Yarimi’s Trading Strategy

Yarimi’s Background

Nasser Al Yarimi is a 24 year old London based Forex trader that has developed a following in the trading world for his ability top extract money from the market.

His journey into trading began around 2016, but he only actively pursued it from late 2019 when he committed himself fully to trading, isolating himself from social media to focus on honing his trading skills.

Despite his initial struggles and setbacks, including dropping out of university and working odd jobs, he stuck to trading and it eventually paid off, leading to significant financial success and the establishment of Yarimi University, his platform for sharing trading knowledge.

Nasser Yarimi’s Trading Strategy

Yarimi uses three basic strategies and we will look at them in some details here:

Trend Following

This is a basic strategy where he looks for strong trends in the market and uses technical indicators such as moving averages, trendlines, and momentum indicators (like MACD or RSI) to confirm and ride these trends. He seeks to enter positions in the direction of the prevailing trend to maximize profitability.

Breakout Patterns

Breakout trading is another strategy Al Yarimi employs effectively. He identifies key support and resistance levels or chart patterns (like triangles, rectangles, or flags) where price is likely to break out. He then enters trades when prices break through these levels, aiming to capture significant price movements.

Pullback Trading

Al Yarimi also utilizes pullback trading strategies. After identifying a strong trend, he waits for temporary reversals or pullbacks within that trend. He looks for areas where the price retraces to a support level or a moving average, viewing these as potential entry points to join the trend at a better price.

In addition to the basic setups, an understanding of the market context/overall trend as well as proper risk management can make a huge difference in the outcome of the trades. In that regard, here are a few other things that he uses to improve his trading results:

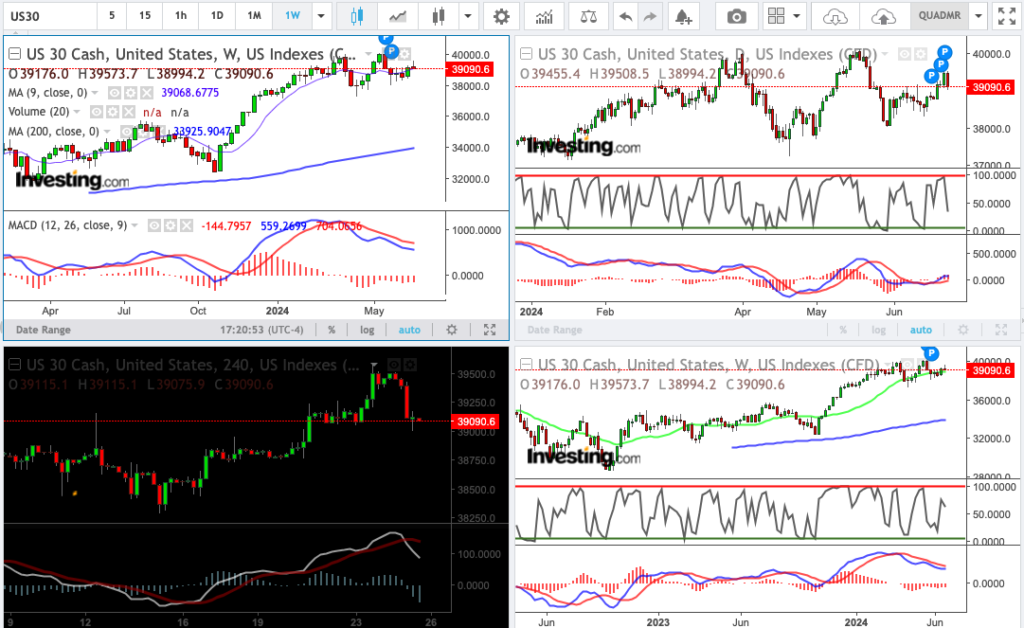

Multiple Time Frame Analysis

Al Yarimi often employs multiple time frame analysis. He examines charts across different time frames (e.g., daily, hourly) to confirm trends and identify potential entry and exit points. This approach helps him to align shorter-term trades with longer-term trends.

Risk Management

Integral to his setups is strict adherence to risk management rules. Al Yarimi sets predefined stop-loss levels based on the volatility and structure of the market. He aims to protect capital by limiting losses on unsuccessful trades, which is crucial for preserving profitability over the long term.

Confirmation Signals

Before entering trades, Al Yarimi typically looks for confirmation signals from multiple indicators or patterns. This confirmation helps him to reduce false signals and increase the probability of successful trades. It also ensures that he enters trades with confidence based on his analysis.

His Trading Philosophy

Educational Pursuit: He advocates full immersion in learning about trading methodologies, including concepts like risk management, supply and demand and order blocks. This educational foundation will help develop a structured approach to trading.

Discipline & Focus: Work on understanding your psychological triggers and bad trading habits. This introspection will allow for the development of better emotional control and decision-making skills.

Be Selective: Over time, Yarimi refined his trading techniques, becoming more selective with his entries and focusing on high-probability setups. So he always points out that a shift from frequent trading to quality setups will help to minimize losses and maximize profits.

Focus On The Long Term/Big Picture: Try to avoid chasing the shirt term wins. Focus on building a sustainable trading career and business model.

Final Thoughts

Overall, Nasser Al Yarimi’s trading methodology blends technical analysis, disciplined risk management, psychological resilience, continuous learning, and a focus on long-term success. His approach reflects his journey from initial setbacks to achieving significant trading success, which he shares to inspire and educate aspiring traders.

If you liked this feature, you can check out other Trading Strategy breakdown for traders like Quallamagie, Stockbee, Tim Gritani, NBB Trader, ICT, Mark Ritchie, Modern Rock, Patrick Walker and many more.

Comments are closed.