Blackrock is powered by its artificial intelligence portfolio management system called Aladdin and this system, in turn, powers hundreds of other investment management professionals across the world.

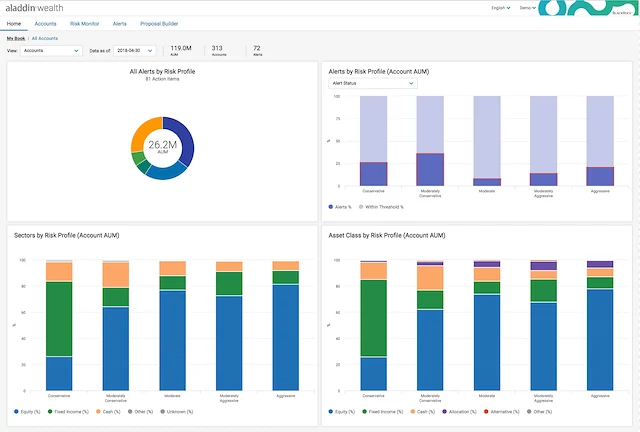

The core function or use case for the Aladdin system is that it allows investment managers to access data across both public and private markets. This offers a “whole portfolio” solution that supports portfolio and risk management operations in just one solution.

Since the acquisition and integration of eFront , the platform has grown tremendously and has been widely embraced by the investment management industry and there are signs that the growth is just beginning.

An Interesting Story

But how did Aladdin come to be? We started looking into the functionality of Aladdin but found its origin story to be very interesting and revealing. So in this article we are going to take a step back in time so we can better understand its beginnings.

Too Big To Fail

The financial collapse of 2008 popularized the concept of companies which are too big to fail. Around that time companies like Goldman Sachs (GS) (), Fannie Mae (FNMA), Freddie Mac( FMCC)) and AIG received insane bailout sums from the government in order to get back on their feet.

Blackrock’s Deal

To bring this plan to fruition, the government hired an establishment to analyze which companies to bail out and which ones to let go. Blackrock was the company that was awarded these key tenders for the cleanup of the financial sector by the US government with no competitive bidding.

This is a process that was enveloped in secrecy and ended up being the source of some criticism and controversy at the time.

King Larry Fink

Larry Fink is the Chairman and Ceo of Blackrock and also one of the key mediators between the White House and Wall Street. Word is that he was personally responsible for bailing out the same companies or banks in which Blackrock already had a stake and this cemented his dominance on Wall Street after the crisis.

Still The King Today

When the pandemic hit and the economy went into a tailspin, the Federal Reserve decided that liquidity was needed to once again give a lifeline to sinking corporations that had too much debt. Once again, the FED chose Blackrock to manage and buy corporate bonds. This made Fink the most powerful businessman in the post-pandemic economy.

A Spoon In Every Pot

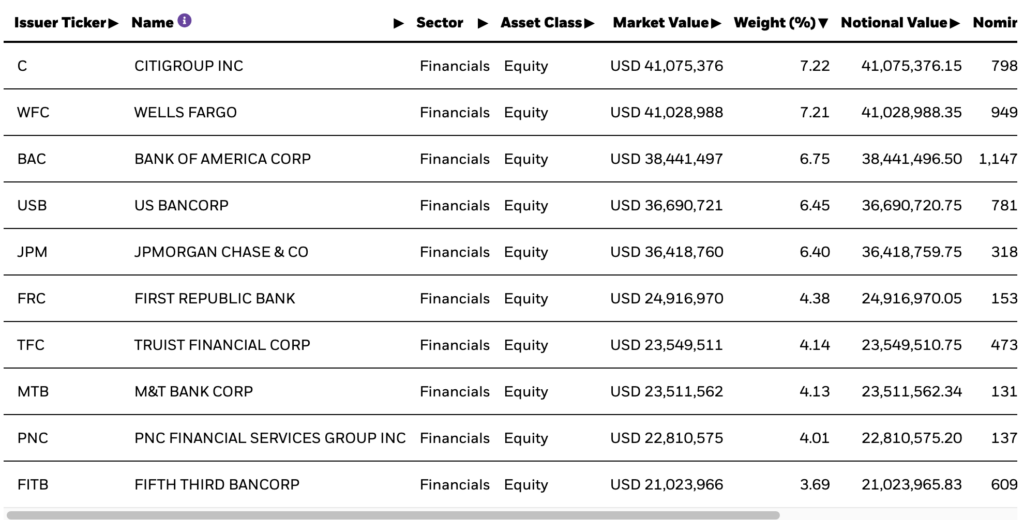

Over 33 years Fink has built Blackrock in stealth by making sure most of its operations aren’t in the public eye. In recent times, even when Blackrock was outbidding and out buying single-family homes in the U.S there was barely any press around it. Today the firm holds sizable stakes in the majority of U.S banks which has given it a tremendous amount of power and control

Blackrock also owns some of the most prominent Pharmaceuticals and mainstream Media Houses in the country as well. The company is so influential that its assets under management are larger than the GDP of almost every country in the world.

