Patrick Walker is a veteran CANSLIM trader who has been making money for many years by focusing on only trading the best setups, in the strongest stocks at the best time. He hails from St. Louis Missouri and was a College professor and money manager before becoming a private trader and educator.

Pat recently presented at the TraderLion Trading Conference and this is a summary of the steps and strategies that he shared.

If you read and follow closely you should be able to pick up some solid information that can help you find “super stocks” and help you improve your trading immediately.

What You Need To Do To Get Better At Trading & Investing

He wasted very little time and got right to delivering real value by recommending what he says are must read books like How To Make Money In Stocks by Bill O’Neil, Trade Like A Stock Market Wizard by Mark Minervini, Monster Stocks by John Boik & Market Wizards by Jack Schwager.

He specifically recommends reading Jack Schwager’s chapter on Dr van Tharp because of the immense value and learning you will get from it.

The following are the Fundamental, Psychological and Price Action/Technical related steps that Pat laid for traders to follow in order to get ahead in the market and in this business of trading.

Don’t Focus On The Money

Walker first reminds us not to focus on the money. Simply focusing on the money will put you in the wrong mental frame of mind and can lead to poor outcomes. Simply, focusing on the money will cloud your reasoning and your judgment. Instead, you should focus on good stock selection as well as risk and money management. If you can do these things, the money will follow.

Focus On “Mission” Winners

Walker is the founder and principal trader of Mission Winners and he made the point that the term “mission” is really an acronym that is designed to help traders stay focused on the important things. This is how he broke it down:

M= Markets

I= Industries, more specifically a focus on the big picture or industry group

S= Sector

S= Stocks in the group

I= Institutional Support, here he makes the point that it is important to have other people than yourself involved in the stock because retail traders can’t really move a stock.

O= Outstanding. The company should have outstanding management, product/service and earnings. You need to focus on the cream of the crop.

N= Never Say Never. This he describes as the most important part of the Mission winners thesis.

Turn Off The Noise

It is important to tune out the cross talk and the noise in the media. While you shouldn’t be ignorant to the news, you should not be too focused on it as the constant angst and negativity can lead to you developing a negative thought process which is not good for trading.

You also want to tune out the ideas and opinions of others as much as possible. Don’t inundate yourself with too many stock ideas and avoid finding yourself in a situation where you are constantly searching for, or chasing, trade ideas and setups.

Learn Why A Stock Goes Up In price

As basic as this concept is, a lot of market participants simply do not understand this. While the fact that a company has an outstanding product/service and great earnings are a big factor in determining its price, the real reason a stock goes up in price is because there are more buyers than sellers.

You want to focus on stocks that consistently have more buyers than sellers involved.

Focus On Stocks With 40% Or More Earnings Growth In The Last Quarter

There is an Investor’s Business Daily (IBD) article that was first published in 2008 that looked at the 600 best performing stocks from 1952 to 2001. The key finding of that study was that 3 out of 4 stocks that made very big price moves, over that period, had earnings growth of more than 70% before their breakout. Furthermore, about a quarter of these stocks had earnings increases on average of 90% in the following quarter.

The point being made here is that, as far as fundamentals are concerned, you should focus on stocks that have earnings growth of 40% or more last quarter. That will put you right where the big movers are. This reduces the amount of leg work and screening you have to do by about 90%.

This Is How You Set Up Your Screen To Find Super Stocks

When you combine the 40% earnings growth requirement with some other criteria, you will unearth some potential monster winners. Here is what a complete screen should look like:

- Focus on stocks in the top 40 groups or sectors

- Make sure the stocks are over $10.00 per share

- They should have an average volume of at least 200,000 shares per day

- Make sure their earnings are up 40% or more last quarter

- The stock should be within 20% of its 52 week highs

- The stock should be above its 50 Day Moving Average

If you simply focus on stocks with these criteria and buy them on base breakouts and manage your risk smartly, you can make a lot of money. You don’t need to look at every stock in the world, this screen will show you the best of the best.

