Dan Irish who goes by @DansGamePoker on Twitter/X who has developed a reputation for being able to time and take advantage of small cap “pump and dumps” and making really big profits. In this feature we will take a look at the exact system/strategy that he uses.

Dan Irish’s Background

Dan got started trading in 2017 after he was inspired by Tim Sykes. He initially started trading short, but he eventually switched over to long trading because he found it to be more simplistic and less stressful.

Dan’s trading routine involves waking up early to scan the news for potential trading opportunities.

Dan’s Trading Strategy

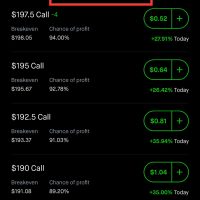

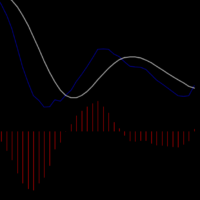

Step 1: It all starts with a big move so he scans for stocks that are gapping up on big volume. This is usually an indication that a small cap stock is getting ready to manipulated for a move higher.

Step 2: He then watches the stock because his intention is to take a secondary move i.e the follow up move that trends to come after a stock has popped and then comes back to test the level from which it broke out initially.

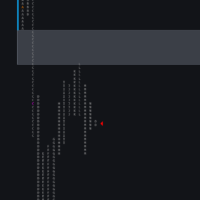

Step 3: To ensure that he nails the entry the right way. he marks the low and high of the post spike consolidation. He says he prefers the patterns that are forming a “tight triangle”.

Step 4: Once the stock breaks out of the consolidation/triangle he enters the trade.

This Is What The Typical Setup Looks Like

Dan Irish’s Trading/ Market Philosophy

Dan Irish’s core trading philosophy is to focus on the details and to be aware of what is going on in the market at all times. He also believes in having a plan and sticking to it.

Here Are 7 Key Facts About Dan Irish & His Trading Career

- Dan Irish is a small cap trader who has made millions of dollars trading stocks.

- Dan got started trading in 2017 after he was inspired by Tim Sykes, a well known penny stock trader.

- Dan initially started trading short, but he eventually switched to long trading because he found it to be more simplistic and less stressful.

- Dan’s trading routine involves waking up early to scan the news for potential trading opportunities.

- Dan’s biggest single day win was $99,000, and his biggest single day loss was $44,000. He says that the biggest loss felt a lot worse than the biggest win felt good.

- Dan has not diversified his income much outside of trading. He owns a home, and he has a small Roth IRA account. However, he says that he is not the best person to talk to about diversification because he does not do much of it.

- Dan’s advice for other traders is to focus on being consistent and to not give up. He says that if you can get back to being consistent, you can make a lot of money trading.

If you liked this feature, you can check out other featured traders like Seth Klarman, Tim Grittani, Modern Rock, Kristjan Kullamagi and many more.

Editor’s Note: This feature was contributed by Kareen Jeffs a contributor for Stocks & Futures Trading Magazine