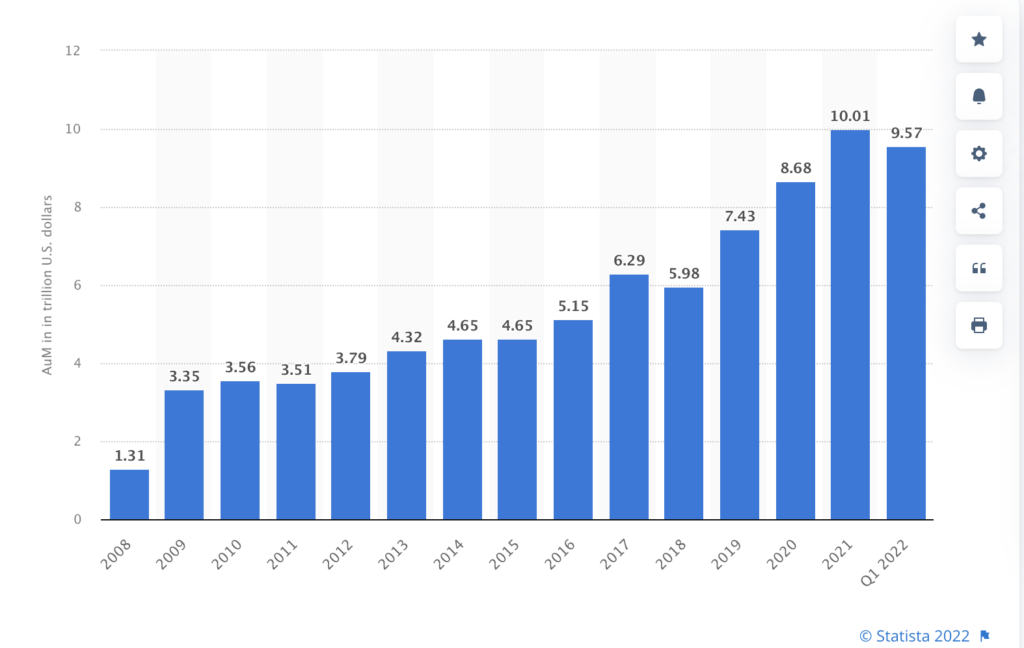

With over nine trillion dollars Blackrock services and holdings include several Sovereign Wealth Funds, Central Banks, College Endowments, Retirement accounts for everyday average folk in the form of Pension Funds, Fortune 500 companies and millions of individual investors.

This giant is also stakeholder in some of the largest publicly traded companies like Microsoft (MSFT), Apple (AAPL) & Facebook (META)

The Man Behind The Curtain

Blackrock is a trillion dollar company with stakes in multiple other trillion dollar companies. For some perspective on how huge Blackrock really is, consider the fact that 300 of the top pension funds of the world hold a collective of six trillion dollars in assets under management; the only company which comes even close to Blackrock’s size is Vanguard with 7.1 trillion.

If we combine the collective assets under management of the top three asset management firms which are Blackrock, State Street and Vanguard we are looking at a whopping 15 trillion dollars which is approximately 70 percent of the United States GDP.

Larry Fink has achieved all of this while keeping an extremely docile public image of himself and his company. As the “godfather of finance” he makes sure that his company has a piece of every top tier deal anywhere in the world. William Cohan former investment banker and the author of House Of Cards has described Fink as “the man behind the curtain”

In a recent interview with Blackrock Fink was asked if he’s the most powerful man in finance since he controlled a company that had nine trillion dollars in assets under management but he instantly downplayed the sentiment by saying “i don’t think of myself as powerful”.

Larry Fink Before Aladdin

Fink’s beginnings are humble, his father had a shoe store while his mother taught english. He earned a Bachelors in Political Science and an MBA in Real Estate from the University Of California. At the age of 24 he began his career on Wall Street where he was just another young man trying to make a name for himself in the world of finance.

He joined First Boston on a $20k/year salary scale but it didn’t take long before his managers noticed his dedication and skill and soon enough he was groomed to become the CEO three years after joining First Boston.

He was named head of the bank’s Mortgage-Backed Securities and he handled the job so well that he managed to increase earnings by one million dollars and his reputation grew on wall street. Soon he was spearheading some of the largest deals including the $4.6 billion GMC vehicle loan securitization at the age of 27.

Aladdin Was Born Out Of Failure

He became the company’s youngest ever CEO at the time. In the second quarter of 1986 the financial staff of First Boston made a severe mistake. The treasury department expected that interest rates would rise but the opposite occurred. Fink was in charge of the deal when their client lost $100 million dollars due to their blunder.

Everyone was aware of the mistake and due to the public humiliation of the company and Fink was later fired from the job. He was embarrassed and defeated even though he wasn’t really the one to blame since his analysis was based on data from the Computerized system that the Bank had adapted a few years earlier.

Fink was perplexed but after determining what went wrong, he came up with a plan to rise from the ashes and create the world’s largest management firm. According to his friends, he felt obliged to redeem himself and prove his own worth and so he took the chance to carve a legacy out for himself. In 1988 Larry Fink and seven of his peers created Blackrock with a five million dollar bank loan.

