The Top 10 Rules For Successful Futures Day Trading

Day trading is a high-risk, high-reward activity that can be extremely lucrative for those who approach it with a disciplined and well-informed mindset. Here are the top 10 rules for successful futures day trading:

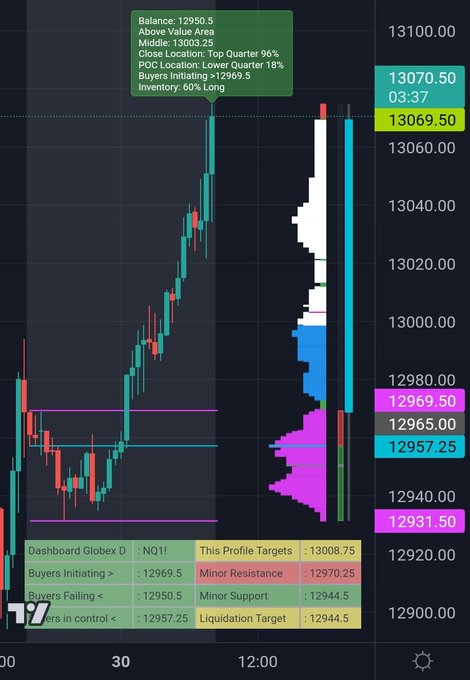

Rule 1: Identify The Overnight Range Or Key Range

The Opening Range (OR) is the price range established during the first few minutes of the trading session. It can provide an important reference point for day traders to identify support and resistance levels.

Rule 2: Establish A Bias

Before entering a trade, it’s crucial to determine whether the market is trending up, down, or sideways. Use objective criteria to avoid getting caught in choppy markets.

Rule 3: Set Long Targets at Resistance

Resistance is a price level where selling pressure is expected to be strong enough to prevent the price from rising further. Setting long targets at or near resistance can help you capture gains as soon as they become available.

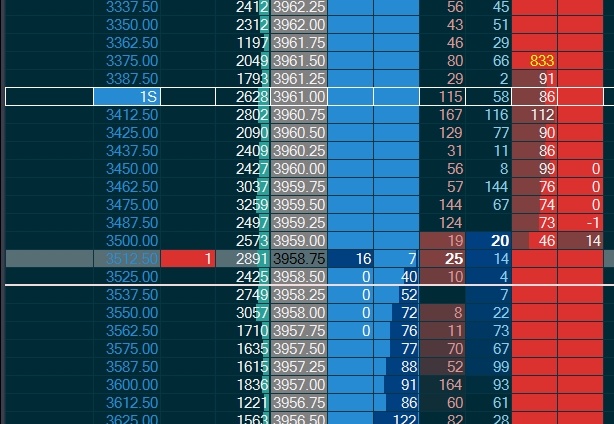

Rule 4: Set Short Targets at Support

Support is the price level where buying pressure is expected to be strong enough to prevent the price from falling further. Setting short targets at or near support can help you lock in profits when the price hits these levels.

Rule 5: Set A Limit For No Longs Below

Avoid buying stocks below a certain price level to minimize losses. Setting a limit for no longs below this level can help prevent losses from getting out of hand.

Rule 6: Set A Limit For No Shorts Above

Similarly, avoid shorting stocks above a certain price level to limit potential losses. Setting a limit for no shorts above this level can help you stay disciplined and avoid taking unnecessary risks.

Rule 7: Follow The Plan

Once you’ve developed a trading plan, stick to it. Avoid making impulsive decisions based on emotions or market noise, and always trade according to your plan’s guidelines.

Rule 8: Keep Stops No More Than 2% Of Account Size If Possible

Always use stop-loss orders to minimize losses. Ideally, the stop should be set at a level that represents no more than 2% of your account size.

Rule 9: Don’t Let a Green Trade Go Red

If a trade is in the green, consider taking profits or tightening your stop-loss order to lock in gains. Allowing a profitable trade to turn into a losing one can wipe out your gains and potentially lead to larger losses.

Rule 10: Take Profits if They Are There Using a Trailing Stop

Trailing stops can help you lock in profits while allowing your trades to run as long as possible. By gradually moving your stop closer to the market price, you can capture gains while minimizing your risk.

When using a trailing stop, it’s essential to strike a balance between being too aggressive and too conservative. Adjust your stop based on market volatility to achieve the right balance.

Happy Trading! Remember to stay disciplined, manage your risk, and stick to your plan to maximize your profits. With patience and persistence, you can achieve your trading goals. Good luck and happy trading!

This feature is the work of full time NQ/ES trader The AI Dog. If you liked this feature you can get nore useful trading info and strategies from you can also get more useful trading info like How To Trade Single Prints, Stockbee’s Trading Method, Blackrock’s Aladdin, A Tutorial On Market Structure, How To Trade With the BPSPX, The ICT Candle Counting Method, How To Pass A Trader Evaluation & Get Funded, The Top Step Trader Review, ICT Liquidity Runs, How To Trade The Options Chart & The Falang Futures Algo and How To Use Volume To Trade Like Banks & Institutions

Edited & Posted by Ryan Thibault for Stocks & Futures Trading Magazine

Comments are closed.