ThiccTeddy’s Volume By Price Trading Strategy

Volume By Price or Volume profile trading is a solid trading strategy that can be used to make huge returns if you use it the right way. I recently came across a thread by a trader known as ThiccTeddy that laid out the strategy in a very simple and effective way and decided to share it here with full credit to him.

Volume By Price Definition

Volume by price is also known as: –VRVP on TradingView or just Volume Profile. Simply put, Volume by Price is a horizontal histogram shown directly on your chart. It shows you the amount of shares traded at each price level.

How To Use Volume By Price As A Trading Strategy

There are various ways that Volume by price can be used for long and short term trading but the short tutorial that you will see today is centered around identifying and trading what are known as Volume Shelfs and Volume Deserts. We will use those levels to create a trade plan with low risk, high reward, a stop loss, and a potential target.

How To Identify Volume Shelves

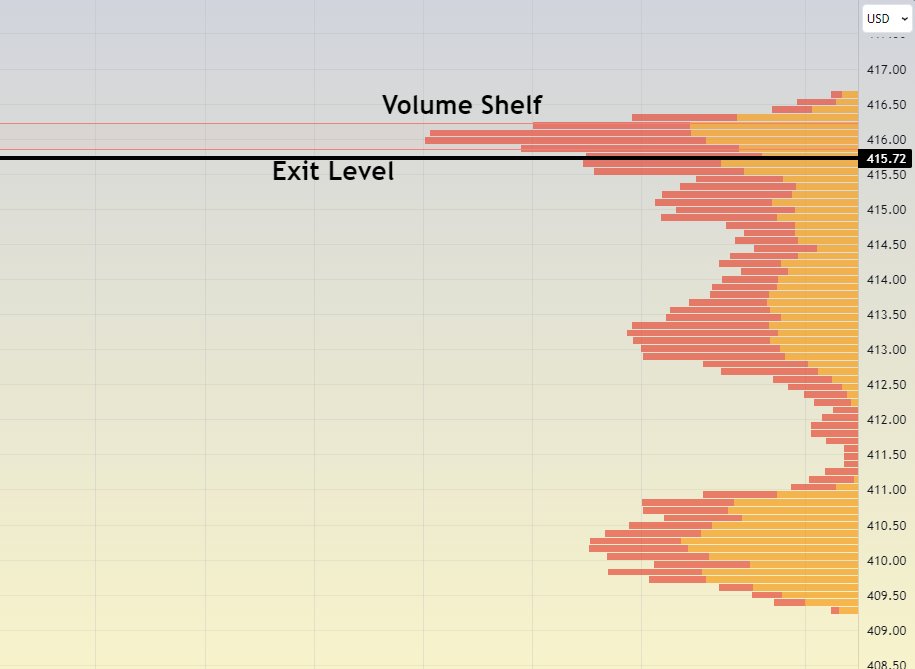

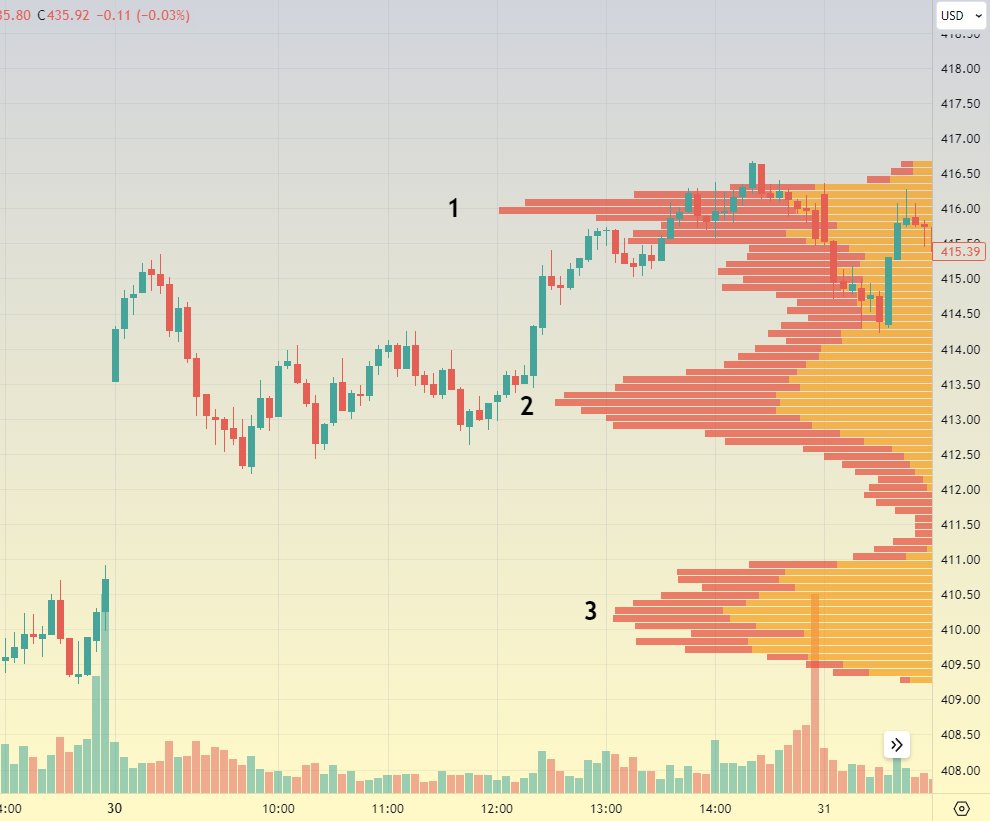

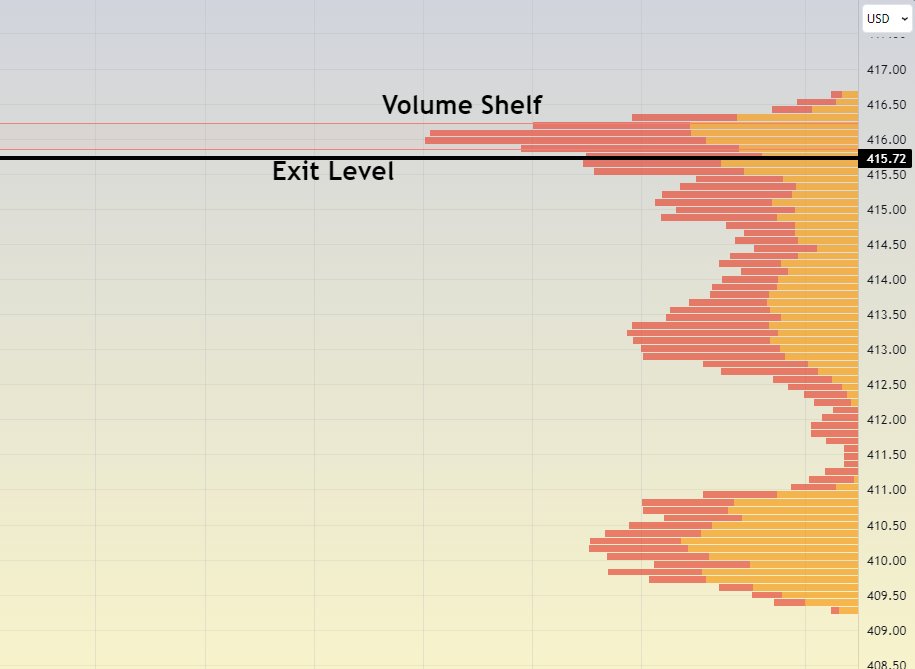

The spikes in volume are what we call a shelf. I prefer to use the top 3 highest volume shelfs as my ‘levels’ as seen in the example below:

How To Identify Volume Deserts

The low volume areas between shelfs are what we call deserts

The main thing you need to understand is that shelfs are populated by a lot of buyers and sellers that will create bounces/rejections depending on what direction the price is trending and Deserts are areas with less population. Price often cuts through them easily.

In order to get a low risk & high reward entry, we need to position ourselves near a shelf, and exit as we approach the next shelf. A stop loss directly under the shelf we entered on is what makes this strategy ‘low risk’.

