How To Choose A Trading Strategy

This Is How You Choose A Trading Strategy

Every new trader has heard that “you need to plan your trade and trade your plan” but you can’t begin to plan unless you have a strategy/method that you use to find trading opportunities and execute. In this article, I am going to walk you through the process of choosing a trading strategy.

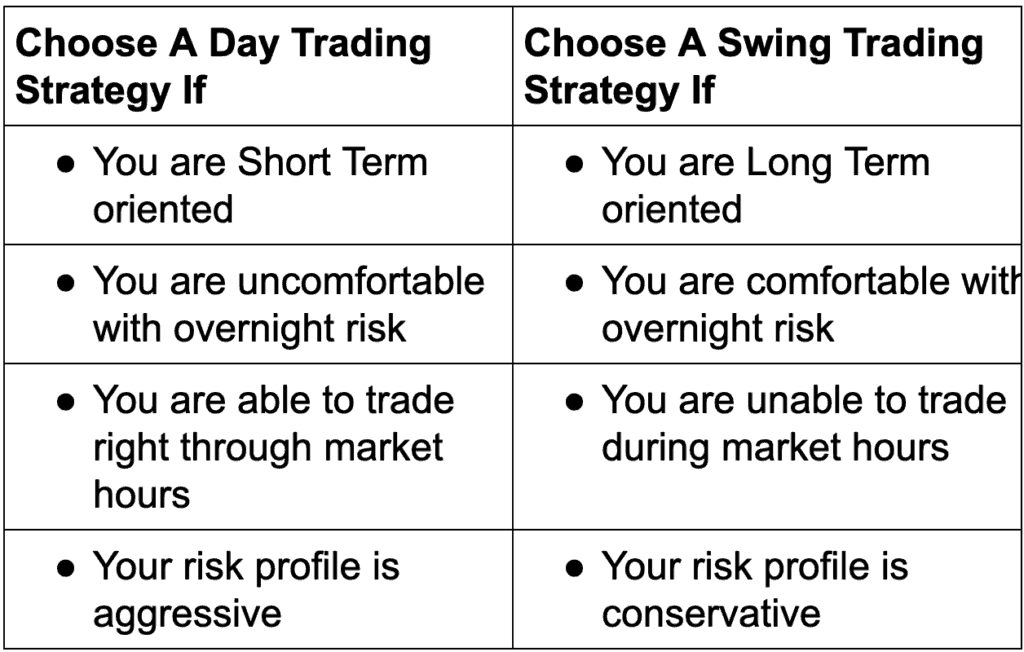

STEP 1: Determine What Kind Of Trader You Are

You have to determine what type of trader you are. The best trading strategy is the one that fits your style/personality so you will need to figure out what your style is. For instance are you a Day Trader or Swing Trader? Can you sit patiently for a few days or weeks and allow a trade to play out?

Or do you prefer to close your positions at the end of the day and avoid overnight risk. Are you comfortable doing both? It is very important that you know your style so you can choose a strategy that suits you. There is no point in using a Swing Trading strategy when you really are a Day Trader at heart. It will only lead to losses and frustration.

STEP 2: Find Out What Your Appetite For Risk Is

You need to determine what level of risk you are willing to take. Some strategies will expose you to more risk than others. So you would be doing yourself a great favor if you took an honest look at your situation and establish how much money you are willing to risk in your trading account.

If you don’t have a lot of money to put to work, then your strategy has to be one that is geared towards growing a small account with limited risk as opposed to a more aggressive strategy that requires a greater level of exposure.

STEP 3: Set Your Trading Goals

You need to be clear on what your trading goals are. You need to know if your intention is to grow your account slowly overtime or if you simply want to make some fast money to supplement your income.

Your goal will play a big part in settling on a trading strategy. Again, you do not want to settle on a very aggressive strategy that swings for the fences when your real intention is to slowly build up your account. Your goals and strategy must be aligned.

STEP 4: Know How Much Time You Can Commit Trading

You need to decide how much time you can commit to trading. The fact is that some strategies will require more management than others so you need to know what is possible based on your schedule. For instance, if you have a demanding 9-5 job then you will simply be wasting your time learning a Day Trading strategy as you will not be able to put in the time necessary to make it work.

Again, your time commitments and your strategy must be aligned so that you can avoid unnecessary losses and frustration.

STEP 4: Know What Your Edge Is

You have to ensure that your strategy has an edge. This is by far the most important thing that you should look for. You have to ensure that the strategy you choose actually makes money and is very robust so that it can stand up in various market conditions.

Nothing else you do will be worth anything if your strategy doesn’t have a positive expectancy ( wins more than it loses under normal circumstances) and keeps you on the right side of the market.

So here are the 5 things you need to ask yourself when choosing a Trading Strategy:

-

Am I a Day Trader or Swing Trader?

-

How much money can I afford to risk trading?

-

What are my trading goals?

-

How much time can I realistically commit to trading?

-

Does this strategy have a positive expectancy?

Here is a simple “decision” table that should help you to choose a trading strategy that is right for you. Just make sure that any strategy that you choose has the all important positive expectancy.

And just to be clear, a positive expectancy is basically how much a strategy is expected to win vs lose. These numbers are based on the historical win/loss % of the strategy.

I have been using a simple & very profitable Momentum trading strategy for the past 18 years. This strategy has a 78% positive expectancy and is suitable for both Swing & Day trading. I made a video that lays out the strategy step by step and you can get this info by clicking here: Momentum Trading Strategy

Comments are closed.