One of his first clients was the Federal Deposit Insurance Corporation (FDIC) around the time that the savings and loan crisis began. This brought the entire financial industry to the brink of collapse but the FDIC hired Fink’s Blackrock to handle the risky assets after the government took control but Blackrock was working on a technology tailored to Fink’s analysis style.

Was Aladdin Ahead Of Its Time?

The technology was called Aladdin and it proved, in time, to be state of the art. Blackrock managed $9 billion dollars in 1991 and then went on to manage $17 billion by 1992 and $53 billion by 1994.

Those early years would cement the foundation for Blackrock’s meteoric rise. In 1995, PNC Financial services group purchased a stake in Blackrock for $240 million dollars and some argued that the move was unnecessary but it turned out to be a shrewd move because by the late 1990s PNC offered Blackrock a constant stream of retail clients to complement its institutional clientele which accounted for around 80% of their assets under management.

Building on this, Blackrock presented a risk evaluation and risk management system that includes 5000 computers that run 24 hours a day 7 days a week and are overseen by a team of Engineers, Mathematicians and Developers. Blackrock’s Aladdin could track millions of daily transactions and evaluate each asset in its clients stock portfolios to see how they might be affected by even the most minor economic changes.

The system was actively monitoring the markets for anything that may go wrong and it would serve as the foundation for a second organization that would broaden Blackrock’s purview beyond asset management. With a well-balanced portfolio blackrock became a publicly traded firm in 1999.

Blackrock’s IPO

Retail investors were seemingly skeptical of Balckrock’s “new” technology which caused the company to have one of the worst IPOs of that period. Over time, the market started rewarding Blackrock for keeping its promises to investors and, through smart acquisitions, over a short 12 year period, Blackrock had seeded offices in Sydney, Singapore, London and Munich.

Bkackrock & Aladdin’s Role In The 2008 Global Financial Crisis

In 2008 Fink was on route to Singapore but back in the United States Lehman Brothers had just crashed this prompted him to return to the U.S the next morning.

The financial sector had changed forever as the proverbial “shit was hitting the fan”. He took it upon himself to call lawmakers and tell them that they had to do something or things were going to get significantly worse. Eventually, the Federal Reserve board of New York appointed Fink to supervise a $30 billion portfolio of Bear Stearns’s assets.

When the Central Bank was taking too long to analyze and respond to the market conditions, the next best alternative was to deploy the powerful Aladdin suite which by now had a history of being utilized by investors and banks when the market was collapsing.

Aladdin was on the rise and continued to flourish by attracting new customers eventually becoming the go-to analytics solution in times of Economic uncertainty. With the acquisition of e-Front in 2019 and Barclays Global Investors later that same year, Blackrock became the nation’s largest asset manager and Fink was named one of the best CEOs in the world 14 years in a row.

The ESG Champion

In 2019 the people and the press started giving Blackrock a lot of flack for being among the top shareholders in prominent Oil and Coal companies who are often labeled as the worst polluters on earth.

These became a blemish on Blackrock’s portfolio and sort of threw Fink back into the negative eye of the media but he is turning this into a huge positive. Blackrock is making a shift towards something known as ESG Investing.

ESG stands for Environmental, Social and Corporate Governance and it means that investments in all companies henceforth would need clearance on Environmental Standards, sustainability & Social equity. This has helped neutralize the critics in the media and actually became the new norm among other asset management companies.

From the looks of it, it seems like Blackrock has taken some serious steps in this direction by partnering with activist investors setting aside grants for sustainable projects and backing a shareholder resolution to get Exxon Mobil to get serious about climate change.

Aladdin & ESG

Larry fink even went as far as to write a letter to his existing portfolio companies urging them to make contributions to society in order to continue receiving Blackrock’s support. This new initiative by Blackrock is the reason we see every other company making an effort to change or pretending to change the way they operate or at least pretend as though they care finance is changing.

Now we have things like Green Bonds and syndicates of sustainable investors that primarily focus on scouting for companies that fit the ESG bill but ESG has recently started coming under fire as well due to allegations that it’s merely a shroud with which the rich and powerful hide their evil doings.

In other words, we are now seeing situations where companies just slap a Gay Pride flag on their logo once a year and pledge to plant a million trees and suddenly everyone forgets about their other destructive behaviors.

Naturally, the ESG push is a part of Blackrock’s Aladdin platform as Investment & Portfolio managers can easily access data on a private or public company’s ESG rating. They can then use this data , along with regular financial information, to make their final investment decisions.

Blackrock as a firm, and Aladdin in particular, continues to evolve with time and it is silently changing the norms in the financial world. The age of Aladdin has just started.

Sources & References

Blackrock’s Aladdin Documentation

2019 eFront Acquisition Press release

Reuters reporting on Blackrock’s Contract Award

Word Economic Forum’s Profile Of Larry Fink

New York Times 2020 Report On Blackrock’s Roll In Pandemic Response

Blackrock’s Fund Holdings Report

Statista’s Report On Blackrock’s Assets Under Management

Vanity Fair’s 2010 feature where Fink’s $100 million loss at First Boston was referenced