Learn Order Flow Trading

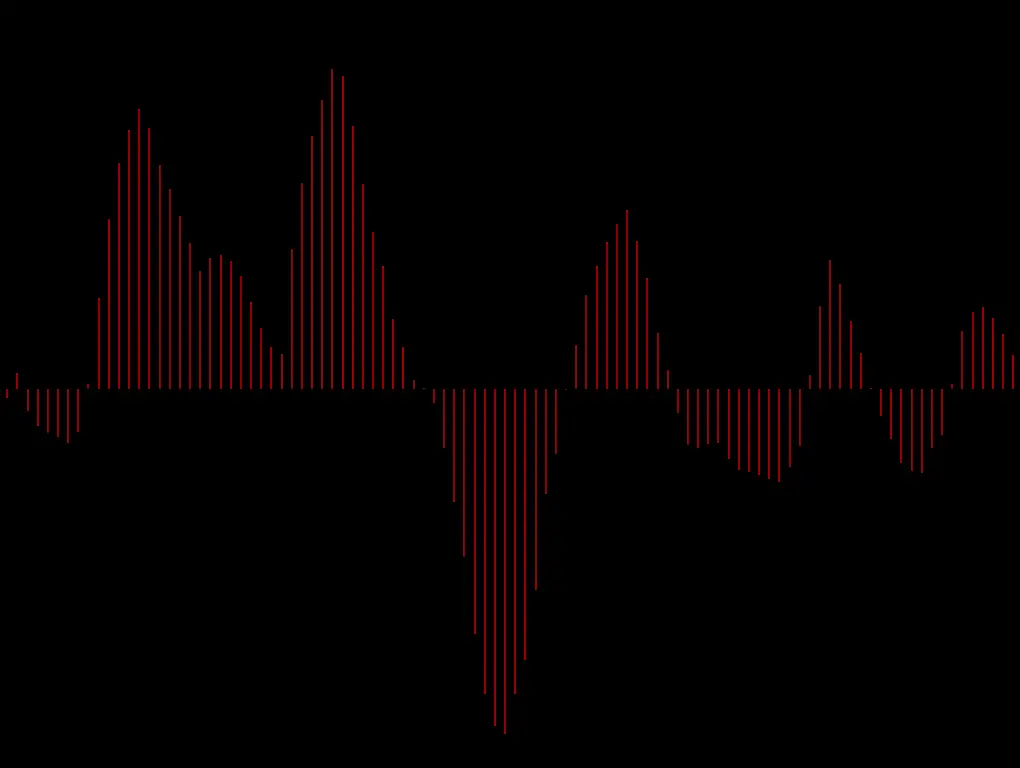

Order flow is the art of getting information from the real time buying and selling data and using that information to make trading decisions.

This, arguably. makes Order flow the purest form of trading because it doesn’t require any indicators or outside information. All the information you need is on the tape right in front of you.

That being said, this is a method of trading that can take many years to learn and even longer to master. In order to get to a basic level of competence you will need to spend a lot of time just observing the price action and Order Flow on the instrument that you are trading.

The Fastest Way To Learn Order Flow

There are really no shortcuts when it comes to learning Order Flow but you can speed up the process a bit if you know what resources are available, where they can be found and how to use these resources.

This is a list of resources that was first put together by Mike and I have simply organized it and added some more resources that I think will be useful. This is the sort of info I wish I had when I just started out.

You are going to need to watch these carefully and take notes. I would even suggest that you watch them more than once especially if you are not clear on some of the principles and concepts. It will be well worth your time to take this information seriously and soak it in.

Make sure you bookmark or save this article so you can come back to it as often as you need.

Here are the steps you need to take and the resources that will help you to get it done. I hope you find it useful.

Learn How To Read The Depth Of Market (DOM)

This is a video that simply and clearly explains the DOM (also called the ladder) and how to use it. You will not find a better tutorial anywhere. The principles and practical applications are laid out so simply that a five year old could probably understand it: https://youtu.be/XRC0HhhI_ek

Here is a second video that covers the DOM basics. It goes over a few key things that were missing in the first video and gives a different angle to what was covered:

Learn Market Auction Theory

This is a series of two videos that are critical in understanding Order Flow because they explain how markets really work using the concept of Auction Market Theory. In fact, if for some reason you are still confused about Order Flow trading then this may help to simplify things for you.

Video 2:

Learn To Read & Understand Market Profile and TPO Charts

Market Profile is the practice of looking at the market based on where the most and least volume has traded. This can give you very good insights into where traders are positioned and how price will react once it trades near these levels again.

One of the best ways to look at the market profile is to use the TPO charts. TPO stands for Time, Price And Opportunity. It simply breaks up the market profile into time blocks and assigns each move certain letters or numbers so you can see the relationship between buyers and sellers.

It is a critical part of Order Flow trading whether you use a DOM or not. In fact, as you have seen, the Market Profile is often superimposed on the DOM on most trading platforms.

This is a video that does and excellent job of presenting the essentials of Market Profile & Volume Profile:

Here is another one by the great James Dalton who wrote Mind Over Markets , that covers a bit more ground and adds the Swing Trading angle to Market Profile:

These two videos should be enough to give you a solid lesson in Market & Volume profile. You won’t need anything else.

Now Combine The DOM, Market Auction Theory & Market Profile To Trade Order Flow

Here are a couple of videos that use either one or a combination of all these tools to trade live. You will see how the information is used to make buy & sell decisions in real time. This is how you will trade using market generated information aka Order Flow.

This first video is from Miltos trading Bonds. You will notice that he is using the DOM, Time & Sales and Volume profile. Listen to his comments carefully as he talks through the trade.

This one is where Brannigan walks us through the 95% probability trades with a replay of a trading session using the DOM/ Price Ladder.

The video goes beyond the DOM trades and even covers some key psychological /behavioral ideas that every trader needs to keep in mind. Make sure you listen to it carefully and take notes as he will go through these before he replays the session.

Hope This Helps With Your Order Flow Studies

This list is not exhaustive by any means but it should be sufficient to get you going because it consists of all the fundamental principles and tools as well as instructions on how to use them all laid out and presented in simple plain language.

If you want to step up your Order Flow game up even further, then you should get what I call the Order Flow bible which is this book called Trading With Market Profile written by the great Peter Steidlmayer.

If the Order Flow is a bit tough to crack ( it won’t suit everybody) you can also check out this simple Day Trading strategy. The principles you will see in this strategy also apply to the futures market.

Happy Trading!