Strategy Number 1: The Shelf Bounce Strategy

How To Setup & Enter The Shelf Bounce Trade

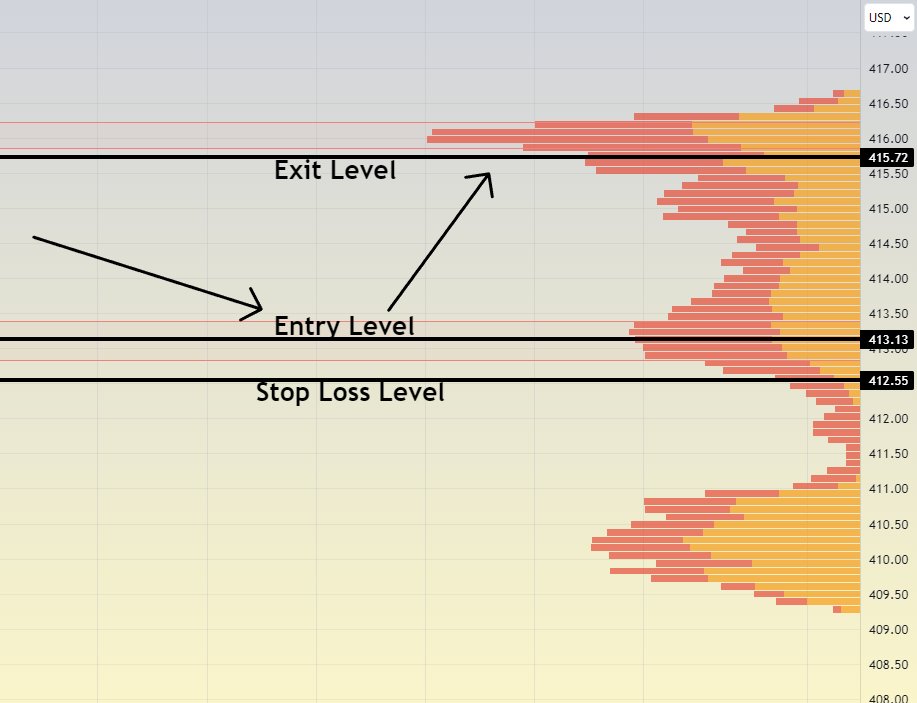

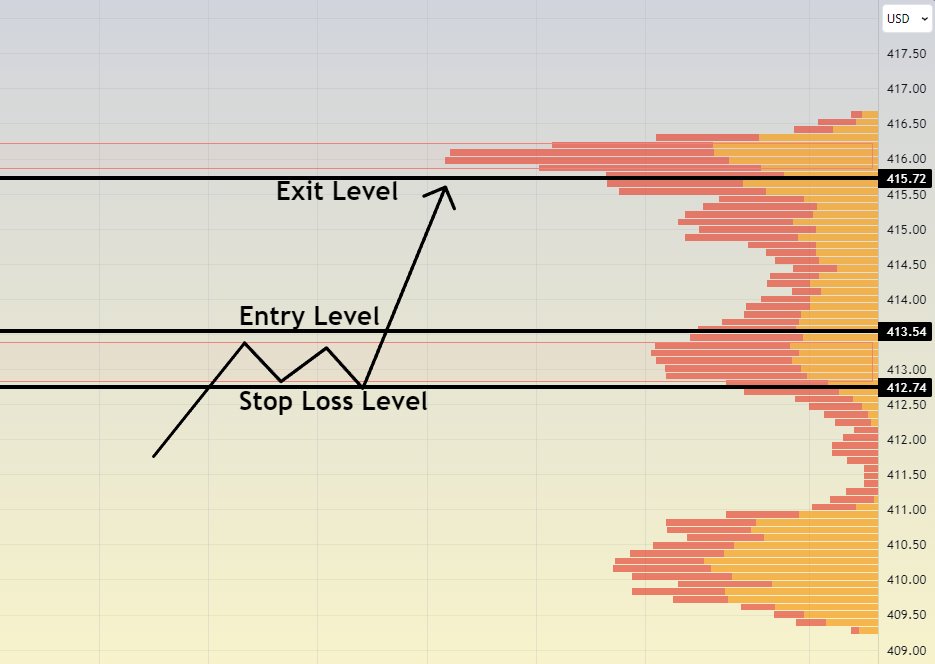

As price touches the lower shelf, we need to be watching for a bounce setup. Once a bounce setup forms, we can enter. You can see my Stop Loss is positioned below the lower shelf, and Exit Level is positioned right below the upper shelf.

In order to get the highest probability Shelf Bounce Trades, Make sure the bounce trade is supported by a high quality bounce setup which is usually characterized by High volume lower wick, tweezer bottom, engulfing, high volume doji, etc.

How To Set Your Stop Loss On The Shelf Bounce Trade

The stop loss protects us from the Volume Desert below our current shelf. If price breaks into that desert, it will likely test the next shelf to the downside Positioning our stop loss in its current place will protect us from that downside.

