Have you ever heard about the breakout from a base setup?

Well you are in for a treat. You are going to learn that there are different variations of these breakouts and find out how to identify and trade these breakouts. Let’s get into it:

How To Identify Bases

All good bases will have the following features:

- Shallow Base Depths

- Prior Uptrend of at least 20%

- Early Stage Base

- Daily & Weekly Accumulation Signatures

- Relative Strength Periods

Now lets break these down one by one:

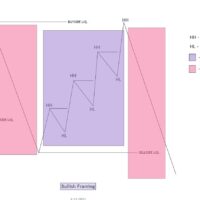

Shallow Base Depths

Base depth is a key component of a proper base. We measure a base’s depth from the absolute peak to the absolute low. Institutions are the major base builders in the market, & the shallower the base, the stronger the institutional hold in the name.

Here are some good criteria to keep in mind when analyzing bases:

< 20-30% off the highs = best

< 30-40% off the highs = good

< 40-50% off the highs = acceptable under certain circumstances

> 50%+ off the highs = avoid (with exception to some younger IPO names)

Base depth will always be at least somewhat dependent on the general market drawdown. Growth stocks usually overshoot the market by at least 2x to the upside AND downside. We also want to pay attention to Relative Strength (more on that later)

If the general market is down 20% off highs, growth stocks may all be around 40% off highs. A good rule of thumb is to check base depths that are less than 2x the average market drawdown. These will likely be the strongest names in the next uptrend.

Prior Uptrends of at Least 20%

Winning stocks continue to win. That is why the best bases have a prior uptrend of AT LEAST 20%. This tells us that institutional accumulation was going on as price was increasing. The bigger the prior increase, the better.

We want to focus on stocks that are already in uptrends, above longer term moving averages such as the 200 SMA. Proper Bases form just after a stock has shown power and the potential to produce a significant trend.

William O’Neil’s famous chart pattern, the High Tight Flag (HTF) is a perfect example of this. The stronger the prior uptrend, the stronger the potential move afterwards.

Click here to check out William O’Neil’s book

Early Stage Bases

Counting base stages was yet another concept created by William O’Neil. The idea is that a stock that goes on a large run will have multiple basing periods, and the later the basing periods the higher the likelihood of failure.

This is why you should focus on early stage bases:

- Not as obvious to the public

- Institutions will be accumulating more shares early in run

- Price leads fundamentals

Daily & Weekly Accumulation Signatures

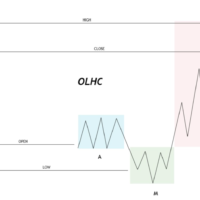

Weekly Accumulation Signatures

To accurately identify accumulation in a base, we want to start on the weekly chart. Why? The longer the timeframe, the more meaningful the accumulation/distribution is.

William O’Neil taught a very simple technique to quickly determine whether a stock’s base was showing enough accumulation for consideration.

Here are the steps:

Step 1: Go to the Weekly Chart

Step 2: Count the # of weeks that showed accumulation (positive price action, strong WCR, & volume above average)

Step 3: Count the # of weeks that showed distribution (negative price action, poor WCR, & volume above average).

Step 4: Compare the two numbers!

The weeks of accumulation must outnumber the weeks of distribution for it to be considered. Another Form of Weekly Accumulation: 3 Weeks Tight Pattern (3WT) The 3WT Pattern is another sign of subtle accumulation on the weekly timeframe. We are looking for weekly closes that are within 1.5% of each other. 3WTs tell us institutions are tightly controlling price.

Daily Accumulation Signatures

Much like the weekly chart, and especially up the right side of the base, we want to make sure the strong up days with above average volume occur more often than poor down days with above average volume.

This tells us that institutions are accumulating on a net basis AS PRICE INCREASES.

There are also volume accumulation signatures that we look for at TraderLion. They are the following:

- Highest Volume Ever w/ Earnings Gap Up (HVE)

- Highest Volume In Over a Year w/ Earnings Gap Up (HV1)

- Highest Volume Since IPO Day/Week (HVIPO)

These traits tell us that a fundamental shift has occurred in the stock, requiring institutions to accumulate shares in an obvious way.

Here are some common signs of accumulation:

· Tight price action (ranges that week over week are less than 10%): Contracting price ranges are a key institutional accumulation characteristic. The tighter the price action, the stronger the institutional hold and accumulation of the stock. This type of price action takes place at these key times:

- Before breakouts (under previous resistance points)

- During Handles (the higher in the base, the better)

- At the lows (shows distribution wearing out)

. Respect for Key Moving Averages (KMAs): The Launch Pad Setup occurs when price reclaims important KMAs to the upside on volume. Price trades underneath the KMAs in a base and then reclaims these KMAs to the upside. The KMAs will start to curl underneath price, forming a Launch Pad for higher prices.

- Price respects the 10 Week Moving Average

- Price respects the 10DMA, 21EMA, 50DMA, 65EMA, and 200DMA

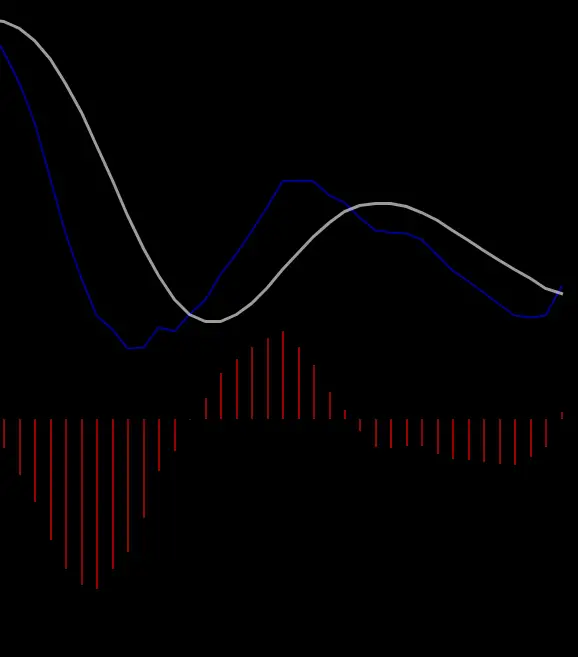

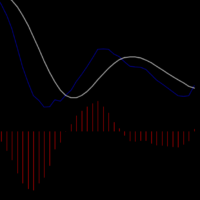

Relative Strength Periods (RS Periods)

All of the best stocks in the market displayed Relative Strength before making their big runs. RS Periods are the easiest to spot when the market is in a correction. Institutions that cannot move to cash have no other choice than to double down on their best ideas.

The one key characteristic to look for is Relative Strength New Highs Before Price (RSNHBP). The RSNHBP characteristic often precedes a big increase in price when overall market pressure is lifted.

Within a base, we should always be looking for the relative strength line to be turning upwards as it comes towards the highs. This tells us that the strength of the stock is real and not just moving up because the general markets are.

Another subtle form of relative strength is when a stock bottoms before the general market. This is telling us that some institution(s) is supporting price and not letting it go lower with the overall market.

If you liked this feature you can check out others like, 50 Things Every Trader Needs To Know, Blackrock’s Aladdin, A Tutorial On Market Structure, How To Trade With the BPSPX, The ICT Candle Counting Method, How To Pass A Trader Evaluation & Get Funded, The Top Step Trader Review, ICT Liquidity Runs, How To Trade The Options Chart , Five Trading Lessons I Learned From Citadel & The Falang Futures Algo and How To Use Volume To Trade Like Banks & Institutions