ICT Liquidity Runs Explained

This is a very quick and simple explanation of the ICT Liquidity run concept with examples and illustrations. Thanks to Polarity for putting this together.

What Is Liquidity

Michael Huddleston, the father of ICT, defines liquidity as the Degree to which a Market can Be quickly Bought Or sold in the Market without Affecting the Asset Price.

A Recapitulation Zone is a zone where the Price Accumulates Liquidity Before Expansion.

Types Of Liquidity

The main types of liquidity are:

1. Buy-side Liquidity (Buy stop)

2. Sell-side Liquidity (Sell Stop)

Above old highs, there are Buy Stops and below old lows , there are Sell Stops as shown below

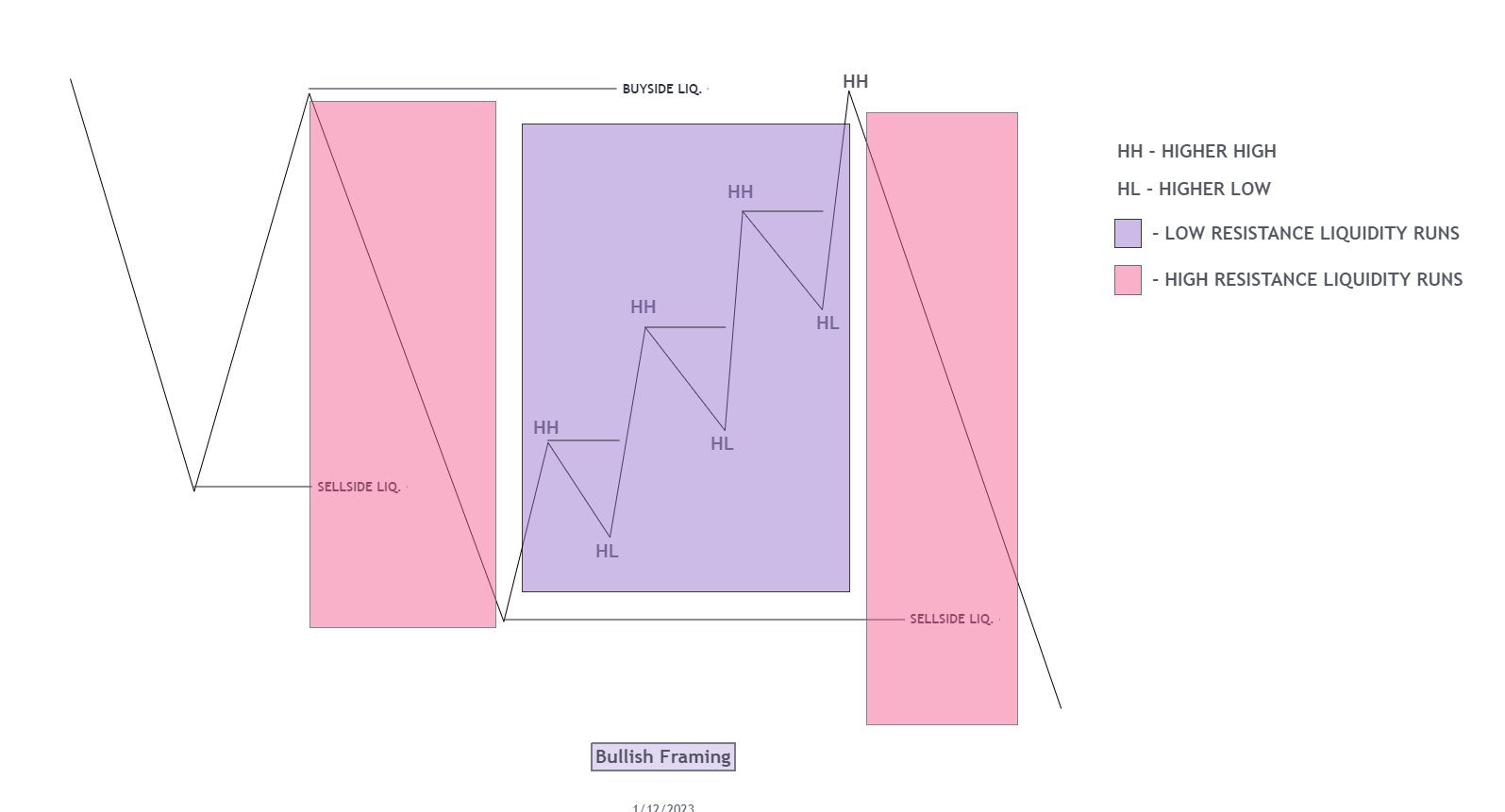

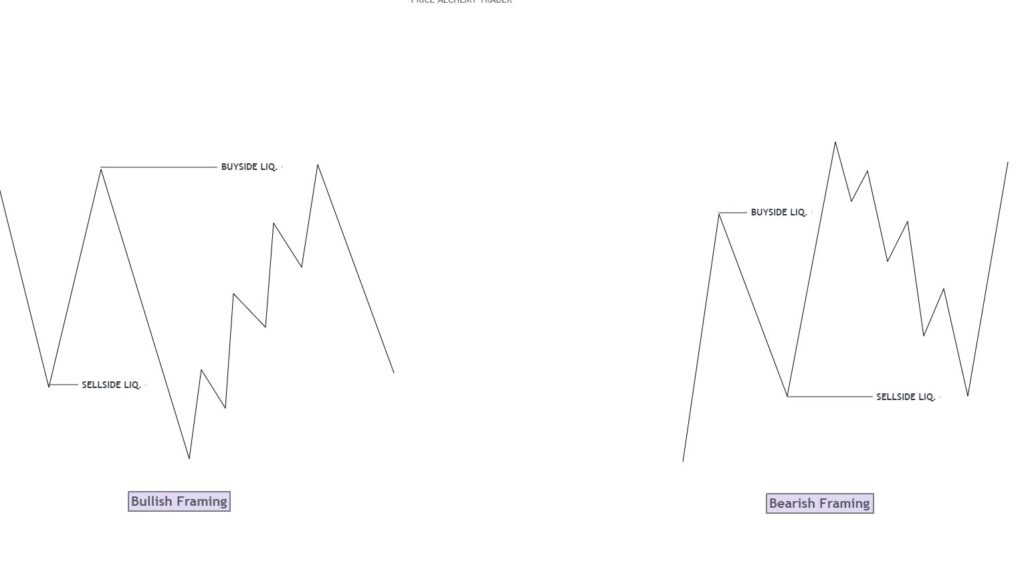

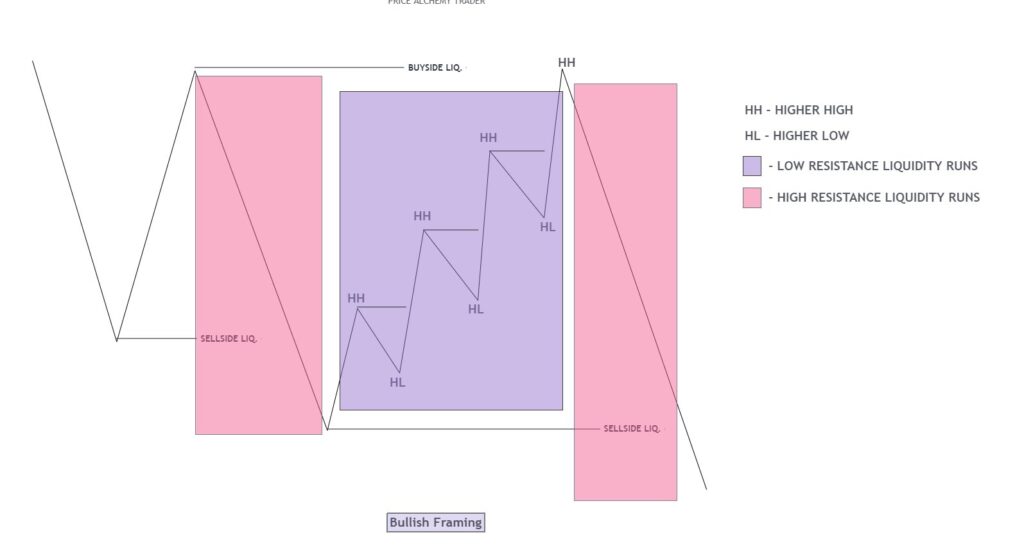

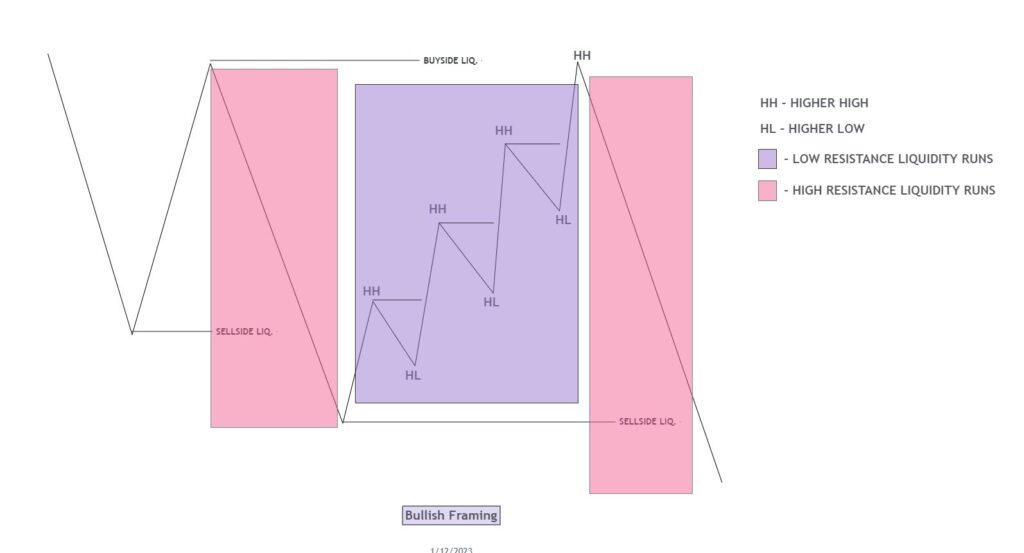

Types Of Liquidity Runs

There are 2 Types of Liquidity Runs

-High Resistance Liquidity Runs

-Low Resistance Liquidity Runs and they look like this:

High Resistance Liquidity Runs ( Expansion mode in a Bias) &

Low Resistance Liquidity Runs ( Making Short term Highs)

Liquidity Run Example #1

Note: the best time to trade the Market is the Expansion Period with the Trend Incorporating the Concept of Power of 3 (Accumulation Manipulation and Distribution) , Distribution always Happens on a Tuesday, Wednesday, Thursday & the statistics prove that the win rate Increases.

Liquidity Run Example #2

This quick tutorial was presented thanks to the great work by trader Polarity. If you liked this feature you can check out others like Blackrock’s Aladdin, A Tutorial On Market Structure, How To Trade With the BPSPX, The ICT Candle Counting Method, How To Pass A Trader Evaluation & Get Funded, The Top Step Trader Review, How To Trade The Options Chart & The Falang Futures Algo and How To Use Volume To Trade Like Banks & Institutions

Comments are closed.