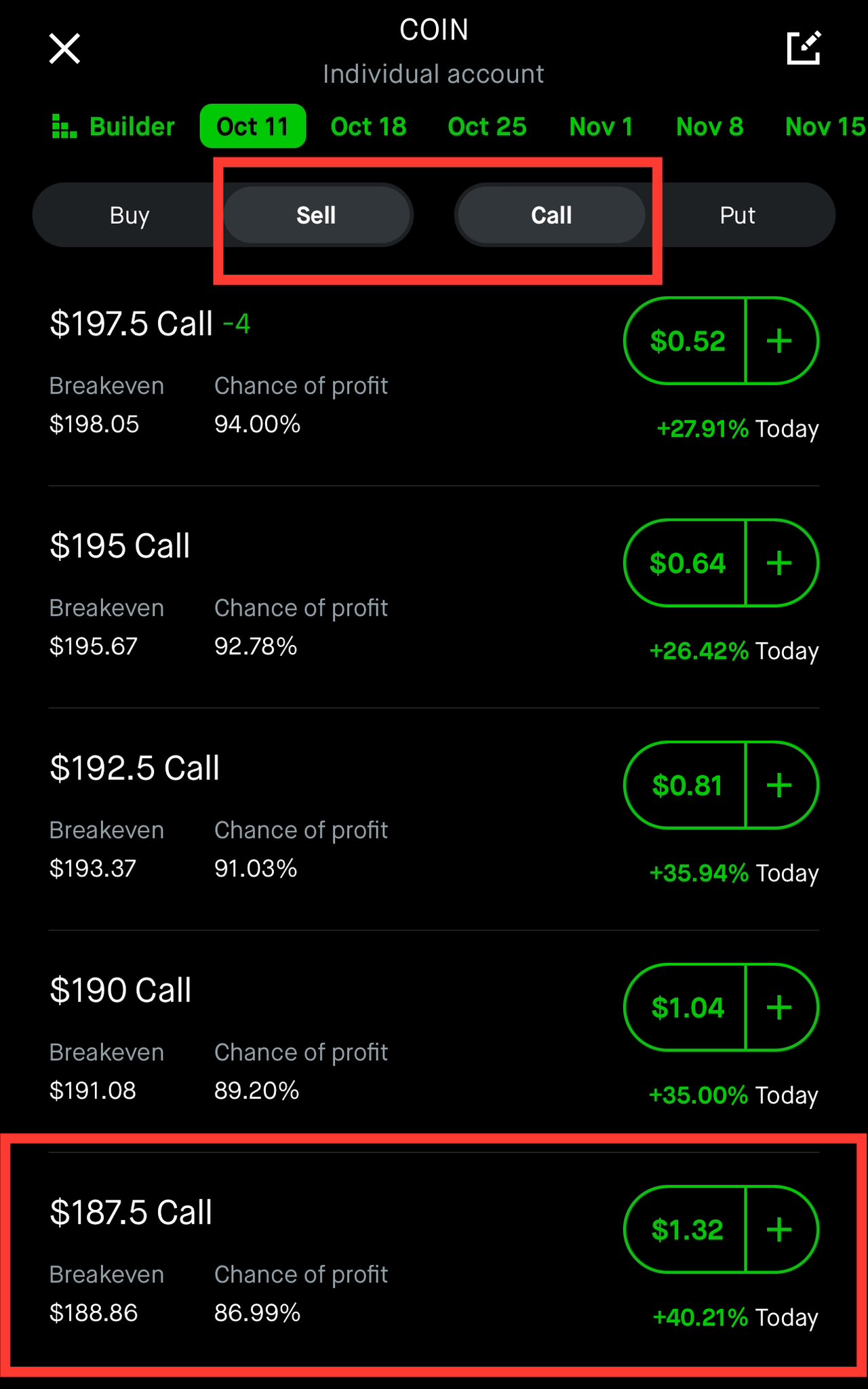

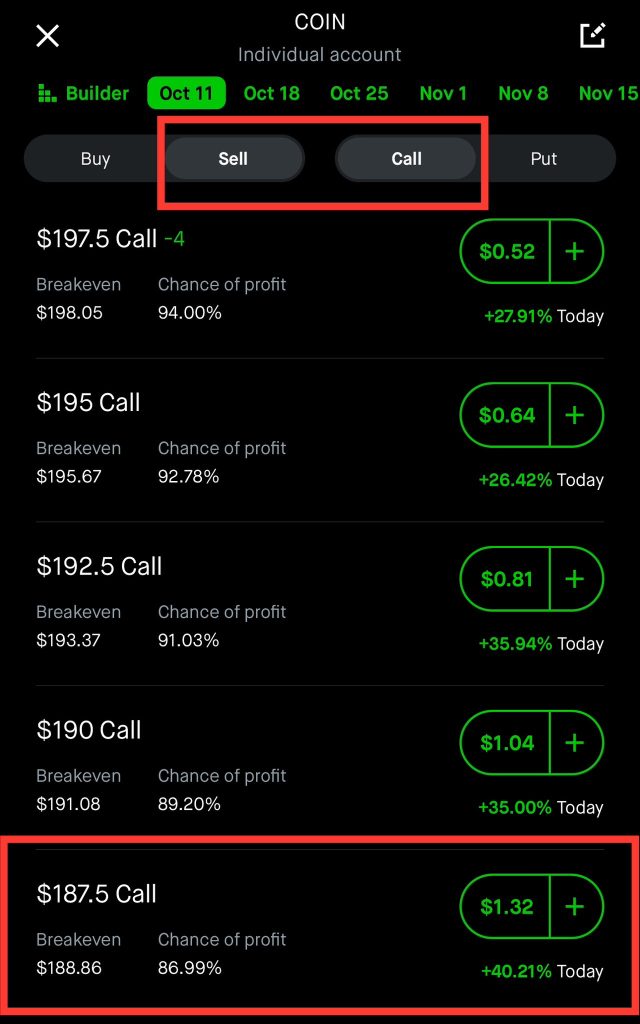

If we take $COIN for example, the current share price is $170. To sell a call, you go to the options chain & select “sell” “call”. From there, you can choose the strike price & expiration. Ex. Strike: $187.5, Expiration 10/11 NFA. This is just an example.

Collect Premium

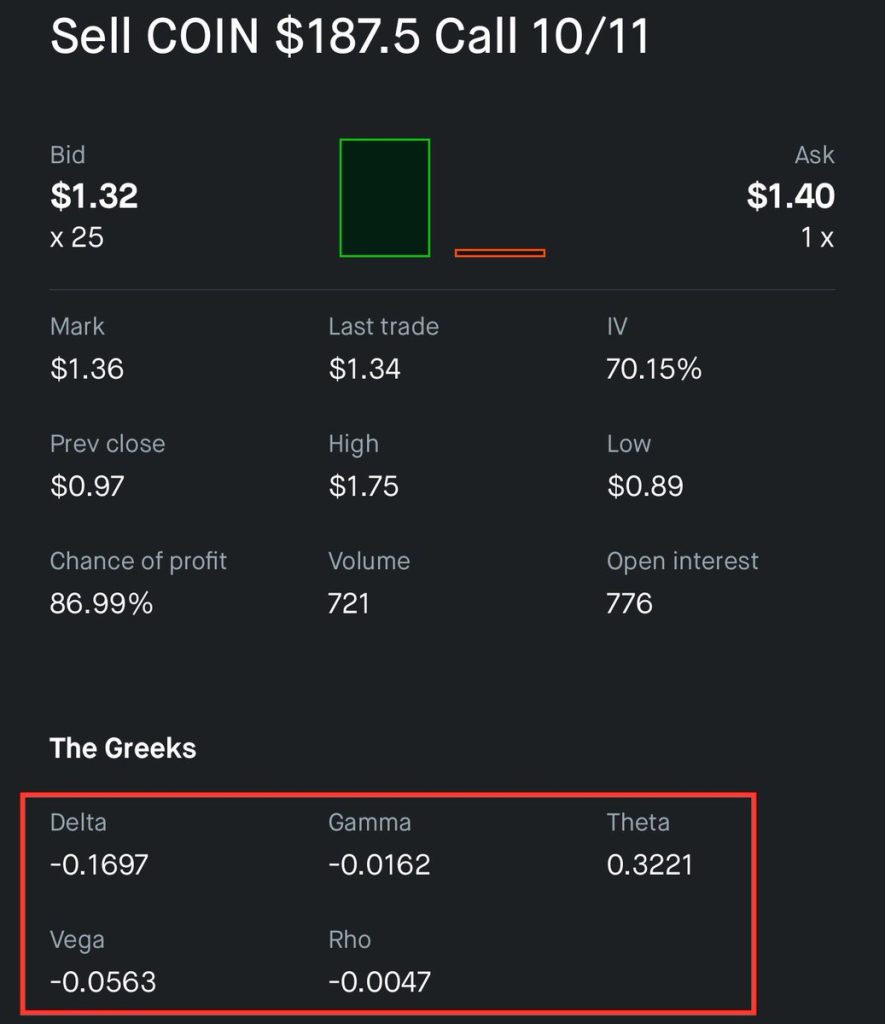

In this example, the Delta is .16 & the premium is $1.32 This means you will get paid $1.32 a share in premium. Remember, options are in lots of 100 shares, so you will collect $132 in income for the week.

Wait for Expiration

Here are the Potential outcomes in this example:

1. The price of COIN goes above $187.5 by 10/11. You are required to sell shares at $187.5 & you “miss out” on gains.

2. The price of COIN stays below $187.5. You keep shares & do not have to sell.

3. The price of $COIN plummets & your downside potential is there. However, there is a way out of this if you want out (buy back).

In all 3, you keep the premium no matter what. Also, if your average cost is BELOW strike, if your shares get called away, you still make $.

The Risks

Now let’s look at some of the risks?

1. If you buy a stock at the top & your average cost is WAY higher than the strike price. You could sell your shares for a loss.

2. You get risky selling calls & buy shares in a company you really don’t want to own (& lose capital).

Covered calls are not risk free but can provide your portfolio with a great downside hedge in market conditions similar to this year.

This was just a really quick write up by darkminer and the whole point is to lay out the basics of Covered Calls. If you want to dive into some more tutorials you can check out How To Trade The VIX When Volatility Spikes, How To Use Volume To Trade Like Banks & Institutions , How To Trade The Options Chart Instead Of The Stock Chart, <strong>How To Trade Using The $BPSPX</strong>, How To Trade The Options Chart Instead Of The Stock Chart , How Gamma Exposure (GEX) Moves The Market

Comments are closed.