This Trader Made $998k Trading Soundhound Stock

Shortbear managed to pull exactly $998,941.24 out of a Soundhound (SOUN) trade earlier this month. In this feature he breaks down how he found, researched and executed the trade.

Finding The Trade

I had been looking at SOUN since the beginning of the AI hype in Feb 2023. Over that time period I got to learn about the business and waited for a setup in order to play. Back in Feb 23, I had briefly longed as this was the leading AI small/middle cap. (lost 90k then).

Why was I interested in SOUN? Let us list the main aspects:

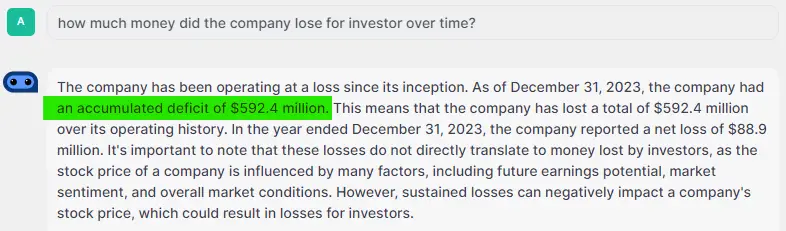

1. Cash Situation

On top of cash lost from operations, the total loss was ~$90mil for 2023. The company lost more than double their revenue in every year of their disclosed financials (2020-2023).

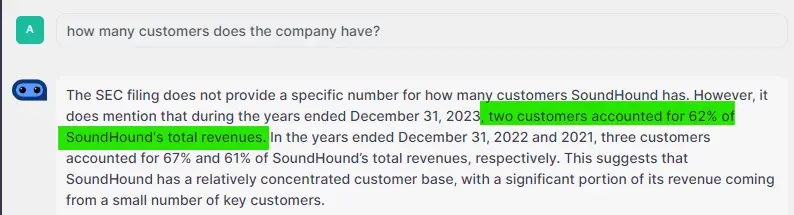

2. Concentration risk

3. History Of Failure

Soundhound lost major customers such as Mercedes-Benz, Deutsche Telekom and Netflix in the recent path and continued by erasing all customer names form the 10k to hide it.

4. Funding Their Failure With Dilution

From November 13, 2023, to February 26, 2024, the company’s outstanding shares increased over 30% in just over two months, from 209,438,885 to 273,229,35.

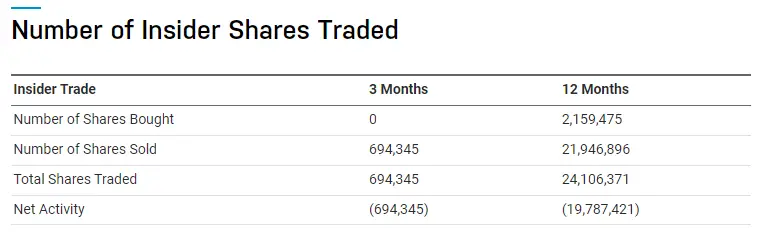

5. Insider Selling

While the shareholders are being aggressively diluted, insiders have been selling the equivalent of 10%+ of the outstanding shares(to illustrate, not exact way to calculate it).

6. Layoffs

SOUN laid off 166 employees in 2023, representing a -38% decline. This is not what a great company with closed deals everywhere does.

I could go on an on, however the point is the company is a failure and has been with its past projects. It burns cash, deceives with their tech ability, uses accounting tricks to hide the true reality of revenue and margins…

Researching The Technicals

SOUN had been building a a base in the low single-digits and broke out mid feb (year later than initial breakout long). Given the absolute mismanagement I had seen on the filing side I decided not to long but to wait for the short.

I was not particularly interested in the first move higher, but got highly interested into the move to 10$. The idea was not to try and pick a top, but to let the dilution and sellers start to overwhelm the buyers. This is not a low float. These plays roll, they rarely crash intraday.

Executing The Trade

The idea was that shorts would get too eager and get pushed out into a final leg post the daily breakout. We pushed higher and immediately crashed. I was in no rush and waited for the structure to build and a bounce to truly enter risking the daily highs.

We continued to build a descending wedge and I added aggressively. I briefly covered big because of rehashed news just in case of a hype based big gap up but put it back on the next morning. I wanted to play the ‘box to box’ trade from one area of support (and stops) to the next.

I covered about 2-3 weeks later into the planned support. Overall I am pleased, but I could have managed slightly better on the bounce to add even higher each time and also could have added more near close after the breakdown day.

If you liked this feature, you can check out more trade breakdowns and strategies like Stockbee’s Trading Method, The ICT Candle Counting Method, How To Trade The Options Chart, How To Use Volume To Trade Like Banks & Institutions , NBB Trader’s Strategy

Written By Chris Yi

Comments are closed.