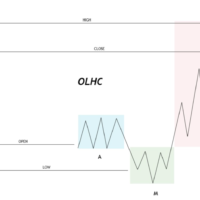

Buy On Clean & Simple Base Breakouts With Volume

These breakouts occur after a period of horizontal consolidation or sideways price movement. The length of time that the stock takes to consolidate forms an obvious base from which the stock could potentially breakout. Here are two examples of base breakouts in Universal Logistics ( ULH) and EXLService Holdings (EXLS)

and …

Why Simple Base Breakouts Work

Clean and simple bases work very well because everybody sees the base and the potential breakout so when it breaks on volume, everybody tends to buy in. The levels also tend to have a lot of resting orders in places where short sellers may have placed stops.

The potential short covering and the buying by breakout traders combine to give you a situation where you will have more buyers than sellers. That is why it works.

Use Proper Pyramiding To Build Your Position

You want to scale into the position rather than buying everything at once. This method is also called pyramiding and it is one of the most effective money and risk management tools. Let’s say your goal is to get a total of 100 shares, your first purchase of stock should be 50 shares and if the price goes up a few points then your next purchase would be 30 shares.

If the price continues to go higher, you would make a third and final purchase of 20 shares. If you make your first buy and the stock doesn’t go up in price then you just don’t buy more. This way you will be relatively safe without full exposure. Never buy your full position all at once.

Where To Set Your Stops & Cut Losses

A clean and simple base will also help you limit losses because you will know exactly where you are wrong and be able to cut your losses before they escalate. The method to use is very simple to execute.

If your stock falls back below the base breakout line by say 30-50 cents then you want to cut your losses completely by closing the trade or just reduce your risk by selling ⅓ or ½ of your position. Take a look at the ULH below for an example of an optimal stop loss.

Don’t be Afraid To Sell Some Into Strength

One of the best things you can do for yourself is to sell some of your stocks into strength and take some profits off the table. By doing this, you guarantee that you get something out of the trade and it bolsters your psychological state and, as you know, trading is about 90% psychological.

You never want to let a good profit turn into a loss. Taking profits into strength reinforces your confidence and puts you in a situation where you are prepared to take advantage of the next opportunities.

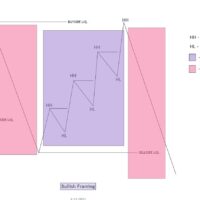

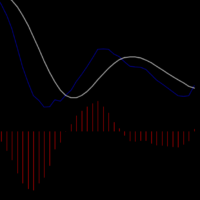

Buying Higher Lows- A Bonus/Secondary Strategy

Stocks that have been in a sustained decline for some time will often put in what is known as a “higher low” pattern which signals a potential change in trend. Walker points out that these are very powerful setups that tend to work very well.

After the initial sell off, the market will put in a low and then rally for a while before pulling back and making another low which is above the previous low. Once that higher low holds, you will often see an even bigger move to the upside than the one that came after the first low.

The chart of Pioneer Natural Resources (PXD) shows a new higher low pattern with potential long set up looking for a move to the upside.

This second chart of Sempra (SRE) shows a completed move after the higher low pattern is formed.

What this pattern shows is that the selling pressure has dried up and buyers may be stepping in. This is a strategy that can be deployed in choppy markets when there are not a lot of base breakouts to be had.

Managing Risk With The Higher Low Method

You would apply the same rules of pyramiding when trading this setup and your stop loss would be just under the low of the “higher low” day as demonstrated in the (PXD) chart below.

Conclusion

These patterns have worked and will continue to work because they take advantage of human emotion and, even though various things regarding the market have changed over the centuries, human emotion has not and will not change. In other words, people will keep reacting to these patterns in the very same way and this means there will always be an edge.

Once you keep this in mind and stick to the criteria in order to find “superstocks” you can do very well in a very short period of time.

Contacts & Resources

You can also check out the other simple and very effective Day Trading Strategies & Swing Trading Strategies here at Stocksandfuturestrading.com

You can get in touch with Pat Walker at his website https://missionwinners.com/ or follow him on Twitter for high quality trading content and ideas.