How Mark Ritchie’s Strategy & Framework Made Him 20 Million Dollars

Mark Ritchie is one of the Momentum Masters. He has been trading since 2007 but really got his break when he won the Minervini Challenge by doubling his account in 6 months and was invited to work with Mark Minervini at his Minervini Private Access as an instructor.

But how did he trade his way to $20 million? And what are some of the lessons that he can share with other traders and investors who want to grow their accounts?

This is a summary of a presentation that Mark did recently. He gives some general thoughts and insights about trading and then he lays out the exact path that you need to take if your goal is to take your trading account into the millions. Here we go:

You Have To Have A Process

You need to have a process or method that you use to identify, set up and execute your trades. More importantly, your process needs to insulate you from the noise out there.

For instance, if your method tells you to take a certain position then you shouldn’t be easily swayed by someone else’s opinion or some random data point that might pop up. You want to be playing your game and not somebody else’s.

Your process should be one that will allow you to find solid trade setups, follow the price action and ignore all the news and even some of the fundamental data out there.

This is hard for a lot of traders to believe but the fact is that, if you focus on finding good stocks with good setups they will guide you and give you all the information you need to execute and manage the trade.

This way you can literally ignore the news. The bottom line is that your process should be built on what will have you buying or selling regardless of what anybody says.

Follow Stocks & Not Opinions

You are operating in a market of stocks and while they move on themes and news, you will do much better if you center your analysis on individual stocks and the narrative and price action that goes with it.

While you shouldn’t be ignorant of the news and economic data, you should at least be aware that a lot of news headlines are based on agendas or referring to things that are stale or no longer relevant to the company.

The same can also be said of some economic data since we usually get data 30 to 90 days after the fact. Read the price action and look at how the stocks are acting and make that the basis of your decision making. The news should be secondary at best.

Always Think Risk First & Focus On Asymmetric Trades

Successful traders are always calculating risk or trying to figure out the odds of taking a particular trade. Your goal should be to take the least amount of risk possible for the trade that you are taking. In other words, you need to be focusing on asymmetric risk to reward relationships in all your trades.

If you can’t find an asymmetric way to get into a trade that will give you the potential to make multiples of the risk you are taking then you should probably reconsider taking that trade and wait until you can get an asymmetric entry.

You Need To Know Your Numbers

You should track and study your trading results so that you can know the truth about your trading strategy. You should know what is your average win, your average loss and what your win rate is. You need to be able to quantify your edge.

When you track your numbers and you see them on a spreadsheet, you get to see how you are really doing and this can help you make adjustments. These adjustments, in turn, can often end up being the difference between you becoming a profitable trader or not. It is by far one of the most underrated activities that a trader can undertake.

Journal & Document Your Trades

It can help a great deal, especially from an emotional/psychological perspective if you take detailed notes about your thought process and your trade execution.

If you have a plan going into a trade, you should write that plan down and then make a note of where you bought and where you sold and then the result of the trade. You should gather data and treat the analysis of this data just like a business would.

Even if you end up not following your plan, you should make a note of that because when you get a chance to look back you will see clearly what happens to your results when you do not follow your plan.

Just gathering data like this will also help you to see what areas you are strong in and what areas you need to work on.

Let The Data Be Your Guide

By logging your trades and tracking the data you are going to see some truths that wouldn’t be evident without the data. For instance , you might notice that all your best trades were executed at a certain time of day or during certain market events/conditions.

You need to trust the data and make the necessary adjustments if you want to get better results.

Similarly, you may think that you are good at Day Trading but when you break down the data you notice that most of your money is being made on longer term trades. Again, this is a case where you need to follow the data and not your own feelings, opinions or preferences.

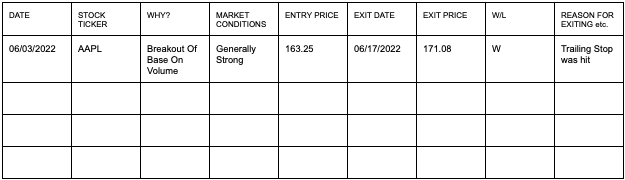

Example Of A Trading Journal

Some people think a trade log exists to record wins and losses but your brokerage statement already does a good job of that. A trade journal goes much further and can be of much greater help in your long term trading performance if you are serious about improvement.

There is no right or wrong way to track your trades but, generally speaking, you want to be able to capture as much of the decision making process as possible. So the focus should be more on the reasons why you got into a trade, the method you used to get in as well as the reasons why you exited the position.

The whole idea is to get this data recorded so that you can refine your system/process by isolating and stripping out the decisions that led to bad outcomes. Overtime, it will also help you to see very clearly what a good setup looks like and what a bad one looks like.

This is even more powerful when you take screenshots of the charts before you take the trade and after you exit.

By combining the trade journal with the charts you are building what Mark calls a “Model book” that can be a guide going forward as it will help you to cut through the fluff and focus only on the high probability opportunities.

This a mock up of a trade log that focuses on process rather than outcomes:

Trading Journal Breakdown

Just to make sure that you fully understand what it is and how to use it, let’s break down a few of the terms:

Date:

The date you took the trade

Stock Ticker:

Obviously this is the symbol of the stock under consideration

Why?

A detailed reason why you are taking the trade.

Market Conditions:

Your assessment of the general conditions at the time that you took the trade

Entry Price:

The price at which you go filled on the position

Exit date:

The date when you closed the trade

W/L:

Was the trade a win or a loss

Reason For Exiting:

A detailed description of the reasons why you exited/closed the trade

The whole idea here is to create a “memory bank” so that you can quickly refer to it. Overtime, as you collect more data, you will start to see patterns and insights that will help you become a much better trader.

