The ICT 9:30AM Open Manipulation

The ICT 9:30 AM Open Manipulation is often said to be one of the easiest trade setups you will ever find. In this feature you will learn how to identify and trade this set up very quickly and simply.

This is another in the series of features on the ICT Concepts. Now let’s get into it:

When Will It Work Best & When It Will Not Work

When price trends after 9:30 AM. It will work best when we don’t see movement after the 9:30AM Open and price generates liquidity.

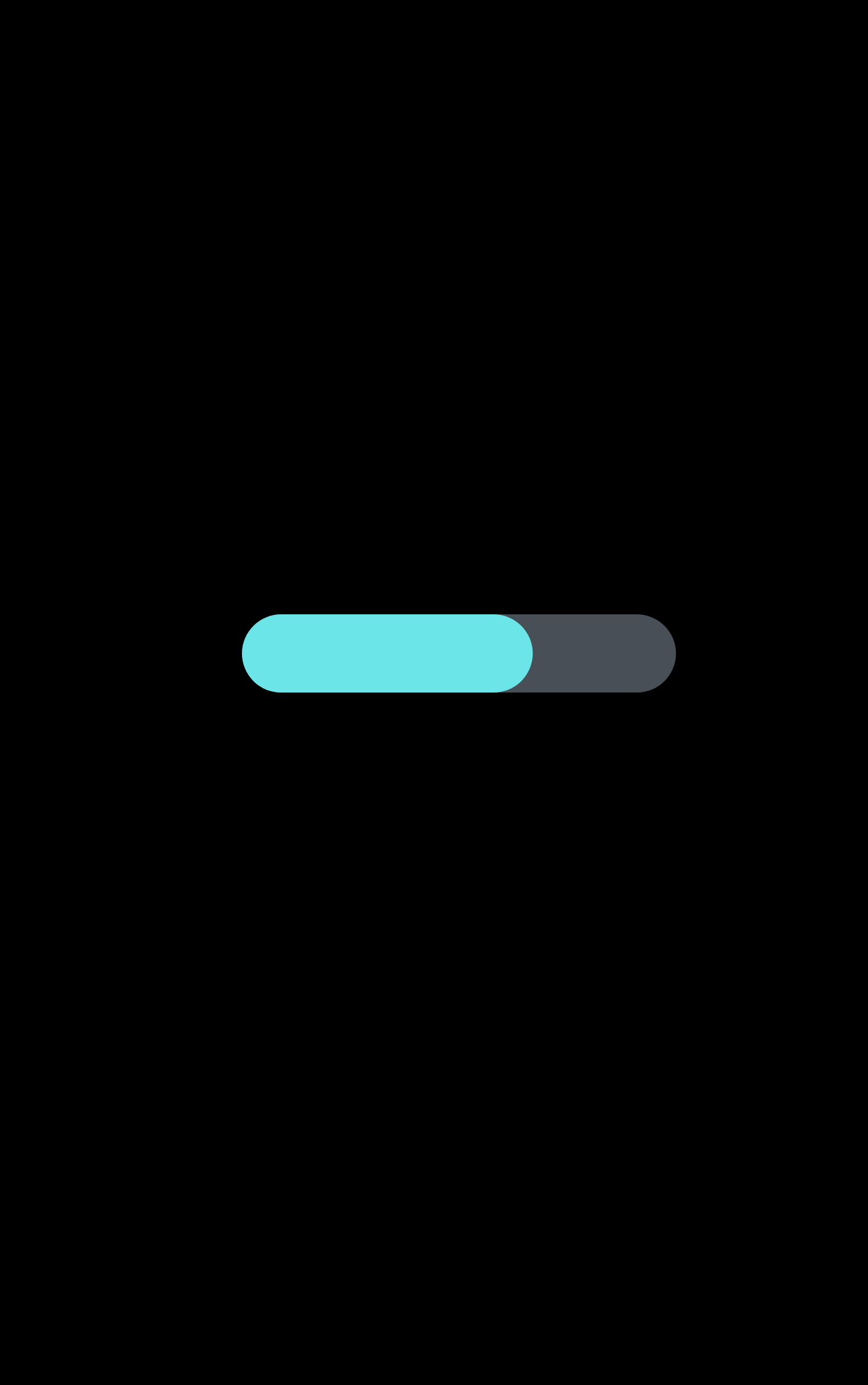

This is what it will look like:

And check out this example laid out step by step:

