These Are The Three Stages That Every Trader Must Go Through To Be Successful

In the book “Trading in the Zone,” Mark Douglas outlined three stages of development of a trader. These are:

- The mechanical stage

- The subjective stage ,and

- The intuitive stage

What stage are you at now in your development as a trader? Not sure? Well read along and see if you can figure it out.

The Mechanical Stage

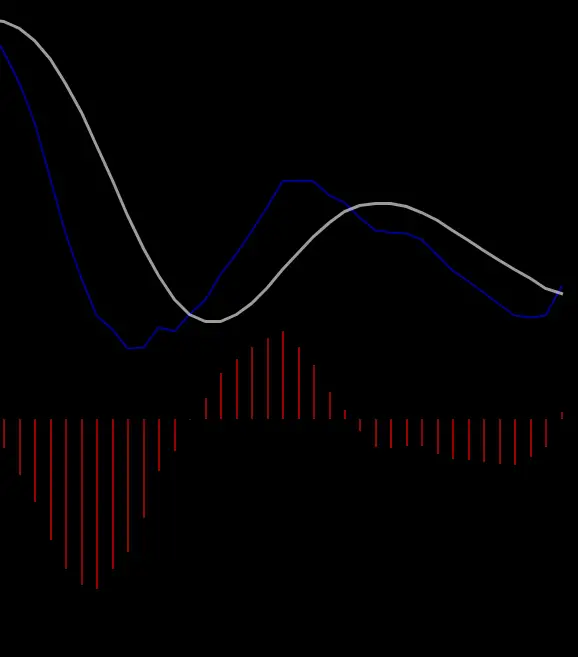

In the mechanical stage, the trader builds trading skills that lead to consistent results and a steadily rising equity curve. They flawlessly execute their trading system and think in probabilities, which leads to self-trust and consistency.

The Subjective Stage

The subjective stage is where traders begin to realize that trading is not just purely mechanical or even systematic. Instead, you will start to realize that trading is also about understanding oneself, particularly one’s thoughts, emotions, and beliefs about the market. Traders in this stage recognize the impact of their psychology on their trading results and start to pay close attention to their mental/psychological state.

The Intuitive Stage

This is the final stage of a trader’s development. This stage represents a level of mastery where traders have moved beyond just understanding the mechanics of trading and executing in a systematic way. In this stage they have also gained control over their psychological and emotional responses.

Subjectivity & Intuition

The subjective and intuitive stages are more advanced levels, based on experience and intuition that evolves from a lot of “in the seat” time. In these stages, you understand that while purely mechanical trading works most of the time, there are times when “breaking the rules” is warranted.

Famed Market Wizard Ed Seykota even has a rule titled “Know when to break the rules” and said, “Sometimes I trade entirely off the mechanical part, sometimes I override the signals based on strong feelings, and sometimes I just quit altogether.“

Why Most Traders Never Get Very Far

The reason most traders never get very far is they either skip the mechanical stage and approach trading like a gambler with a “shoot from the hip” style of doing random things and trading based on emotions; or they get stuck in the mechanical stage, thinking more knowledge or more tweaking of their indicators is the answer to their problems, but then never actually successfully apply these things. They rely exclusively on mechanical signals and are missing that important subjective context that is sometimes critical to trading.

The Novice Trader vs The Master Trader

The Novice

Mark Boucher tells the story of two traders – the novice and the master. The Novice Trader focuses on the “system” and not “understanding the markets.” In so doing, he relies heavily on the system but isn’t able to anticipate or understand the market cycles that usher in his system’s inevitable season of loss. The Novice Trader wants to find a fishing hole where the fish were always biting.

The Master

The Master Trader is simply looking for ideas that help him increase his understanding. He considers a system not as a “golden goose”, but merely a way to find low-risk, high-reward opportunities. He’s more concerned with when the system is best applied and when it might not apply.

The Master Trader isn’t looking for a fishing hole where the fish are always biting, which isn’t realistic. He makes sure the fishing hole he is at actually has fish first. If there aren’t fish in this usual spot, he finds a fishing hole where the fish might be biting for a while or he waits for peak fishing season when catching fish is infinitely easier. In essence, winning traders seek to understand the markets (fish) and not to find magical systems (the magic fishing spot). The systems are merely tools to exploit the opportunities when they are present.

How To Get Through The Three Stages

Trading mechanically is the first step a trader needs to take to find consistency. But at some point, the trader needs to understand that risk management > market environment > trading setup/system. Yes, you need to identify real market edges (entry, exit, and management) and predefine risk on every trade.

If you get stuck on the mechanics of the system, tweaking, fiddling, backtesting, without paying heed to the first two, then it doesn’t really matter how “mechanical” you are – you probably won’t last very long or you’ll continually boom and bust.

The best thing to do is to make sure risk management and market situational awareness are integral parts of your trading system, not just the specific tactics you use to enter, exit, and manage. Pushing risk when the iron is hot and reducing risk when things are cold is the subjective and intuitive part of understanding context and the cycles of trading that many never really grasp.

Editor’s Note

This brief look at The Three Stages is based on a very insightful thread from Asymtrading. I lightly edited it and added a few points to sharpen up the definition of the stages.

All that aside, I think it is very important for traders to recognize that while a systematic/mechanical approach is very important, you need to understand that trading is as much art as it is science and that there should be plenty of consideration given to the subjective and intuitive approach which can only come from experience.

If you liked this feature, you can check out other featured traders like Tim Grittani, Modern Rock, Andrea Canto, Dr David Paul, Michael Huddleston, Mark Ritchie, Patrick Walker and many more. There is also a great article covering a Crypto Fraud that has largely gone unreported.

Contributed By Pramod Srinivassan at Stocks & Futures Trading Magazine