I just finished reading “Evidence-Based Technical Analysis” by David Aronson because a relatively new trader asked me to recommend books that taught or emphasized a more scientific and less “gut feeling” approach to trading and I think this book fit the bill.

Aronson basically challenges everything we thought we knew about technical analysis. He says that instead of just relying on fancy indicators and patterns, we should be testing them out like scientists, using real data and statistics. It sounds intimidating, but he actually makes it pretty easy to understand.

Here are some of the main points from the book.

Ditch The Subjectivity

He throws out the window all those vague descriptions and subjective interpretations that traditional technical analysis relies on. Instead, he teaches us to use clear, objective rules and measure their performance with statistical tests.

This means that anything that can not be defined and tested should be left out. Instead, we want to focus on objective analysis, Where we can confirm or deny the trading idea.

Rely On The Power of Data

This is where things get exciting. Aronson shows us how to use historical data to test our trading signals and see if they actually work. We’re not just hoping and praying anymore, we’re using cold, hard facts to make decisions.

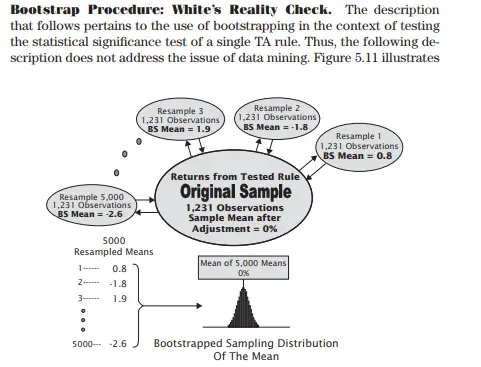

He emphasizes Rigorous testing because it’s so easy to overfit or fall victim to data mining biases. Aronson uses various methods to help us lower the chances of it occurring:

• Out-of-sample testing

• Randomization

• Monte Carlo

• White reality check

• Penalizing strategy metrics

Evaluating Technical Indicators

We finally get to dissect all those popular indicators like moving averages, oscillators, and chart patterns. Aronson doesn’t just tell us what they do, he shows us if they actually work and under what conditions.

He doesn’t simply accept or reject indicators based on their theoretical foundation; he provides statistical evidence to support their actual performance in various market conditions. This allows traders to make informed decisions about which indicators are best suited for their specific trading strategies and market contexts.

Building Your Own Trading Strategy

The best part is that Aronson doesn’t just tell us what to do, he teaches us how to think for ourselves. He gives us the tools and the framework to build our own evidence-based trading strategies and provides a framework for constructing a robust trading plan, incorporating objective signal rules, risk management principles, and position sizing strategies.

This encourages traders to experiment, test, and refine their approaches based on actual market data and performance analysis.

Heavy Reading But Potentially Life Changing

If you are a trader who is quantitative minded and need hard data to form the basis of your trading strategy, then this book is potentially life changing in terms of the scope and depth of the information that you will get from it.

If you are not into hard data and statistics ( why aren’t you?) then it may turn out to be a bit of a heavy read despite Aronson’s best efforts to make the material digestible for the average reader. Overall, it is a good book and if you want to dive into this side of trading you can get “Evidence-Based Technical Analysis” on Amazon.

You can also check out my review of the 100 to 1 In The Stock Market , One Up On Wall Street and my compilation of the 10 Best Books On Trading Psychology.