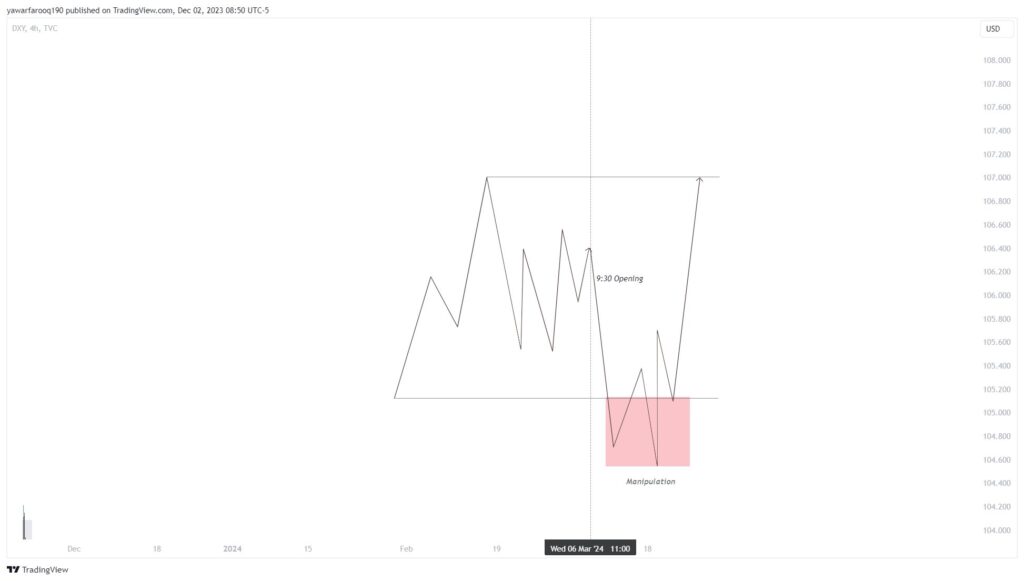

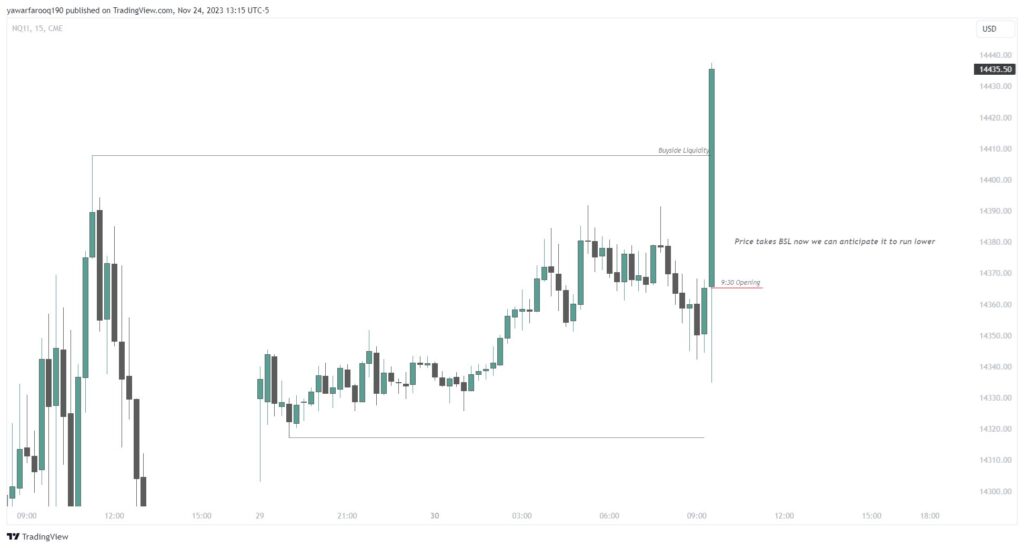

The best way to learn is to study the price action and internalize it. So let’s look at a few more examples.

And here are more examples. Remember to pay attention to the initial move off the 9:30 AM open.

This quick tutorial was presented thanks to the great work by trader @y3fqx. As mentioned before, you can check out more ICT Concepts, definitions and tutorial on the ICT Trading Range, ICT Fair Value Gap, AMD, Asia Range , Market Maker Models etc at the ICT Terminology section of this site. You can also read features on great traders and investors like Charlie Munger and learn Machine Learning as it relates to trading.

Comments are closed.