The following is a list that was put together by Nick Schmidt. He has around the trading block for a while, and has picked up a ton of useful tips along the way. Now he shares 50 important things that new traders should know in order to become a savvy and successful trader.

- You will gain more confidence from the losses you cut short rather than from your big wins.

- You need to have a support system in place to help you through tough times.

- Have realistic expectations and don’t expect to get rich quickly.

- Your fear of losing money is ironically causing you to make bad decisions and lose more money.

- Be willing to take advice from others who are more experienced than you, but ultimately make your own decisions.

- The more pressure you put on yourself to make money in the market, the more difficult it becomes to actually make money.

- Don’t be so critical of your trading mistakes… we all make them. Just learn and move on — quickly!

- The best traders have internal confidence. They don’t listen to the noise around them. Instead, they focus on themselves and what they can control.

- The most important thing in trading is not being right; it’s making money.

- If you stop relying on someone else’s trades, you will be mind-blown by how fast you progress and how much you are capable of by yourself.

- Most trading errors can be minimized by sizing down.

- Be patient and don’t rush into trades just because you are excited.

- Never try to make up for lost ground all at once.

- Focus on your process and not on the outcome of each individual trade.

- One undisciplined trade can undo months of progress.

- No matter how confident you are when you place a trade, remember that the outcome will always be random.

- Focus on your long-term goals and don’t get discouraged by short-term setbacks.

- Sometimes the best thing to do is nothing at all.

- Unless you learn to control your losses, you will never become a successful trader.

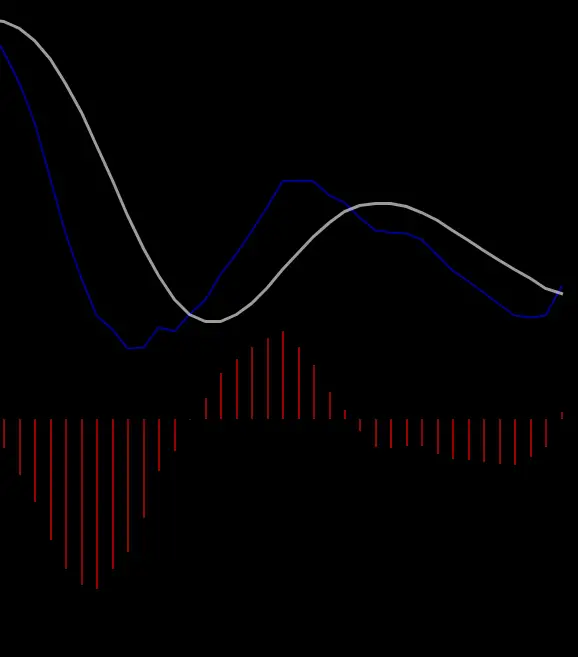

- Always trade in the direction of the trend.

- Trading is not about being right all the time. It’s about making money in the long run. The key is to focus on managing your risk so you actually keep what you make.

- Don’t pick tops or bottoms.

- All of my biggest losses came after my biggest wins. Always stay humble. Arrogance is a quick way to lose money in the market.

- The only way to become a good trader is to first be a bad trader.

- Your trading will improve faster if you focus on one thing at a time. Don’t study everything and then try to remember it all.

- Don’t get attached to your positions.

- It is important to enjoy the process. If you don’t, you won’t stick with it long enough to be successful.

- Don’t over-complicate things. Keep your trading simple.

- Discipline is more important than intelligence (without it, the market will eventually wipe you out).

- Focus on risk management and protecting your capital.

- Be humble. You’re not as smart as you think you are.

- There is no Holy Grail in trading.

- Nobody knows where the market is going to go next, and you don’t need to.

- The only thing you can control is your risk.

- An edge in trading is simply having a higher probability of being right than wrong.

- You need to be able to handle losses and setbacks.

- Focus on your own trading. Don’t worry about what other people are doing.

- You need to have a clear head to make the best trading decisions.

- Focus on making good trading decisions and the money will come.

- You don’t need to trade every day. In fact, you shouldn’t.

- You need to be able to admit when you are wrong and move on.

- Take some time off from trading periodically to recharge and refocus.

- Most traders don’t develop the necessary discipline until they have felt the pain. That’s how it worked for me.

- Keep learning and growing as a trader. There’s always room for improvement.

- Focus on quality over quantity. It’s better to make a few good trades than a bunch of bad ones.

- If you are hesitating when it’s time to execute, you haven’t completely accepted that the outcome of every trade is out of your control. You can do everything right and still lose money.

- Don’t try to predict the future. Focus on what’s happening right in front of you.

- You have to go through the bad trades to get to the good ones.

- Trading is an art that you spend your whole life perfecting.

- It’s important to study the great traders instead of only studying great strategies.

You can follow Nick on Twitter/X for more trading tips and insights.

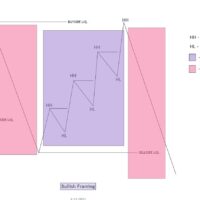

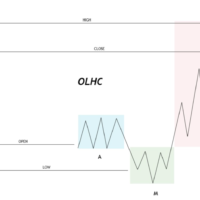

If you liked this feature you can check out others like Blackrock’s Aladdin, A Tutorial On Market Structure, How To Trade With the BPSPX, The ICT Candle Counting Method, How To Pass A Trader Evaluation & Get Funded, The Top Step Trader Review, ICT Liquidity Runs, How To Trade The Options Chart & The Falang Futures Algo and How To Use Volume To Trade Like Banks & Institutions