Macro

- The S&P Futures are down about 12 Points at the moment as buyers failed to advance above the 4550 area in yesterday’s session. The overnight high is 4503.75 and the overnight low is 4486.25. The sentiment coming into today’s session is Bearish.

- The US 10 Year Yield is @ 4.25%

Stocks

- Toyota Motors (TM) is gapping up on the launch of its $170k high end luxury model called the Century.

- Kirkland Homes (KIRK) is down -6.1% after earnings. They reported slow traffic and lower sales.

- Photronics (PLAB) is down -8.5% after reporting Q3 results. They reported slowing demand in some markets & lower revenue.

- Roku (ROKU) is up 11.2% after raising Q3 revenue forecast and announcing job cuts.

- Trivena (TRVN) is up 36.7% after releasing preliminary data from their studies Evaluating S1PR Mechanism of Action and CNS Target Engagement

- Notable Stocks catching Upgrades so far this morning: American Airlines (AAL), Aerovironment Inc (AVAV), CME Group Inc (CME), Semtech Corp (SMTC)

- Notable Stocks that have been Downgraded: Southwest Airlines (LUV), Block Inc (SQ), Olin Corp (OLN)

- Notable Earnings after the bell today: ABM Industries (ABM) Designer Brands Inc (DBI), Science Application (SAIC), Waterdrop Inc (WDH)

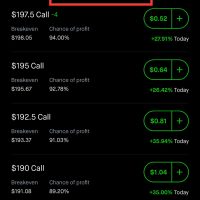

Options

- Pfizer (PFE) Inc DEC 2023 37.50 Calls saw the Open Interest (OI) move up by 50,266 contracts to 60,045 in the last session. This is happening as the narrative seems to shifting back to the new Covid variant, masks & vaccines.

- Rent The Runway Inc (RENT) saw the Implied Volatility (IV) spike by 116.6% with no immediately known/clear catalyst.

- Stratasys Ltd (SSYS) also saw an Implied Volatility(IV) increase of 67.94% ahead of its upcoming extraordinary general meeting.

Futures

- Crude Oil (/CL) Prices are down about .30 cents as the market seems to be shaking off/ignoring recent announcements by Saudi Arabia & Russia that they will be extending price cuts.

- Gold (/GC) Prices are off about $5 on the prospect of the US Dollar strengthening even further in the near term.

- Rough Rice (/RR) & Soybean Oil (/ZL) Futures are down slightly coming into the US session.

- US Wheat (/ZW) & US Corn (/ZC) Futures are up and holding gains coming into the US session.

Forex

- The Japanese yen (USDJPY) is continuing to hod gains and move higher as Japanese officials consider all options amid evidence of currency speculation

-

Australian Dollar (AUDUSD) Falls as GDP Slows. There might be even more downside ahead.

Thats all for today’s round up. if you find this format useful/helpful please let me know so I can continue to produce them for you. The intention is to provide you with info that can help you to be prepared for the trading day.