Know When To Leverage Up & Add To Your Positions

You need to be incremental in your approach to position sizing and be willing to trade around a position. This means you should practice putting on a small part of your position and only adding to the trade once it starts to show you a profit. In Mark Ritchie’s own terminology: “know when to be a Chicken, know when to be a Pig”.

The practice of putting on a position all at once, while practiced by many, is not necessarily the best way to go about things. You need to get used to the practice of buying more at higher prices and just thinking of it as simply increasing your bets on something that is already working.

If you collect and study your data, you will know how well you can do in a good market and be able to leverage up and increase your exposure when the opportunity comes. It is important to note here that it is data that will give you the confidence to really press the advantage.

Mark Ritchie’s Trading Strategy That He Used To Turn $100k into $20 Million

Now that we have the general principles down, it is time to get into the actual processes, methods and setups. This will be presented step by step.

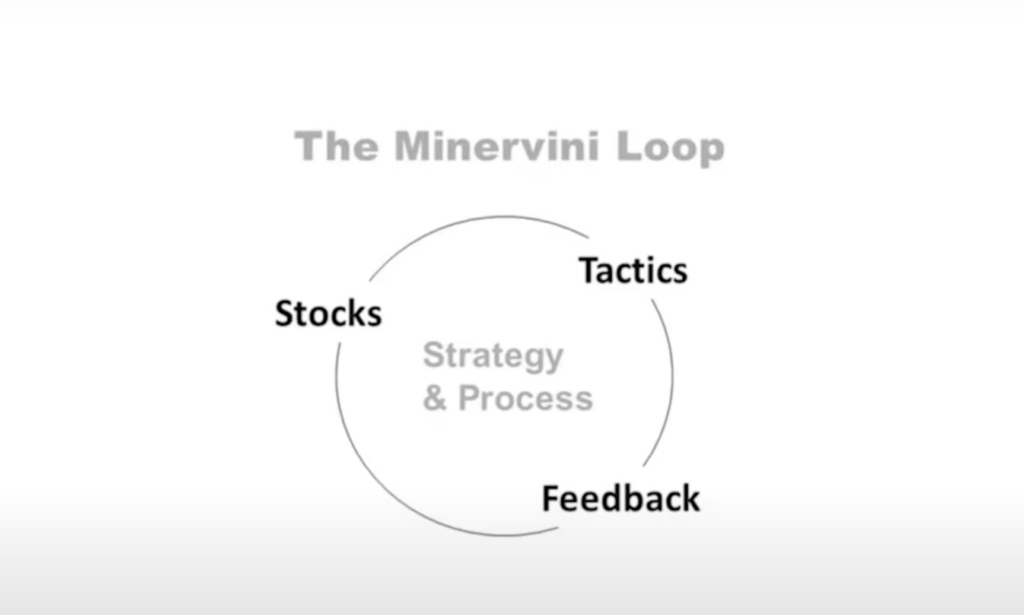

The Minervini Loop

The entire trading method starts with the “Minervini Loop” which is the seamless interplay of Stocks, Tactics and Feedback. And this is how he applies it:

Stocks

You want to identify who the leaders are. Every bull move will tend to have different leaders and you will have to key into those. Forget about trying to buy dips in old leaders, what you need to be focused on are the current leaders.

You should run a screen everyday that looks for the leading sectors and then look for the stocks with relative strength inside those sectors. That is the quickest way to identify current leaders which are likely to continue leading. Pat Walker had a similar method for finding strong stocks.

These stocks should become a part of your watchlist with the buy points noted.

Tactics

You want to dip a toe in here and buy small bits of one or two leading stock just so you can gauge how well they are moving. Sometimes you may identify an entire group of stocks that seem to be moving so you should go ahead and “taste” it by picking up a few shares in the leading names. That is the tactic.

Feedback

The way the stocks move after you buy them will tell you all you need to know. If they hold up well, on balance, in a market pullback or if they keep moving higher and faster than the rest of the market, that means you should be putting on more size and committing to the trade. You will know very quickly whether they are working or not.

Entering The trades

Once you identify your stocks you will want to enter these positions as they are coming out of bases or consolidations in small size and then add to it once it gets a few points above the base breakout level.

Managing The Trades

If the trade falls back into the base you should cut it off and wait for it to set up again. You need to be merciless with trades that fall back into the bases. On the other hand, if the trade begins to work, you should be looking to add to the position a few times effectively “pyramiding” into the position.

Exiting The Trades

You should start selling out of the position as the stock begins to flag or slow down as if it is entering another consolidation area or base. In other words, when you start to get negative feedback, you should start to exit the positions.

This is How You Will Become A Better Trader & Make More Money

You can improve your trading performance significantly by knowing what works for you and what doesn’t and start trading around that truth.

You will know what works for you by collecting and studying the data. Collecting your trading data and analyzing it should not be underestimated. It is a very high ROI activity that every trader should make a commitment to doing.

You can get in touch with Mark Ritchie on Twitter or at Minervini.com where he is a Trading instructor and Consultant. You can also check the awesome Momentum Masters book in which he is one of the featured traders.

Check out the RSI2 Swing Trading Strategy to learn how to find and trade high probability asymmetric setups.

Also If you liked this feature, you can check out strategies from other featured traders like Tim Grittani, Modern Rock, Andrea Canto, Dr David Paul, Michael Huddleston, Thicc Teddy, Patrick Walker , Dan Irish and many more