How To Exit The Shelf Bounce Trade

The idea is to exit before we test the upper shelf. This protects us from the potential rejection that shelf will create. If we hold our entire position into the volume shelf, it could reject and we could end up back at entry. It is very important to plan these exits before you enter.

Strategy Number 2: The Volume Shelf Break Strategy

How To Setup & Enter The Volume Shelf Break Trade

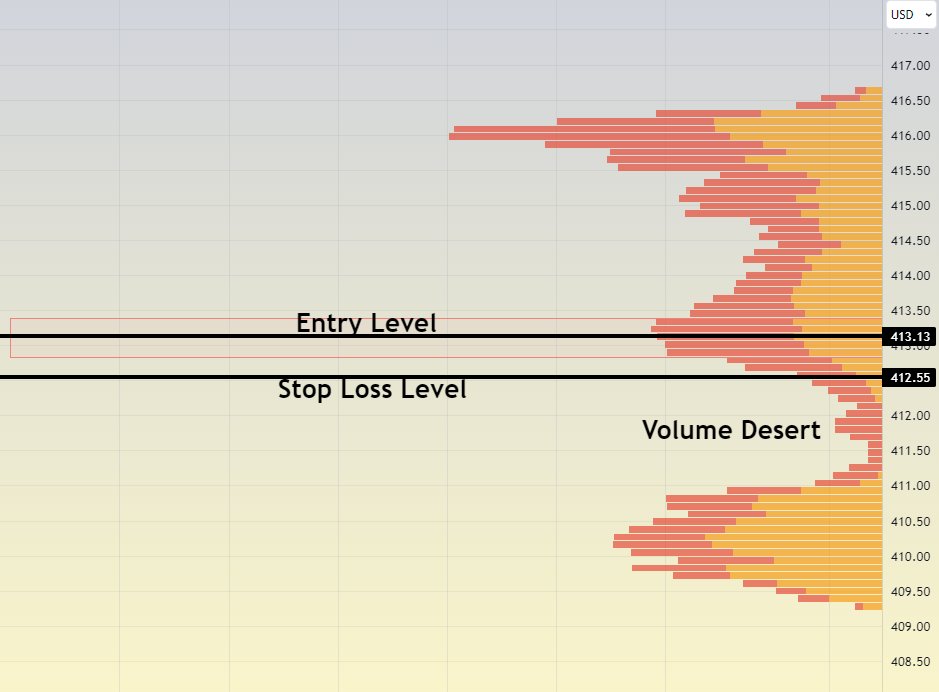

If price is trending up, and we are showing no signs of a rejection once we enter a zone, you can look for a shelf break trade and enter as the top of the shelf is broken, set your stop loss below the shelf, and exit below the upper shelf.

I always wait for a retest after we initially break above the shelf. If that retest creates a bounce, we can enter confidently knowing the shelf has been flipped from resistance into support.

How To Set Your Stop Loss On The Volume Shelf Break Trade

As you can see from the image above, setting a stop loss is very simple and straight forward. You want to place your stop just below the entry level which will most likely be inside of a volume shelf.

How To Exit The Volume Shelf Break Trade

Your profit target/Exit should be just below the volume shelf above your entry. Again, this will allow you to exit the trade before the price runs into resistance or gets rejected.

Some Important Things To Note About The Volume By Price Trading Strategy

- Volume By Price strategies are rooted in real data. Lots of setups and trading strategies lack substance, but these have actual volume numbers to back them up Higher volume within shelves, lower volume within deserts

- This strategy aims to enter near support, set a stop loss below support, and exit before we test resistance. This ensures your trade has a strong support level below and an easy volume desert above.

- If you’re new to Volume by Price watch the shelfs for a week or 2 –Not every shelf test or shelf break is worth trading -The top & bottom of shelves will be defended, that’s why we enter above/below.

Editor’s Note

Simple strategies with only a few data points are usually very robust and stand the test of time. This strategy happens to be one such. That being said, just like everything else, it will take practice and dedication to learn the strategy and get to a level of competence that will lead to eventual trading consistency. Follow ThiccTeddy on Twitter/X.

Also, if you liked this feature, you can check out other strategies from featured traders like Tim Grittani, Modern Rock, Andrea Canto, Dr David Paul, Michael Huddleston, Mark Ritchie, Patrick Walker and many more including the stages that successful traders must go through.

Contributed by Chris Yi for Stocks & Futures Trading Magazine

Comments are closed.