NBB Trader’s Trading Strategy

His Background

NBB Trader aka Omor, is one of a small hand full of Forex Traders who has managed to become consistently profitable.

He grew up in a working class family and spent his teenage years working in retail before he discovered the markets and tried his hand at trading. He quickly blew up his first account and eventually discovered the ICT Youtube channel and that changed everything.

He claims to have turned down a position at Oxford University because it would have interfered with his trading and instead spent years learning everything he could about the ICT concepts and practicing the proper execution of the strategies.

Track Record & Performance

As at the time of writing this, I have not seen any verified returns that he has made public. But he has developed a following in the online trading world, especially among ICT acolytes as one of only a few profitable FX traders.

NBB Trader’s Trading Strategy

According to Omor, he trades what is known as the “8:30 AM Kill Zone”. How he explains it is that at 8:30 AM EST across the currency market, indices Market etc there is usually a retracement into some sort of fair value gap or run on stops and, if you are paying attention, you’ll find a lot of high probability trade setups within this 8:30 time period. More specifically between 8:30 am and 8:45 am.

Now why does the time frame provide these setups? Why does it seem to work so consistently? This is due to the fact that there is an injection of liquidity that the FED wire does at 8 30 a.m every single trading day and this lines up with a high probability trade setup.

So here is a quick look at how you would put this strategy to work

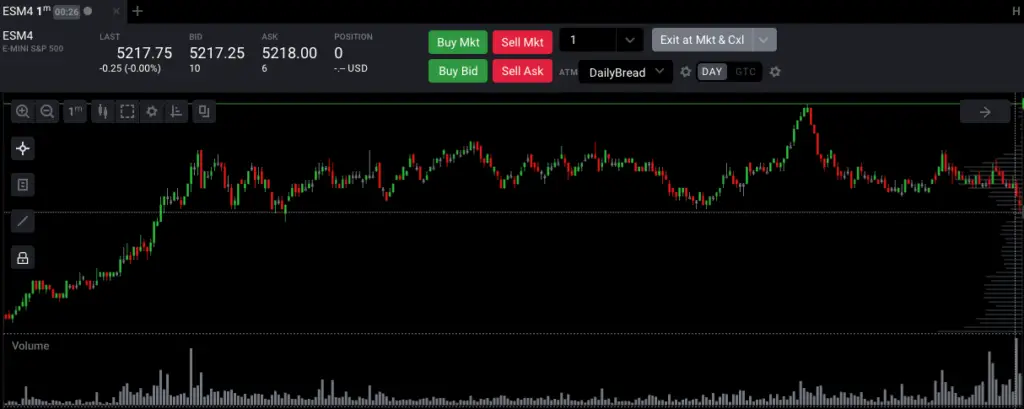

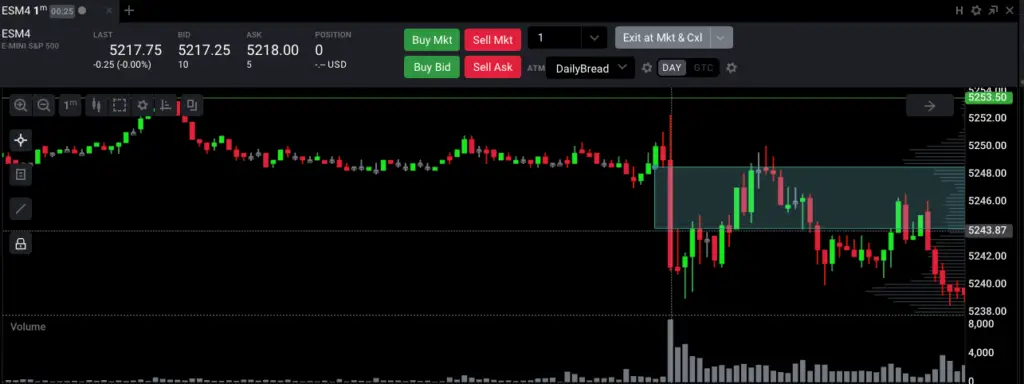

Step 1: Pull up a ! minute chart of the instrument…in this case we are using the Emini Futures

Step 2: Wait for the 8:30 AM Kill Zone/ price delivery

Step 3: Identify the Fair Value Gap

Step 4: Look for a trade off of the fair value gap with context in mind

In this case you could go long into the FVG or simply wait to fade the moves into and above the FVG. Several potentially profitable opportunities were presented inside this 30 minute window before the New York open.

His Trading Philosophy

Omor believes that when it comes to trading, it really boils down to whether or not you have the patience to stick to the plan. It is all about incrementally growing your account as opposed to chasing the quick, big wins.

Click Here to get access to the PDFs and videos that lay out NBB’s complete trading strategy with examples of trade setups and executions.

You can follow NBB trader on X here.

If you liked this feature you can check out others like Stockbee’s Trading Method, Blackrock’s Aladdin, A Tutorial On Market Structure, How To Trade With the BPSPX, The ICT Candle Counting Method, See What It Is Like To Make Millions As A Trader, How To Pass A Trader Evaluation & Get Funded, The Top Step Trader Review, How Your Trade Size Impacts Your Returns, ICT Liquidity Runs, How To Trade The Options Chart & The Falang Futures Algo and How To Use Volume To Trade Like Banks & Institutions

Comments are closed.